Public companies holding Solana (SOL) in their treasuries are facing massive losses, as the total unrealized losses among these firms recently climbed to $1.5 billion. According to data from CoinGecko, most of these unrealized losses are concentrated among US-based firms.

Solana treasuries bleed amid market downturn

Solana, one of the leading smart contract protocols by usage, has fallen 58% over the past year. In the past month, the cryptocurrency is down 38.6%, trading at $84 at the time of writing.

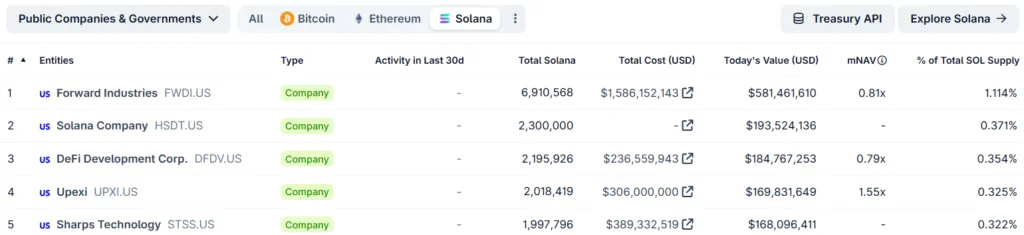

Data from CoinGecko shows that 19 companies collectively hold slightly more than 2% of the total SOL supply. Among these firms, Forward Industries leads by far, holding more than 6.9 million SOL, worth more than $581 million according to current market prices.

Notably, the total acquisition cost for Forward Industries is slightly more than $1.5 billion, suggesting that the firm has a massive unrealized loss of almost $1 billion. Forward Industries alone controls about 1.14% of the total SOL supply.

The above image shows the rough picture of total unrealized losses incurred by Solana treasury firms. The actual loss is likely higher since Solana Company – the second largest company by SOL holdings – has not disclosed its cost basis.

Another important metric to view is the declining multiple of Net Asset Value (mNAV). To explain, the mNAV measures the firm’s market valuation compared to the value of assets it holds.

A declining mNAV is indicative of declining investor confidence, while a rising mNAV suggests the opposite. A fall in mNAV typically makes it challenging for companies to raise funds without diluting shareholder value.

SOL accumulation hits break

Notably, the bulk of SOL accumulation was done between July and October 2025. Since then, no company has made any significant SOL purchases. Importantly, the stocks of the leading Solana treasury firms are down as much as 73% over the past six months.

Although the SOL price is on a long downtrend, there are some glimmers of hope for the digital asset. For instance, despite the weak price action, the amount of SOL coins staked on the network continues to climb up, igniting the so-called ‘supply crunch’ narrative.