The central bank of Norway, Norges Bank, does not warrant the issuance of a Central Bank Digital Currency (CBDC) at present, going against the norm of many countries wanting to launch their native CBDCs.

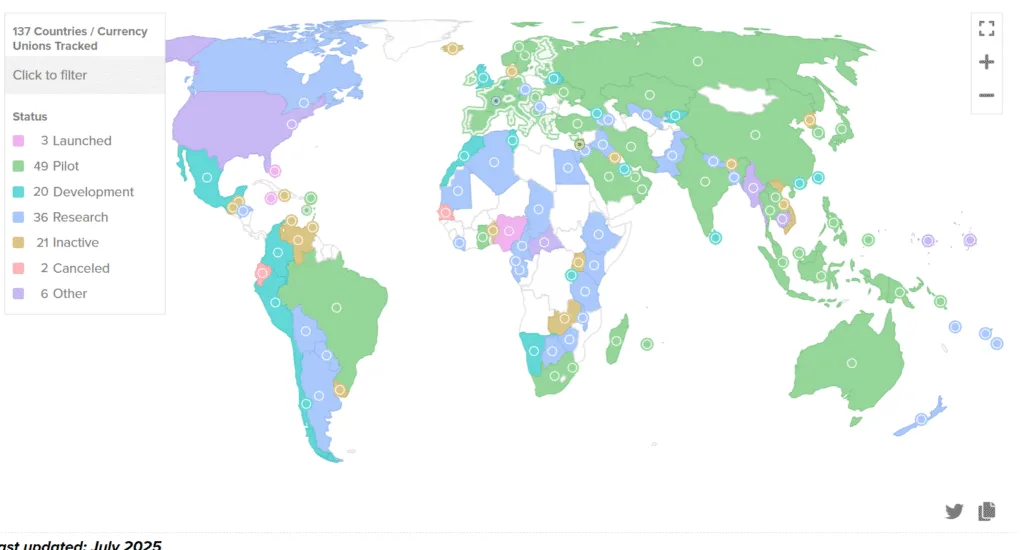

In an era of central banks trying CBDCs, launching pilot projects, and trying to test the waters, Norway’s central bank thinks that a CBDC is not necessary as of now. As shown in the chart below, more than 137 countries have shown interest in CBDCs, with almost 50 launching their own pilot projects. Norway stands out by not tagging along with the herd, as it is not a necessity.

Governor Ida Wolden Bache, stated: “Norges Bank has concluded that introducing a central bank digital currency is currently not warranted. The need for such a currency may, however, change in the future. We will be ready to introduce a central bank digital currency if it becomes necessary to maintain an efficient and secure payment system. We look forward to cooperating with the financial industry and other central banks on work in this area,”

Although Norges does not see the necessity of launching a CBDC at present, it does not completely write off considering CBDC in the future.

Where are CBDCs heading to?

Overall the CBDC market is projected to reach a valuation of approximately USD 150 billion by 2033, growing at a compound annual growth rate (CAGR) of 30% from 2025 to 2033.

The CBDC market could be segregated into two primary types: Retail CBDC and Wholesale CBDC. Retail CBDCs are for the use of the general public, giving them a digital alternative to cash. These are meant to enhance convenience and security for consumers, offering a digital means of payment that can be used for everyday transactions.

Meanwhile, wholesale CBDCs are designed for use by financial institutions, primarily for interbank settlements and cross-border transactions. They help improve the efficiency and speed of interbank settlement by transferring value between banks.

Wholesale CBDCs are being experimented with to check their potential to streamline cross-border transactions, reduce transaction costs, and enhance the efficiency of the financial system. Central banks are actively researching and testing wholesale CBDCs to assess their feasibility and potential benefits, with several pilot programs underway worldwide.