The U.S. stock market index, the Russell 2000, hit a new all-time high, and Ethereum might follow this index, as it has been closely following it for a long time. However, for Ethereum to follow the stock index’s trajectory, there are certain other conditions that should be met.

As shown in the X post above, Ethereum has been mimicking the Russell 2000’s price action for a long time. The Russell 2000 is a U.S. stock market index that tracks 2,000 small-capitalization companies. The Russell 2000 and the Purchasing Managers Index are two parameters that are used to gauge the strength of the economy, based on the production or manufacturing of businesses.

Ethereum has moved in unison with the Russells 2000, establishing crests and troughs in synchrony. Given that ETH keeps mimicking this U.S stock, it should rise. However, if ETH is to play out according to the charts, there are few criteria that it needs to fulfill.

Although the correlation between ETH and Russels 2000 is compatible, liquidity needs to flow into cryptocurrencies not just equities. If liquidity does not rotate into cryptocurrencies then there is no way that ETH could spike.

In fact the Federal Reserve injected about $13.5 billion into banking systems by buying back treasury bills, however, this should enter into crypto markets to move the prices.

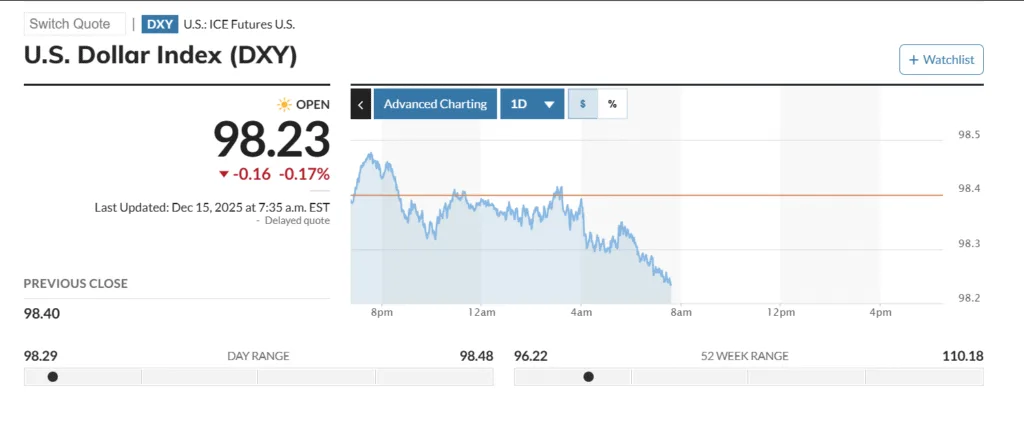

This depends on whether the dollar and bonds are weakening or strengthening. A waning or weakening dollar signals easing global liquidity, which historically creates the conditions for sustained ETH rallies, while dollar strength chokes risk appetite.

As shown in the chart, the US Dollar Index has lost 0.16% just within the last 24 hours. And even on the larger timeframe, like the 3-month chart, DXY has been losing value, making it a less likely security to invest in.

What if bonds had a better yield than crypto, then people would be investing in bonds than in crypto. Bonds are issued by governments and corporations to pool money for their activities. When they issue these bonds, there is a yield percentage that will be paid back to the investor as coupon payments or at maturity of the bonds. Think of it like the government is borrowing money from individuals.

So when the yield on the bonds or the returns is low, investors would not be interested in bonds. The Fed cut interest rates, which means the borrowing rate is less, and this makes bonds, something that investors would not be lured to.

Given that neither the dollar nor the bonds is attractive, the next best option would be cryptocurrencies. This gives ETH a higher chance of getting back into the bullish trendline as shown in the chart below.