In an endeavor to make Ripple’s stablecoin RLUSD accessible in African markets, the company made three new partnerships. This new venture will aid various African enterprises, with the major use case being cross-border payments.

Financial institution digital asset infrastructure provider, Ripple, made partnerships with three companies– Chipper Cash, VALR, and Yellow Card. Among the many use cases, RLUSD will facilitate instant settlement of cross-border payments; access liquidity for remittance and treasury operations. Integrate with decentralized finance (DeFi) protocols while reliably bridging between fiat currencies and the crypto ecosystem, ensuring seamless and efficient transitions when entering (on-ramping) or exiting (off-ramping) the crypto space.

In addition, it will provide collateralization for trading tokenized real-world assets such as commodities, securities, and treasuries onchain.

Farzam Ehsani, co-founder and CEO of VALR, the largest exchange in Africa, stated, “The listing of RLUSD reflects our broader strategy to support trusted stablecoin options that serve the evolving needs of both institutional and retail clients seeking a reliable digital dollar for a growing range of use cases.”

A satisfied Chris Maurice, CEO and Co-Founder at Yellow Card, stated “Our customers demand access to stable digital assets that are useful for secure cross-border payments and treasury management. Offering a regulatory-compliant stablecoin like RLUSD is a natural step in our mission to deliver trusted, enterprise-grade solutions.”

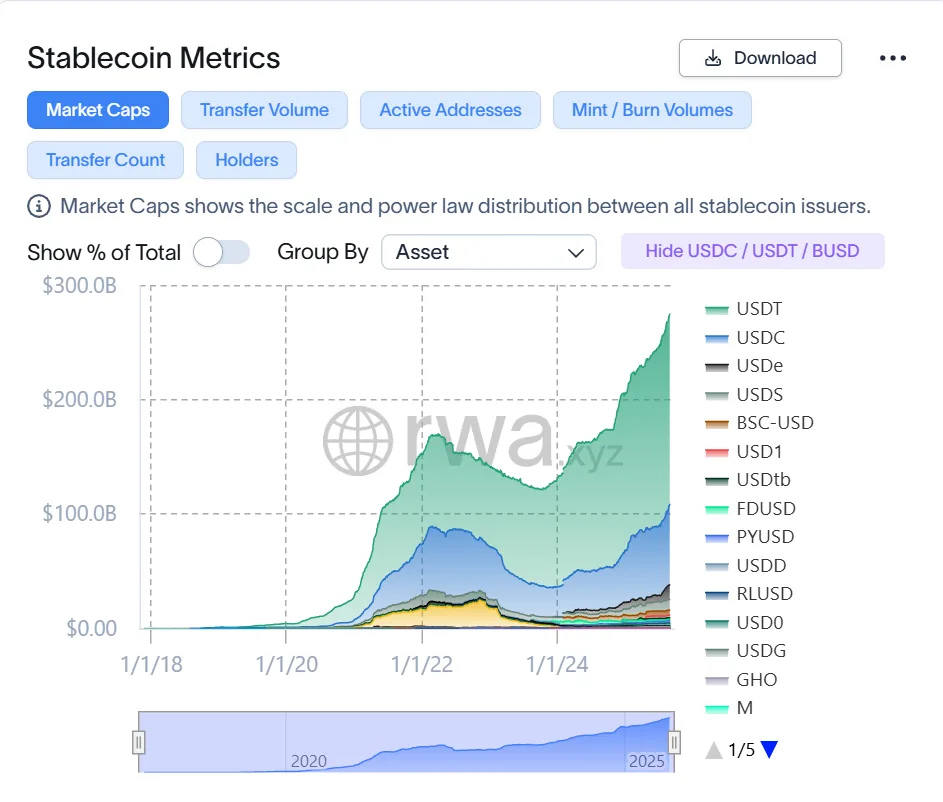

Stablecoin market cap grows to $275 billion in 30 days

Meanwhile, the stablecoin market cap is approximately $275 billion, up by 6.5% during the last 30 days. In addition, the monthly transfer volume of stablecoins has also increased to $3.58T by almost 12% in the last 30 days.

Stablecoin market cap growth signals:

Higher demand for stablecoins:

More people or institutions are buying and holding stablecoins (e.g., USDT, USDC, RLUSD) for trading, payments, or savings.

More money available:

More stablecoins in circulation means that exchanges and DeFi protocols have more liquidity. This makes it easier to move money between platforms and trade other cryptocurrencies.

Getting started with crypto and DeFi:

A market cap that is going up often means that new money is coming into the crypto world. People are bringing in real money and changing it into stablecoins before trading or investing.

Trust in the issuer:

A growing supply can show that people trust the issuer of a stablecoin (like Tether, Circle, or Ripple) and their reserves.