Ethereum’s price recovered above the psychological $2,000 level, with 50% of the coins being locked in staking and the supply being cut short.

Ethereum graced a historic moment in its 11 years of existence, with about half of its coins locked into its proof-of-stake contract. As such, over 80 million ETH has been escrowed into the contract.

With the Ethereum coins in circulation being limited to 50% of the total supply, the coin recovered above $2,000, a psychological level.

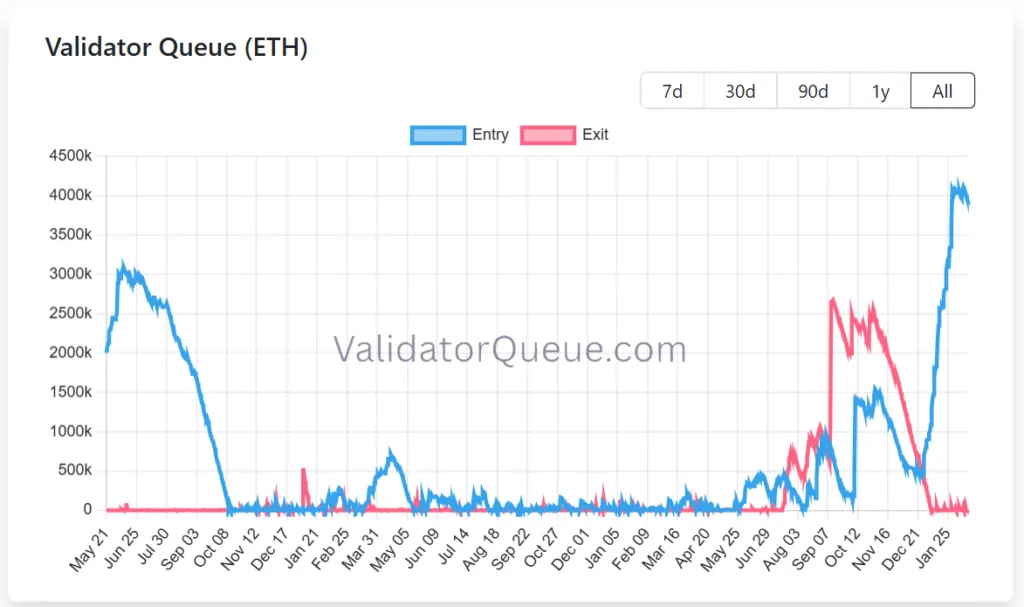

Validator inflows head and shoulders above outflows

This comes in the wake of heavy congestion in the validator queue. As shown in the chart below, more than 3.8 million ETH is waiting in the queue to be staked into the contract to become validators.

Despite the wait time to become a validator hitting 67 days, the community is still patiently waiting to become validators.

The entry and exit queue numbers are poles apart. In particular, when the ETH waiting to enter hits 3.8 million, the exit queue is much shorter at 1.8 K ETH.

This shows that the Ethereum staking system is seeing massive inflows and almost no outflows, indicating strong confidence in staking rewards and bullish sentiment on ETH.

Ethereum tests 50-day moving average

On the 4-hour chart, ETH is currently testing the 50-day moving average as it rises after rebounding off the lower trendline of the ascending triangle. The ascending triangle has a flat top and a rising bottom.

At the top, the sellers defend this level, while the buyers keep pushing the lows higher. There will come a threshold point where the buyers will outweigh the seller pressure, and the ETH prices will have a directional move.

The ETH prices will move with intent once it breaks out of the pattern and soars high. A conventional breakout from the ascending triangle usually produces a spike that is equal to the height of the wedge at its widest point. Given that ETH follows this breakout style, $2,200 will be an easy target.