Another U.S.-based public bank has joined the bandwagon of financial institutions integrating blockchain to launch their own stablecoins.

With the signing of the GENIUS Act into law, there has been an increase in financial institutions testing the waters to see if they could integrate blockchain technology into their routine operations. In the latest incident, Minneapolis-based publicly traded U.S. Bank is testing a stablecoin, collaborating with consulting firm PwC and the Stellar Development Foundation on the project.

Explaining more about this initiative on the Future of Finance podcast, Mike Villano, senior VP and head of digital asset products at U.S. Bank, stated:

It’s another way to move money on a blockchain, and we look at blockchain as an alternative payment rail. We’re very interested to see what use cases are going to manifest from that and what customers are going to be most interested in.

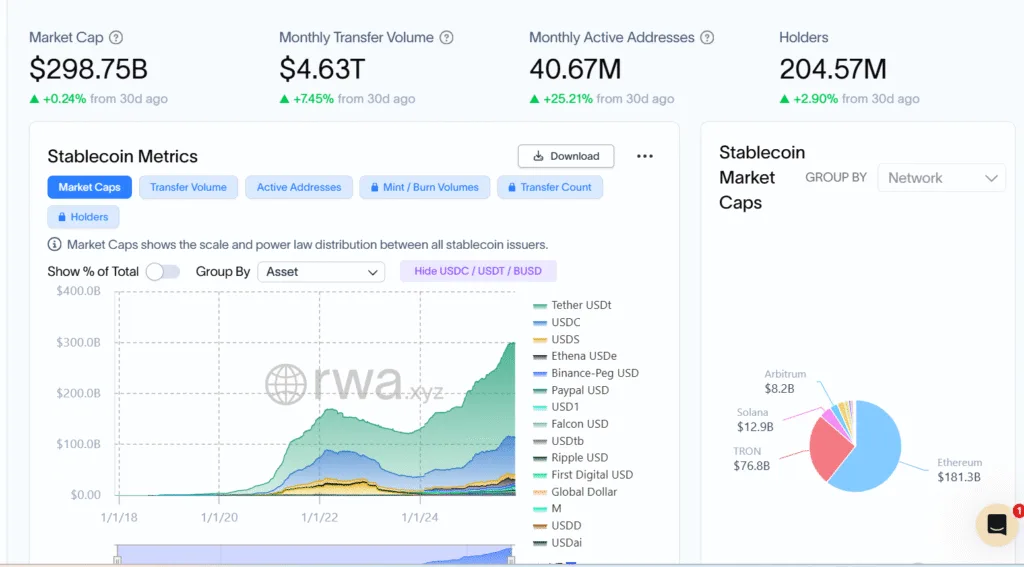

Meanwhile, the stablecoin market cap is up by almost 0.25% during the past 30 days, as it inches closer to $300 billion level. Even the monthly transfer volumes have spiked by 7.5% over the last 30 days, reaching $ 4.6 trillion.

Why are traditional financial institutions opting to launch their stablecoins?

When it comes to cross-border transactions, banks take time to process, and there is a fee for the transaction. However, on the blockchain, transfers are faster and easier and cost much less.

Banks do not want private firms like Tether, Circle and other stablecoin issuers to take over this space. Hence, to be competitive and stay in the game, these financial institutions are resorting to blockchain.

Banks also fear losing their market share. When private firms like Tether gain dominance, users will pull out their deposits from banks and hold stablecoin, creating a liquidity drain in banks. But bank-issued stablecoins keep those digital dollars on the bank’s balance sheet.