Ripple’s token XRP ranked 4 on the trending list, as some companies are launching XRP ETFs in the next few days. However, despite these positive announcements coming through, XRP is still on a downtrend.

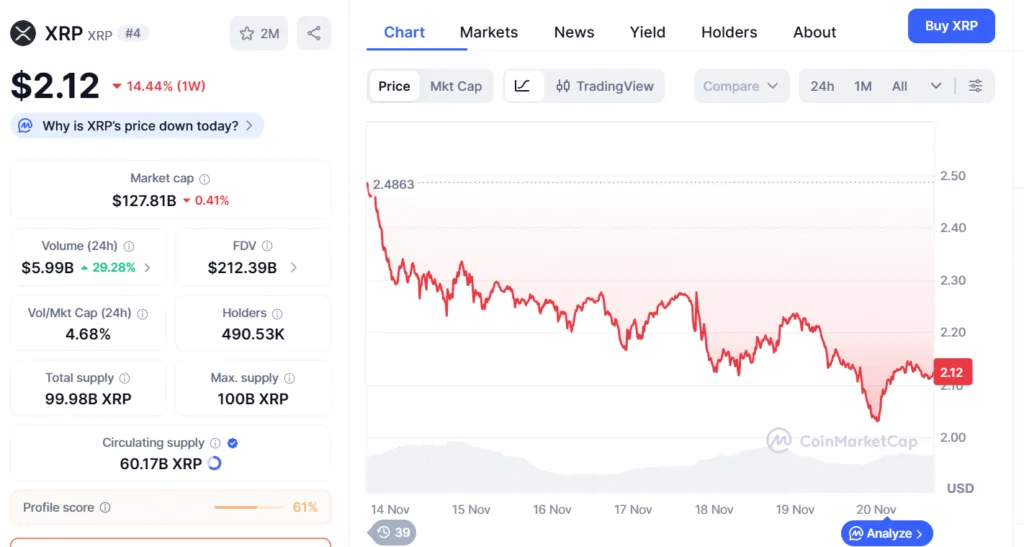

The XRP token has been on a downtrend throughout the past week, crashing gradually from $2.48 to $2.12. What’s more surprising is that XRP was crashing despite the launch of the ETFs day drawing near. The coin lost almost 15% of its value as the range of fluctuation kept getting wider while it moved lower.

When the range of fluctuation widens, as the prices crash, it shows that the liquidity is thinning out, as the bears dominate the market.

This downtrend comes in the wake of Grayscale and Franklin Templeton’s ETF about to hit the market. Asset manager Grayscale submitted its updated S-1 filing with the SEC on November 3 and it might go live on November 24.

When an S-1 filing is submitted to the Securities and Exchange Commission (SEC), it has a window of 20 days to react to this. However, in the event it fails to show any reaction, Grayscale’s ETF will be effective in 4 four days. In addition, ETF analyst James Seyffart believes Franklin Templeton might also go live on November 24.

Given that both the ETFs go live on the same day, it will become the biggest ETF launch event in XRP’s history.

On the daily chart, XRP is trading inside a falling wedge. The pattern is not complete, hence, the breakout is not imminent. So, during the build-up to the breakout, XRP will be moving up and down in a zig-zag pattern, hitting the upper and lower trendlines. Once XRP breaks out of the pattern, it could surge and hit $2.6 and move further higher.