The crypto market remains in disbelief of an impending altcoin season, as fear still dominates traders. The Altcoin Season Index charts fail to show any progress, and the only thing visible as far as the charts are concerned is fear. But there is a different narration building beneath the surface. The altcoin market cap is nearing a breakout while macroeconomic conditions are getting better.

Let’s take a look at the market sentiment. According to the Fear and Greed Index on CoinMarketCap, the overall market sentiment remains in the fear zone. This indicator is a tool that gauges the overall sentiment of the market, or the mood of the traders.

Fear still dominates market

Although it recovered from the extreme fear, there is no convincing data to show that the market is actually recovering, as the downtrend continues. This means that the traders are still very risk-averse and do not want to enter the market any time soon.

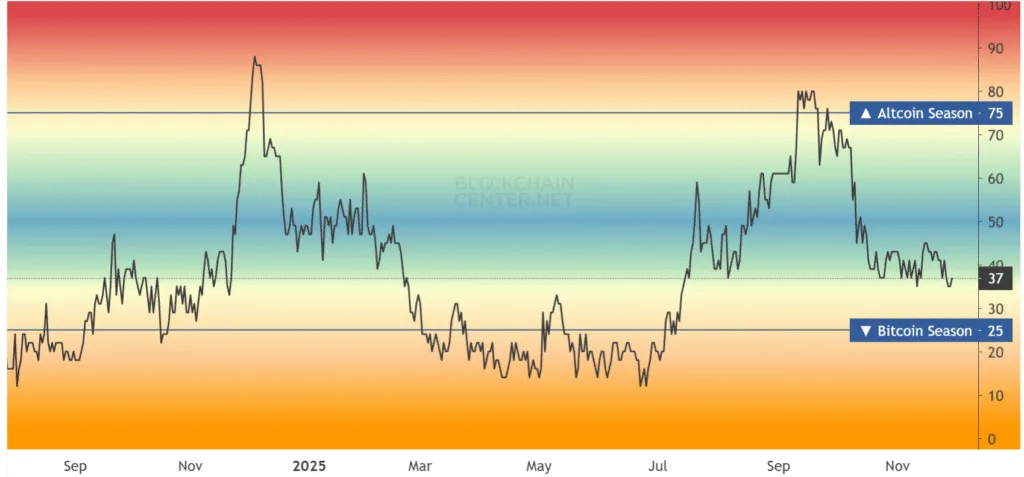

Altcoin Season Index in neutral zone

The Altcoin Season Index, an indicator that measures the altcoin’s performance against Bitcoin, is still in the neutral zone as it shows 37 on its scale. This goes on to say that 75% of the top 50 coins haven’t outperformed Bitcoin for the past 90 days continuously. In addition to that, the ASI line is continuing its downward trend, falling more towards the Bitcoin season as shown below. In such an anti-altcoin season condition, a crypto analyst spotted an interesting pattern on the charts.

Altcoin market cap nears breakout point

The analyst who goes by the pseudonym Moustache spotted that the total crypto market cap excluding Bitcoin is still maintaining its uptrend as it forms an ascending triangle. This pattern has a diagonal bottom and a flat top. Now that the altcoin market cap is nearing completion, Moustache stated, ‘I can’t be bearish here folks’, as an ascending triangle usually breaks out towards the top.

Macroeconomic landscape gets better

On the other hand, the quantitative tightening (QT) is about to end by December 1. During QT, the government drains all the liquidity in the market by selling government bonds. This drains the supply of money in the market. However, with this QT coming to an end, there is going to be more money in the market.

Last time QT ended BTC dominance tops out. When Bitcoin dominance tops out, it means that Bitcoin has reached its threshold, and then funds start to rotate into altcoins, kicking off the altcoin season.

The ASI indicator depends on the performance of the altcoins. However, as funds have not yet rotated into altcoins, the ASI shows no change. Although the ASI is still neutral, the tectonic shifts are happening behind the scenes, and before you know it, fear will disappear, and the ASI will move.