As the next Federal Open Market Committee (FOMC) meeting inches closer, keywords related to the Fed and interest rate cuts have hit an 11-month high on social media platforms in anticipation of a rate cut. Santiment, a crypto-related social media tool, reported that social dominance–the percentage share of social media discussions (Twitter/X, Reddit, Telegram, etc.) that are about a specific asset spiked last Friday.

Why did the interest in Fed-related keywords spike all of a sudden?

On August 22, Friday, the Federal Reserve Chairman Jerome Powell, speaking at the annual Jackson Hole economic symposium, hinted that the first rate cut for 2025 might be in September. With this one comment from Powell, the whole crypto market was excited, and the fear and greed index shifted from cautious to greedy. And the whole talk of the town on social media platforms was about interest rates and Fed-related.

The speech changed the whole outlook of the crypto market. Bitcoin, which was under the firm grip of the bears, was fluctuating just below the $112K level. But Powell’s words had the energy needed to rejuvenate Bitcoin from $112K to $117K. Even Ethereum broke the shackles that kept its movements restricted below the $4.35K. It blasted off, crashing above this resistance with ease, and printed a new all-time high of $4.95K.

Will there be a rate cut in September?

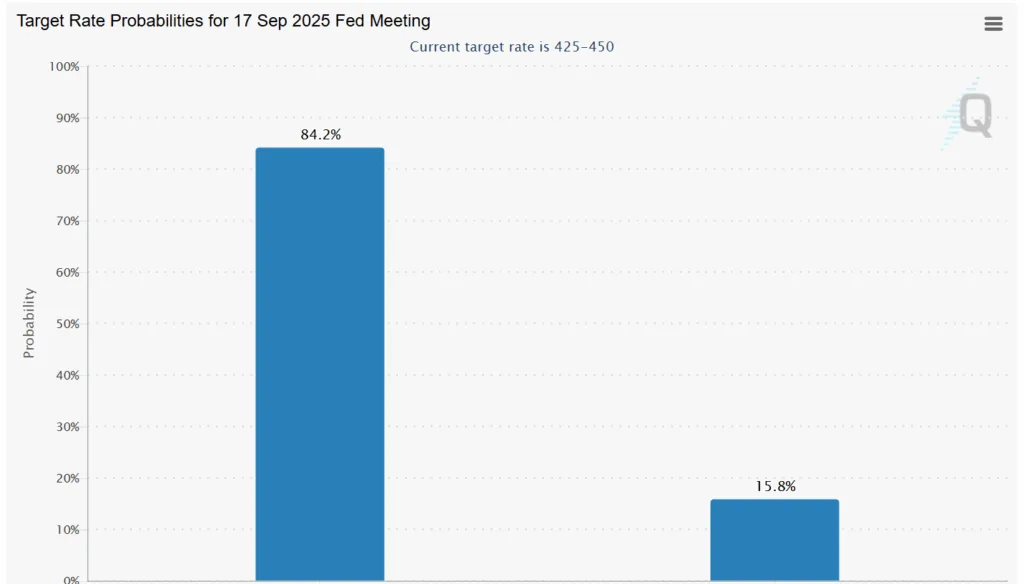

According to the CME FedWatch tool, around 85% of market participants expect interest rate cuts at the upcoming September FOMC meeting, while roughly 15% anticipate rates will remain unchanged. Notably, before the previous FOMC meeting, the same survey indicated there would be no cuts — and that prediction proved accurate. This track record suggests that the current probability forecast carries significant weight.

What will happen to crypto prices if there is a rate cut?

When interest rates are cut, borrowing becomes cheaper and liquidity in the economy rises. This expands the money supply (M2), making capital more available. With low rates, investors are less attracted to safe, low-yield assets and more inclined to allocate funds toward riskier assets like crypto.