Solana lost a major support level and crashed below the psychological $100 level as the geopolitical tension impacted the broader crypto market. The Solana total value locked (TVL) declined, and the futures market turned bearish as the funding rate went negative.

Solana, also known as the Ethereum Killer, crashed to double-digit values after it lost a major support level at $115.

Solana entered this two-digit zone not because there were any major liquidation or exchange-traded fund (ETF) disturbances. It was mainly because traders are maintaining a risk-averse position as the geopolitical conditions in the U.S. get heated.

Solana ends consolidation and crashes

Solana has been on a downtrend since October 2025. However, towards mid-November, the coin started to consolidate at the 0.786 and 0.618 Fibonacci levels.

But the broader bearish market conditions seeped into Solana. The spot market weakened while the bear momentum gained, pushing the coin below the 0.786 Fibonacci level, ending the consolidation phase.

SOL TVL declines

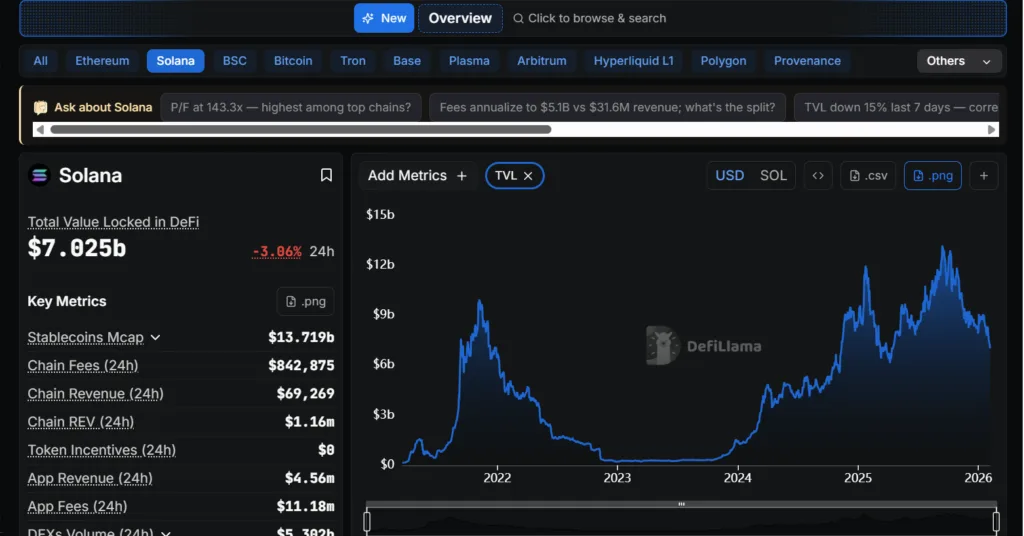

The Total Value Locked (TVL) in the network also crashed from more than $13 billion in September 2025, to about $7.5 billion as of the time of writing. The TVL represents the funds parked in DeFi protocols, DEXs, lending platforms, staking contracts, and yield farms.

A reduction in this metric shows that either the market is withdrawing funds, selling tokens, bridging to another chain, or moving to stablecoins.

SOL funding rate turns negative

The open interest, which is a representation of the future contracts, has dropped to 6.2 billion from above 8.8 billion in mid-January, showing that the investors are less interested in the SOL futures market. Meanwhile, the OI weighted funding rate has gone into the negative zone.

When the funding turns negative, it means that the shorts are paying longs, signaling that bearish positioning is dominant and traders are betting on a further downside.

Although it reflects strong short-side sentiment, extreme negative funding can sometimes backfire. The crowded shorts may get squeezed if the market rebounds sharply, and smart money may see this as a chance. Traders watch this closely as a contrarian signal, using it to gauge risk and potential reversal points.