Solana prices have been on a roll even in the midst of ongoing market turmoil. The real activity on Solana is much higher when compared to Cardano. This analysis comes in the wake of Solana crashing to December 2023 levels.

Despite the macroeconomic factors spilling into the crypto markets and the prices crashing, Solana has been performing well, at least much better than Cardano. When comparing the market cap per daily transaction, Solana has a $400 market cap per transaction, while Cardano has a value of $16 million market cap per transaction.

The market cap per transaction is a metric that is used to measure the real activity on the network. It measures whether a blockchain’s valuation is supported by real activity or if its market cap is too high relative to how much it’s actually used. If a lot of people use the network, then the market cap per transaction falls, and if fewer people use it, the market cap per transaction rises. As such, the lower the market cap per transaction, the better the usage of the network.

SOL derivatives markets blossom

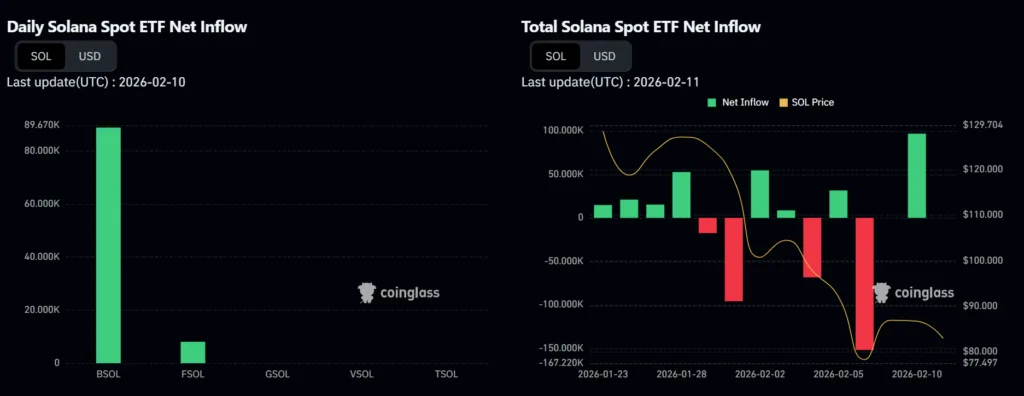

Solana is not just thriving on the usage; the derivatives market is also flourishing. The total Solana ETF net inflow saw an inflow of $8.4 million even during the market crash. Unlike other crypto derivatives markets, which had a profuse outflow of funds, Solana ETPs managed to attract funds even in chaotic times.

In terms of price, Solana has crashed to December 2023. However, despite the prices crashing to these bearish levels, if there are funds flowing into the derivatives markets, it shows that the investors have a greater faith in the network and are not just hanging around for profits.

The above chart shows SOL has fallen below the $80 price levels, which were seen back in December 2023. The relative strength index indicates that the market is oversold and that the price should recover in the coming days. However, the traders will be closely monitoring prices until they reach three digits.