Solana ETF net flow was head and shoulders above the XRP, ETH, and Bitcoin ETF net flows. With the funds flowing into Solana, the prices avoided crashing to December 2023 levels.

When the two top large coins, Bitcoin and ETH, saw investors pulling their money from the funds, Solana and XRP ETFs had a net inflow. Crypto analyst Ali reported that Solana had a positive flow greater than XRP, while BTC and ETH ETFs leaked funds over the past week.

SOL ETF flow surpasses BTC, ETH, and XRP

In particular, Bitcoin saw a net flow of -3,694 $BTC, worth roughly $232.60 million, while Ethereum leaked 67,069 $ETH, worth approximately $125.18 million.

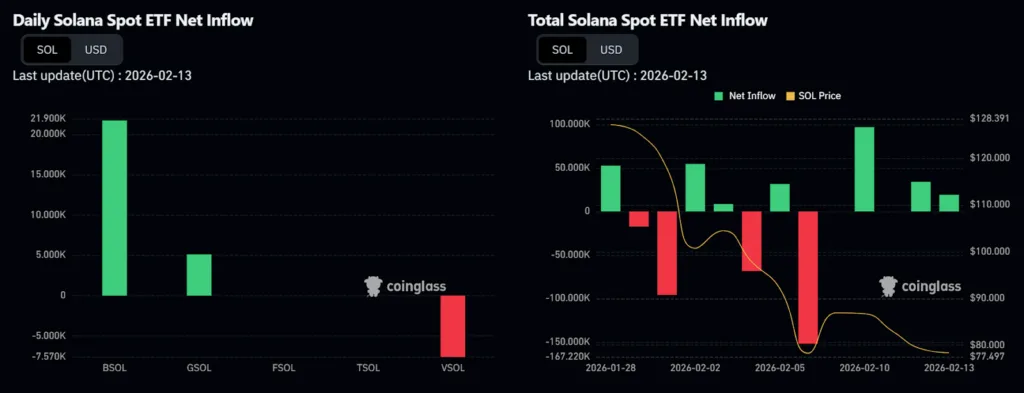

While the two top cryptocurrencies by market cap bled profusely, XRP saw an inflow of +6.22 million $XRP, worth roughly $8.76 million, and Solana attracted +120,353 $SOL, worth roughly $9.90 million.

Although Solana exceeded XRP, ETH, and Bitcoin, the daily net flow of funds into Solana spot ETF has reduced over the past two weeks.

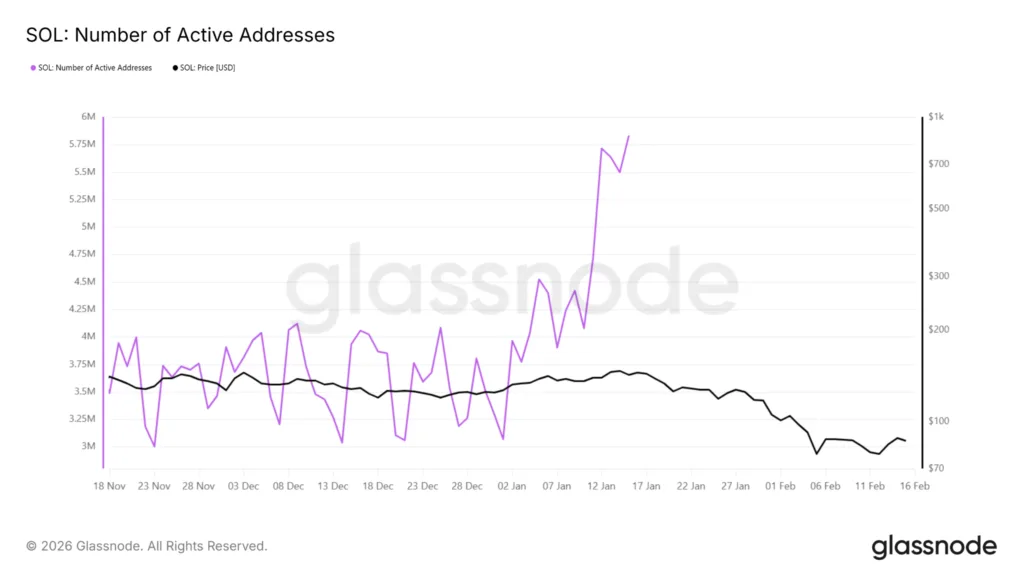

The on-chain metrics too have been quite impressive, as the number of active addresses saw an exponential increase during the past three months.

The active addresses grew from just a bit above 3.8 million to 5.8 million at the time of writing. In unison with the rising active addresses, the transaction volumes also spiked up to 57 million SOL from 42 million SOL on Jan 10.

The combination of active address and transaction volume increasing in tandem shows that not only are users active, but they are also making reasonable transactions, which is a real economic activity.

SOL narrowly escapes a huge crash

These activities narrowly saved Solana prices from crashing to December 2023 levels. Although the coin just escaped a dump to $70 – December 2023 levels – the coin is far from safe.

It has just begun a new uptrend, and it will need to hold this shape for some time. Priced at $86, SOL is at a pivotal point.

If the coin manages to establish a support level above $87, the new uptrend will be sustained; however, if SOL crashes below the $86 price level, SOL will be once again at risk of crashing to $70.