Solana, the seventh-largest cryptocurrency by reported market cap, may be close to the capitulation zone. Recent exchange-traded fund (ETF) outflows suggest that SOL selling pressure may be nearing exhaustion.

Solana ETFs see massive outflows

According to an X post by blockchain analytics account Santiment, Solana-based ETFs saw $11.9 million worth of outflows on February 6—the second-highest amount on record. Similarly, the total net outflows on February 9 were around $14,500.

Data from the crypto ETF data tracking website SoSoValue confirms the flight of capital from Solana ETFs. Notably, Solana financial products have not seen a single week in the green (with capital inflows) since the week ending January 23, 2026.

Currently, Solana ETFs have a cumulative total net inflow worth almost $862 million. Meanwhile, the total net assets tied in Solana-based ETFs currently hover around $733 million, representing approximately 1.47% of Solana’s total market cap.

That said, the past few months have not been entirely encouraging for Solana. The large-cap cryptocurrency has lost around 62% of its total market cap over the past four months.

Santiment said that it appears that “traders are getting closer to capitulation,” adding that major outflows from ETFs have historically been a textbook bottom signal. If this holds true, then the $67.5 local bottom hit on February 6 may prove to be a turning point for SOL.

Traders on X did not waste much time before speculating on the SOL’s future price action after the recent market rout. Crypto trader Shah shared the following chart, saying that SOL at $300 by May 2026 won’t be surprising.

Providing a contrarian take, crypto analyst Crypto Wave Vision offered a bear case. They shared the following chart, that another downward move may still be on the cards for SOL before it flies to fresh highs.

A divergence between price and on-chain metrics

While SOL’s price action has been nothing short of underwhelming over the past few months, the smart contract platform’s network activity continues to show strong momentum.

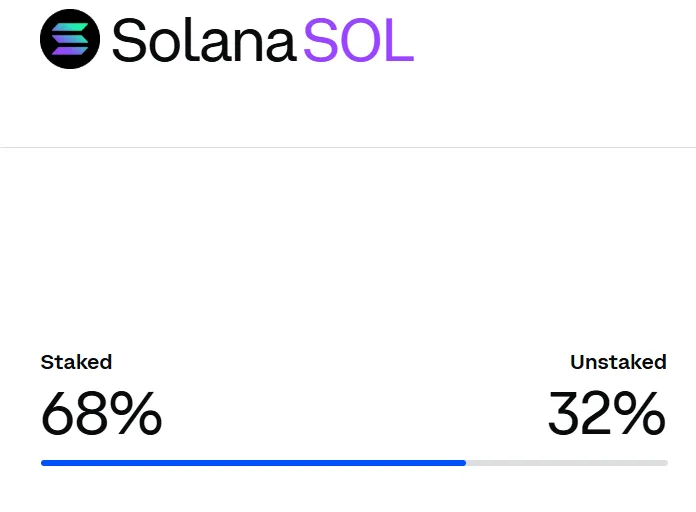

According to data from Coinbase, around 68% of the eligible SOL supply is currently staked, indicating that the majority of the token holders, in volume terms, prefer the stake-and-forget approach, bolstering Solana’s resilience.