The XRP charts are displaying very gloomy conditions; however, the token has potential beyond charts, as there are plans for treasury and approval of XRP ETFs.

During the past week, XRP crashed while the whole crypto market bled with the announcement of tariffs on China. Unlike other cryptocurrencies, which kept crashing, XRP, however, showed a lot of resistance. With every support level that it was pushed to, the token tried to consolidate; however, the fear that was as large as life made the traders panic sell, crashing the prices.

On the chart below, it can be seen that XRP was trading inside a bearish descending triangle after which it broke downwards. When the descending triangle forms, it has a slanted top and a horizontal bottom line. The slanted top occurs as sellers keep pushing the prices lower; however, the buyers defend the support level (horizontal support) at $2.74.

With the range of motion constricting and the sellers increasing, XRP has broken downwards, as the buyers could not defend $2.74 anymore. As far as the technical indicators are concerned, the Relative Strength Index (RSI), which was dipping, has turned around and directed upwards, which is a good sign. This shows that the drop is over, or that XRP has reached the floor price for now.

It’s not just technical that XRP is bracing for a comeback, but fundamentally too. Ripple Labs, the company behind XRP, announced that it has plans to set up a digital asset treasury. As such, the company will initiate a fundraising of $1 billion, which will be used to purchase XRP tokens. With XRP trading at approximately $2.4, $1 billion could fetch 400 million XRP tokens, reducing the supply and increasing the demand.

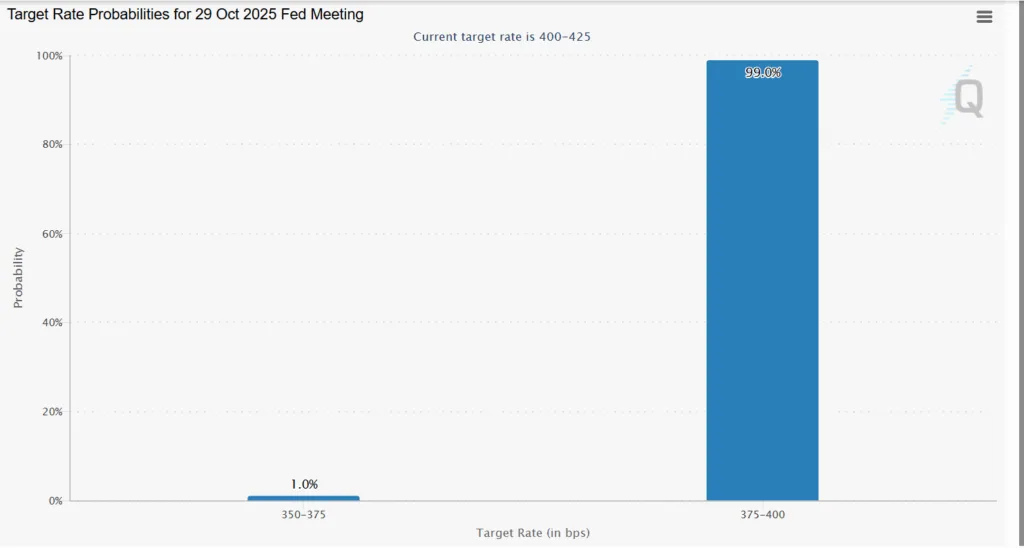

On top of that, the Federal Open Market Committee meeting scheduled for October 29 has a 99% chance of a rate cut, according to the CME Group market data. With another cut, the money supply will increase as borrowing will be cheaper, and the traders’ risk appetite will improve, and they will invest in crypto.