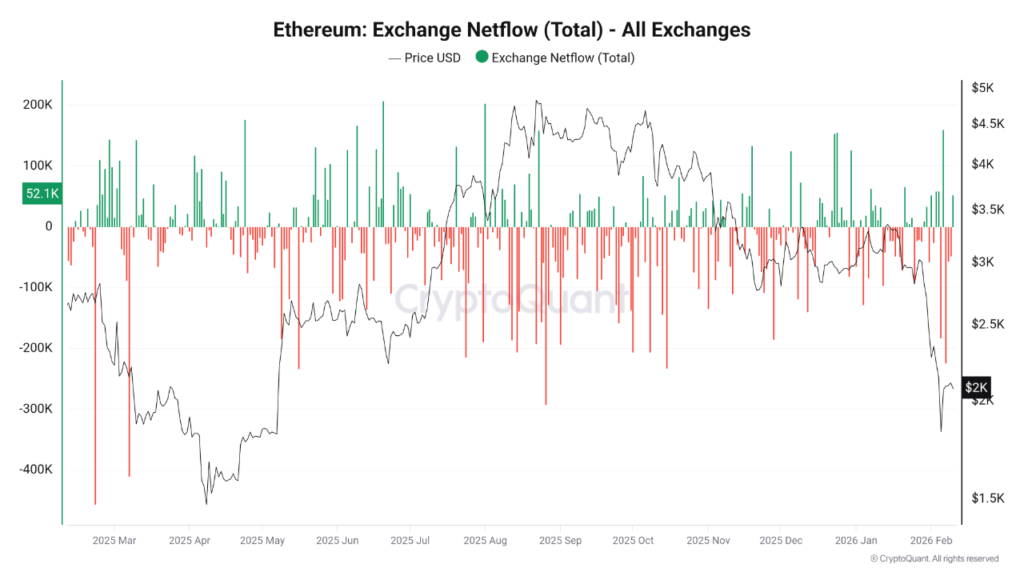

Despite the Ethereum (ETH) price cratering 33.4% over the past month, the second-largest cryptocurrency by market cap looks on the cusp of strong positive price action. Recent exchange data shows that over 220,000 ETH was withdrawn from exchanges, the highest amount since October 2025.

220,000 ETH leaves crypto exchanges

According to a CryptoQuant post by Arab Chain, there has been an increase in ETH withdrawals from exchanges over the past few weeks. Across all the cryptocurrency trading platforms, the net ETH outflows increased past 220,000 ETH, the highest level since October 2025.

The rising volume of Ether being pulled from crypto exchanges shows that the digital asset is being moved to private wallets. Such patterns are usually associated with periods of accumulation, exhibiting risk-reduction behavior.

On February 5 on Binance crypto exchange, daily net outflows hit almost as high as 158,000 ETH – the highest level since August 2025. This confirms that the majority of ETH being withdrawn is concentrated on the exchange with the deepest liquidity.

A net outflow of nearly 158,000 ETH from Binance shows that large holders are moving assets off exchanges to reduce immediate selling pressure. Since Binance has the deepest liquidity, concentrated withdrawals at this scale point to accumulation or longer-term holding behavior.

Will Ethereum price benefit?

From a price perspective, ETH was trading in the range of $1,800 to $2,000 during the withdrawals from exchanges. The movement at these price levels suggests that some investors are treating this range as an attractive buy zone for holding ETH following the recent market pullback.

That said, there are multiple warning signs that the recent downturn in ETH’s price may persist for longer than what most anticipate. For instance, ETH’s Binance buy/sell ratio recently fell under one, suggesting that the depressed price action may linger for longer.

Similarly, recent on-chain analysis shows that ETH is starting to show signs of capitulation. The digital asset’s 14 SMA recently went parabolic amid record-high token transfers.