The Solana network hit a new all-time high on the Total Value Locked (TVL) in Defi, on its blockchain, with increasing institutional demand.

The Solana TVL hit a new all-time high of $12.44 billion, surpassing its previous all-time high, which it set in 2023. The TVL of the network moved slightly above its previous all-time high of 12 billion, establishing a new all-time high. According to Defilama, an on-chain analytical platform, the platform gained more than 25% during the past 30 days.

What does an increase in TVL mean?

Total Value Locked (TVL) is basically the total amount of crypto assets deposited into a DeFi protocol. It reflects how much capital users are entrusting to the project, typically in the form of staking, lending, liquidity provision, or collateral. When this value increases, it means increased:

Trust and credibility

- A high TVL shows that many users trust the protocol enough to lock their funds there.

- It signals market confidence and helps attract new users or investors

Liquidity and usability

- More locked assets = deeper liquidity.

- This means lower slippage for trades, more stable lending/borrowing, and generally a smoother user experience.

Earnings and sustainability

- Protocols often earn fees from trading, lending, or yield farming.

- Higher TVL usually means higher revenue for the project and, in some cases, better rewards for token holders or stakers.

Valuation and market perception

- Analysts often compare a project’s Market Cap / TVL ratio to assess if it’s over- or undervalued.

- A very low ratio can suggest the token is undervalued relative to the assets it secures.

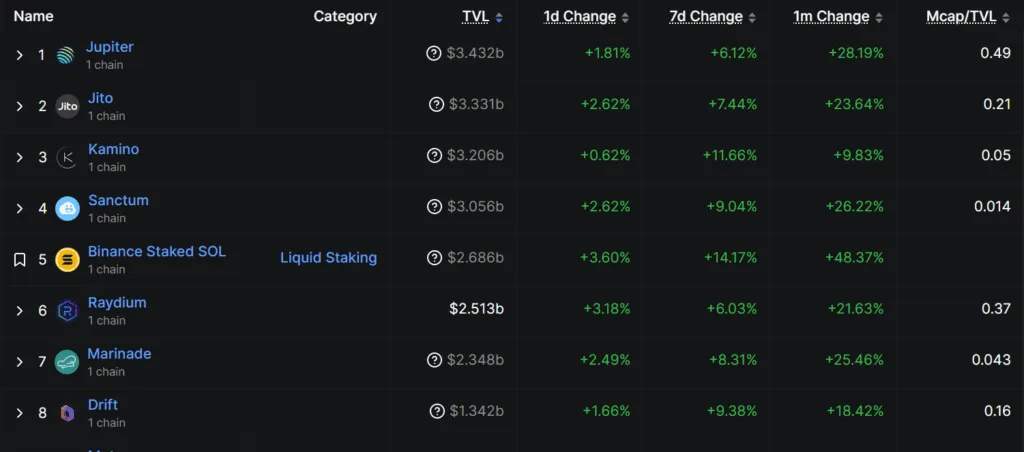

8 top institutions on Solana have more $1 billion TVL

When it comes to institutional demand, many projects at the top gained value by two digits during the past month. Out of the top 10 projects with the highest TVL, 8 projects have locked over $1 billion in Solana. Among these 8 projects, 7 have gained value by double digits over the past month.

Jupiter captured the first place with a TVL of $3.4 billion, Jito was second to only Jupiter, with $3.3 billion staked, while Kamino took third place with $3.26 billion.

🚀 Solana's TVL smashes new ATH at $12.1B amid surging institutional interest! ETF delays aside, with treasury buys, upgrades, and a bold 2025-2027 roadmap, $SOL is set for liftoff from $218 toward $230. HODL tight! #Solana #SOL #Crypto #Bitcoin #Web3

— Crypto Airdrop Hunter (@cryttpoi) September 10, 2025

Sighting the increase in the TVL, a crypto netizen requested the crypto community to hold their SOL tokens as “with treasury buys, upgrades, and a bold 2025-2027 roadmap, $SOL is set for liftoff from $218 toward $230.”