SOL, aka the Ethereum Killer, is expected to reach 3 times its current price. Increasing treasury and institutional purchases and upgrades, making Solana faster and cheaper, are the driving factors behind this surge.

$SOL feels like it's lining up for the trade of the cycle.

— Lark Davis (@TheCryptoLark) September 11, 2025

ETFs coming, treasury purchases, upgrades making it faster and cheaper = price goes higher

Bitwise's CEO Matt Hougan thinks $SOL could be in a position similar to when $BTC was at $40K and $ETH was at $1600

Meaning,…

“Bitwise’s CEO Matt Hougan thinks $SOL could be in a position similar to when $BTC was at $40K and $ETH was at $1600,” said popular entrepreneur Lark Davis, in a X (formerly Twitter) post. This means, “Solana’s bullish tailwinds could ignite a 3X in price within a short matter of time.”

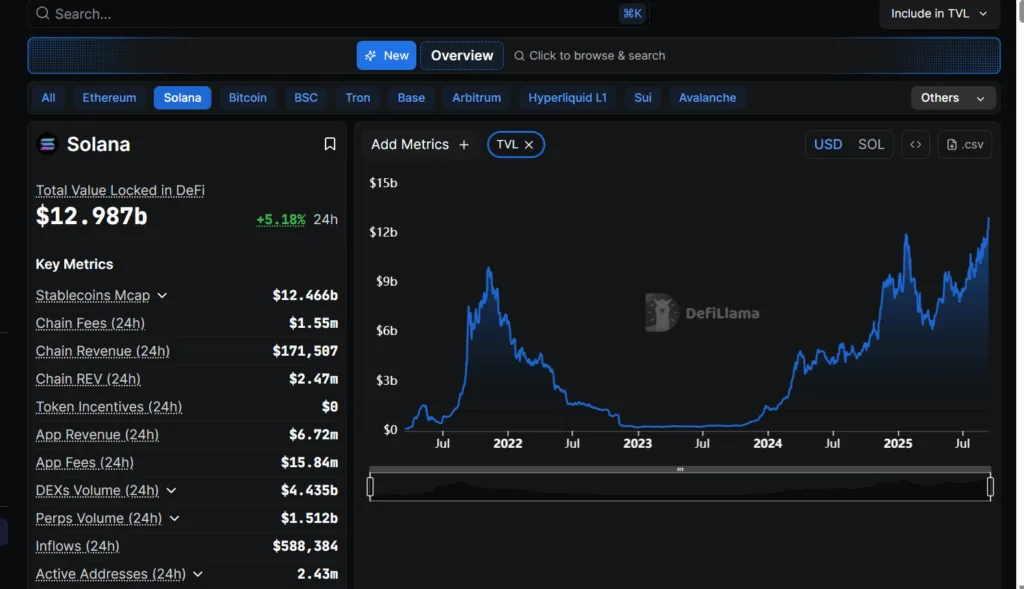

To better understand Solana, let’s take a look at the fundamentals. The Total Value Locked on the Solana network neared $13 billion. TVL stands for Total Value Locked.

It represents the total dollar value of crypto assets deposited (or “locked”) in a blockchain’s DeFi protocols, such as lending platforms, decentralized exchanges (DEXs), yield farms, and staking pools. Increase in TVL shows growing user confidence, higher liquidity, ecosystem growth, and a bullish signal.

Meanwhile, Solana (SOL) captured the fifth place on CoinMarketCap among the tokens with the largest market cap.

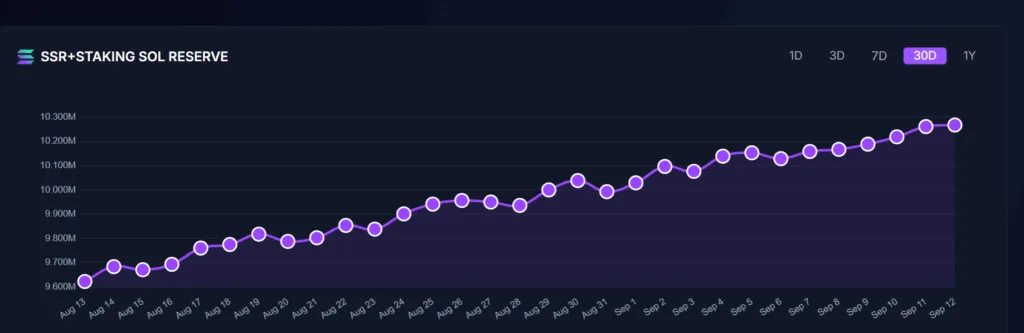

The Strategic Solana Reserve (SSR) rose from 9.99 million SOL to 10.26 million SOL from August 31 to date.

Among the institutional demand and treasury reserves, Sharps Technology holds the title with 2.1 million SOL holdings worth more than $500 million. Second only to Sharps Tech, Defi Development Corp holds 2.02 million SOL worth about $480 million, while Upexi, Inc holds 2 million SOL worth $475 million.

Solana’s technical pattern goes for a toss

On the technical front, nothing is being played by the book. The rising wedge shown on the chart below is a bearish pattern, where the prices start to crash after the wedge is formed. However, in this scenario, SOL broke above the upper trendline, making a new higher high.

Why did SOL dismantle the pattern?

Major news, like institutional adoption, partnerships, ETF approvals, and protocol upgrades, has the power to overturn the technical pattern.

In Solana’s case, it is a combination of ETF approvals and upgrades. In particular, SOL Strategies, a Solana-focused treasury firm, got approval to list on Nasdaq under the ticker STKE. In addition, the July Alpenglow upgrade expanded block capacity by 20%, reducing congestion risks. Next up, the eagerly awaited Firedancer client is expected to drive transaction per second (TPS ) to 1 million TPS, which is among the main catalysts that overrule the technical pattern.