As the total crypto market cap has plunged from around $3.5 trillion in November 2025 to close to $2.4 trillion at the time of writing, it appears that the market’s appetite for risk is also fading. Recent data shows depleting stablecoin liquidity in the crypto market.

USDT liquidity dries up in the market

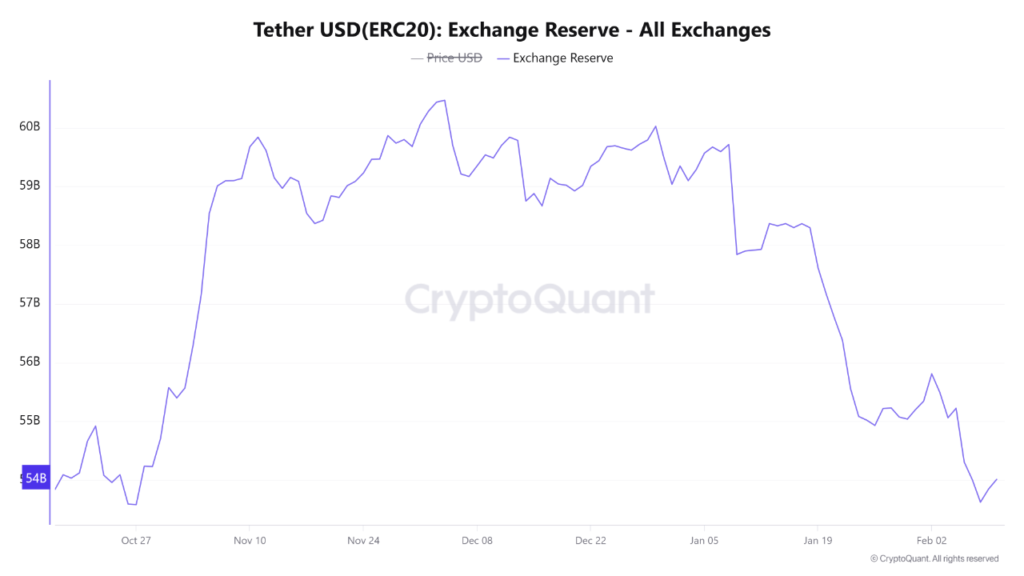

The Tether USD (USDT) stablecoin exchange reserves have seen a sharp decline across all major crypto trading platforms since late December 2025. The fall in stablecoin liquidity coincides with the fall in prices of major altcoins, such as Ethereum, Solana, Cardano, and others.

According to the following chart, ETH has crashed by more than 40% since December 2025—from $3,458 to $2,005 at the time of writing (February 10). The fall in both USDT reserves and ETH price signals a loss of immediate buying power among market participants.

Stablecoin reserves on crypto exchanges have declined from approximately $60 billion on December 30 to close to $53 billion as of today. In the meantime, Solana, the leading altcoin of the 2021-2022 crypto bull market, has fallen from $148 to $84—a fall of 43%.

The fall in stablecoins in particular is concerning because usually during a market fall, stablecoin reserves across exchange tend to be on the higher side as investors get ready to ‘buy the dip.’ However, this is not the case currently.

The simultaneous fall in both Ethereum and stablecoin reserves suggests a ‘capital flight’ in motion. This, coupled with precious metals like gold and silver regaining some of their recently lost momentum, shows that investors are still uncertain about the global macroeconomic structure.

Where are the stablecoins going?

Although there is a loss in appetite for risk-on assets like cryptocurrencies amid the existing market sentiment, it does not necessarily mean that stablecoins are lying idle in some random wallets.

Stablecoins have several use cases beyond providing liquidity in the crypto market. For example, they can be deposited into decentralized finance platforms to generate passive income.

Stablecoins are also seeing growth in adoption. In 2025, Circle’s USDC stablecoin recorded transactions worth a whopping $33 trillion.