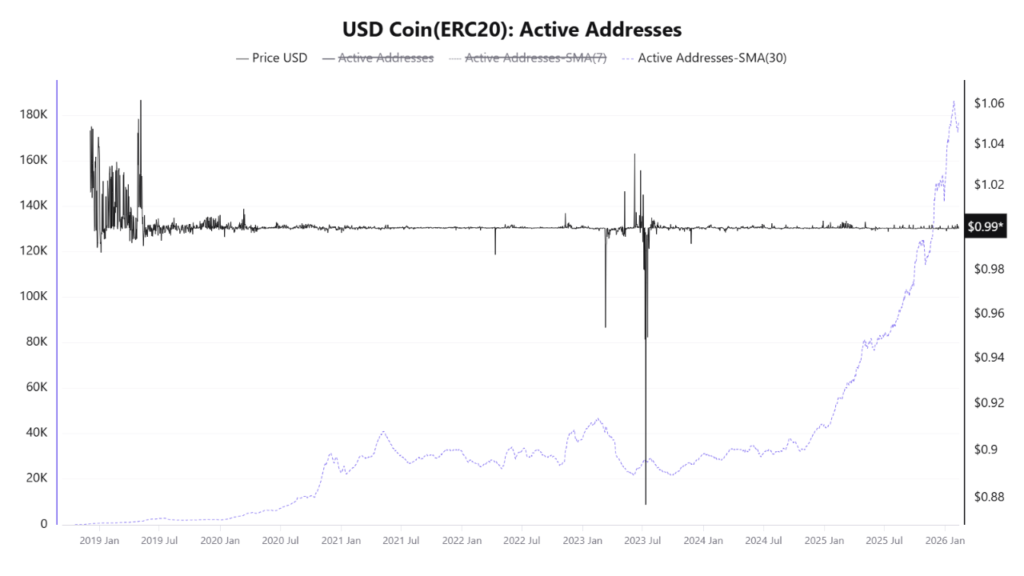

According to the latest on-chain data, stablecoin USDC’s 30-day simple moving average (SMA) of active addresses has surged to a fresh high of 186,000. Past data suggests that a rise in network activity typically has an inverse relationship with the current price of major digital assets.

Rise in stablecoins, decline in crypto

The rise in USDC’s 30-day SMA active addresses coincides with a strong correction in the crypto market. Bitcoin has fallen more than 45% from its October 2025 high of $125,000 to $68,000 in February 2026.

In the same timeframe, Ether—the native coin of the Ethereum blockchain—has declined from around $4,751 on October 7 to $1,991 as of today, representing a massive loss of 59.8%.

CryptoQuant analyst CryptoOnchain remarked that the surge in stablecoin addresses reflects the classic ‘risk-off’ investor behavior. In simple words, investors are aggressively swapping volatile crypto assets like BTC and ETH for stablecoins like USDT and USDC to preserve capital.

One silver lining amidst the ongoing depressed price action in the crypto market is that liquidity, or ‘dry powder,’ is not leaving the ecosystem. Rather, it is merely ‘parked’ on the Ethereum blockchain.

The rising number of stablecoin active addresses represents a massive accumulation of the so-called dry powder for large investors to deploy when they feel the asset prices are attractive enough for an entry.

Market reversal ahead?

The increasing divergence between rising stablecoin activity and the falling digital asset prices shows that the crypto market is currently in a state of capitulation. That said, high stablecoin accumulation during price bottoms typically precedes a market reversal.

The analyst concluded by saying that Bitcoin’s $68,000 price level is being tested by capital that is waiting on the sidelines. Once enough stability returns, this parked capital is likely to re-enter the market.

Popular crypto entrepreneur Tom Lee had similar thoughts to share earlier today. Speaking at Consensus 2026 in Hong Kong, Lee predicted that ETH is poised for a V-shaped recovery following the test of the $1,890 support level.