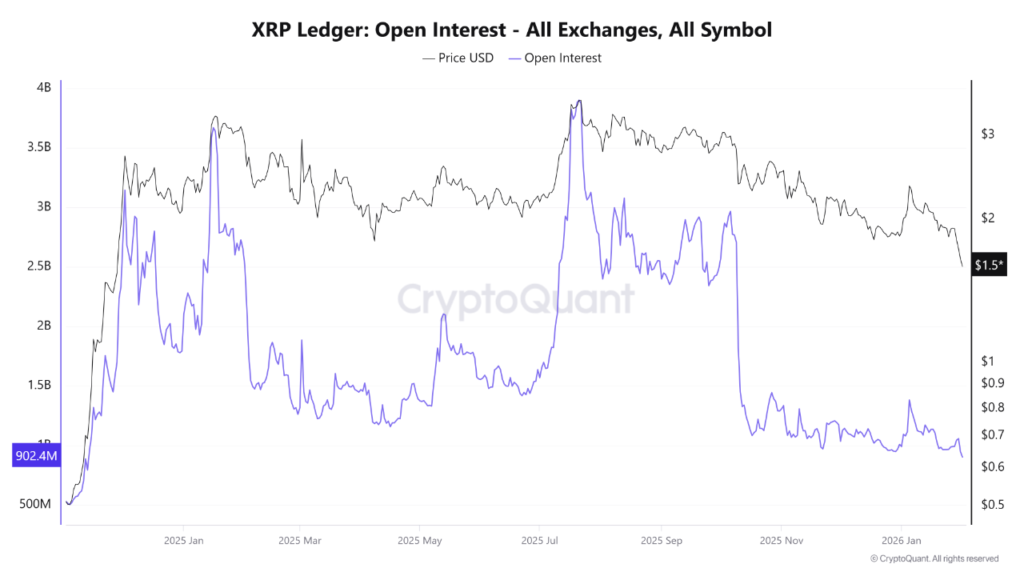

The XRP derivatives market is seeing a clear reduction in leverage, evident from recent exchange data. Notably, open interest on XRP derivatives contracts has declined to close to $902 million – the lowest level since 2024.

XRP derivatives open interest falls to a low

The crypto market has been declining at an alarming rate, with the total market cap falling from $4.2 trillion in October 2025 to close to $2.7 trillion as of February 3, 2026 – representing a 35.7% pullback.

In tandem with the declining market cap, the XRP derivatives market open interest has also suffered a substantial decrease to around $902 million. For context, the metric was hovering around close to $2.5 to $3 billion in 2025.

On an exchange basis, Binance-based XRP open contracts currently command an open interest to the tune of about $458 million, still marginally above its December 2025 level.

According to CryptoQuant analyst Arab Chain, the fall in open interest across different exchanges is indicative of a reduction in leveraged exposure, instead of a simple redistribution of liquidity among crypto trading platforms.

Past data shows that such periods are often followed by extended periods of price consolidation or the creation of new price bases. In addition, if the XRP open interest rises in the future – coupled with an increase in XRP price – could suggest that the digital asset may be on the verge of a new uptrend.

Could XRP be poised for an imminent uptrend?

Currently ranked fifth on the Coingecko list of cryptocurrencies by reported market cap, XRP’s recent movements suggest that it may be on the cusp of an uptrend, despite the wider crypto market weakness.

Recently, XRP whale inflows to Binance crypto exchange hit their lowest levels since 2021, indicating that large holders may be anticipating a price appreciation in the short to medium term. The number of ‘millionaire’ XRP wallets – wallets holding at least one million XRP – is witnessing a rise as well.