Despite the broader geopolitical tension and bearish macro market sentiment, Standard Chartered Bank predicts Solana prices to hit $2,000 by 2030 as it is advancing on all fronts.

Although the bank predicted SOL to hit four figures by 2030, the institution revised its previous forecast of SOL hitting $310 by the end of 2026 to $250.

As Solana pushes past relying solely on memecoin protocol fees to SOL-stablecoin pairs and SOL ETFs, Global Head of Digital Assets/Crypto Research at Standard Chartered Bank, Geoff Kendrick, stated it’s more than just a ‘one-trick pony.’ Kendrick lowered his 2026 Solana price expectation from $310 to $250 while keeping his hopes high for 2030 at $2,000.

“Long-dated predictions from Standard Chartered say more about how the story around a network is evolving than where it might trade years from now.”

Analyst Lavneet Bansal

Furthermore, he mentioned that prices are hard to model that far out, so the better signal is how chains like Solana are actually being used, whether real activity, payments, and stablecoin flows are starting to take root at scale.

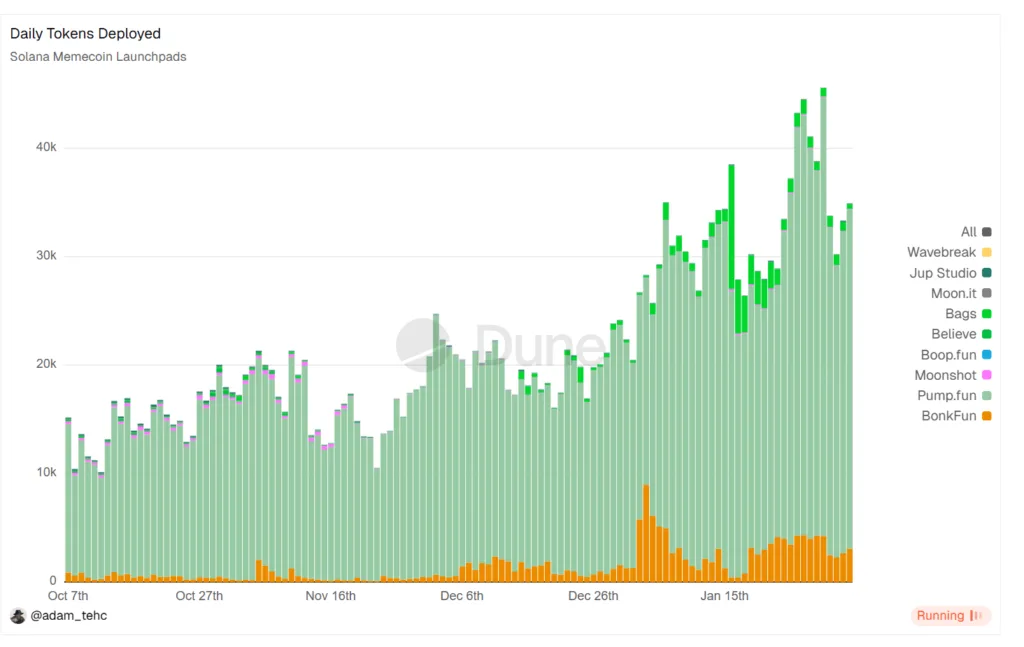

Memecoin launches on Solana surge

Memecoins launched on Solana are blowing up, and on January 31, the memecoins launched crossed 45K, with more than 85% of the tokens being launched on the Pump. fun launchpad. However, towards the beginning of February, the tokens launched on the network started to subside. More than 30K memecoins were launched within the last 24 hours on Pump.fun, while BONK followed up with nearly 3000 coins.

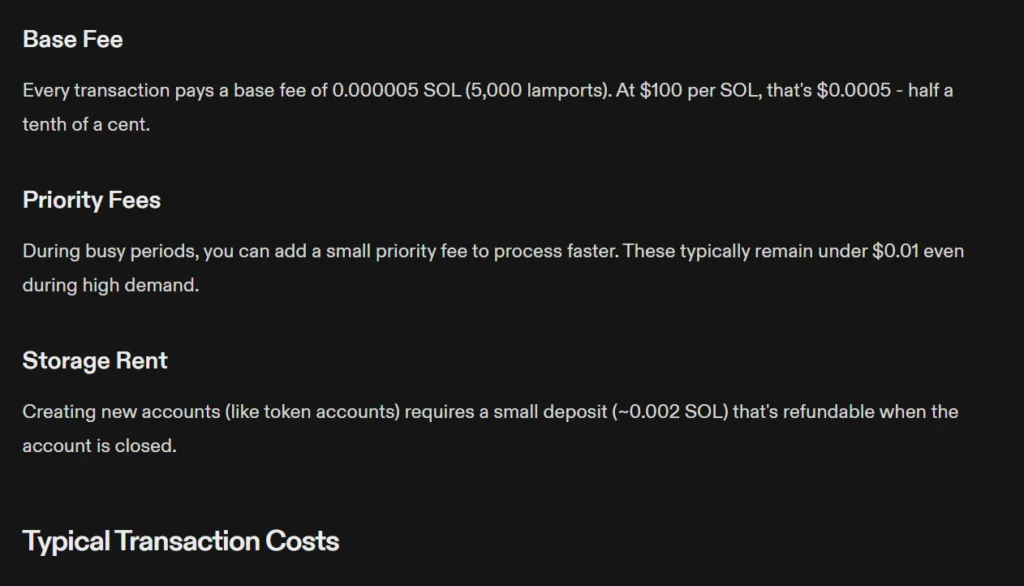

Lower transaction fee: The catalyst for long-term viability

The real-world use cases—transaction fees for Solana—are much more feasible and lower compared to the Ethereum network. One prime example is when Coinbase’s X402 platform, created for micro-sized payments with stablecoins, charges an average of 6 cents per transaction; Solana, on the other hand, charges just a tenth of a cent, making it a much better option for the long term.

On the exchange-traded products front, Bitwise BSOL ETF absorbed 78% of all net inflows into SOL-related ETFs, bringing over 1% of the total supply under ETF management. On top of that, financial institutions like Morgan Stanley applied for the Solana ETF in early January, showing the rise in institutional interest in Solana and its potential.