In an era where traditional finance is converging with blockchain-powered innovation, global banks are accelerating into crypto as regulation finally opens clear and compliant pathways. In the latest convergence of traditional finance with Web3, Swiss crypto bank AMINA Bank AG got approval from Hong Kong to offer crypto trading and custody services to institutional clients.

By securing the Type 1 license from the Securities and Futures Commission (SFC), AMINA becomes the first international banking group to launch comprehensive crypto trading and custody services in Hong Kong.

AMINA took this initiative to close a gap, where institutional clients and family offices faced ‘limited access to international institutional-grade crypto with local onboarding capabilities,’ according to an official press release.

“Hong Kong has established itself as the region’s most sophisticated market for regulated institutional crypto adoption, and this license uplift positions AMINA to serve the accelerating demand from professional investors seeking trusted access to crypto,” said Michael Benz, Head of AMINA Hong Kong and APAC.

The traditional finance landscape is shifting from an anti-crypto stance to a more relaxed position, not just in the U.S. but worldwide. AMINA could be the first bank to secure the Type 1 licence, but it would not be the last. What’s the reason for this transition?

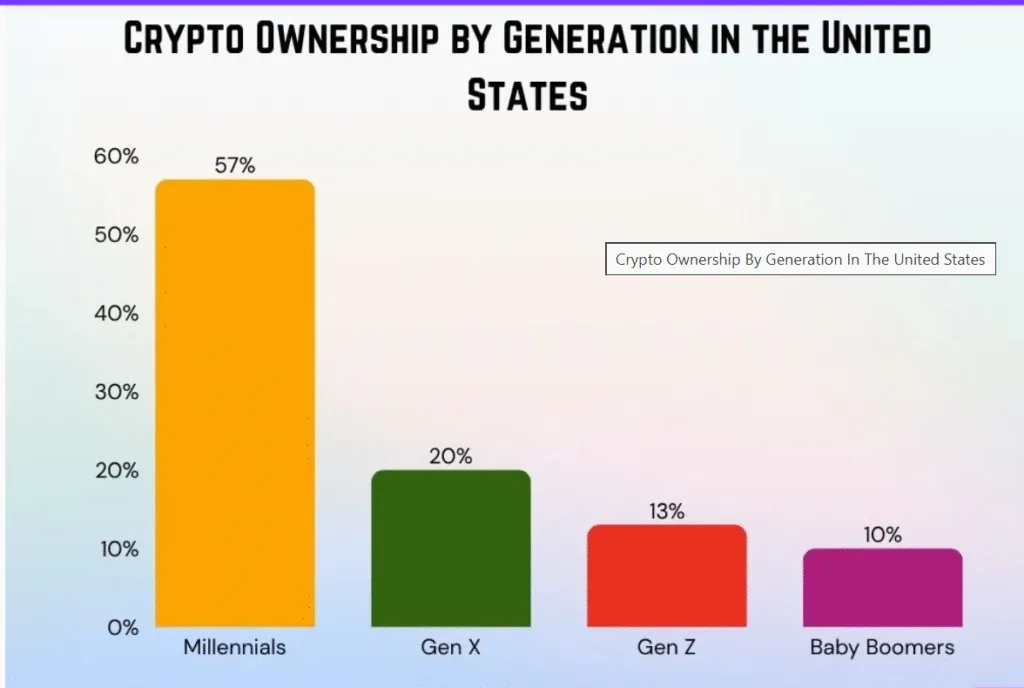

New user profile: Millennials and Gen Z, unlike the baby boomers, want more transparency over transactions and control over their funds. So banks have to cater to the rising demand of these new users in a different way.

Security and speed: since transactions are recorded on a public ledger, every transaction is transparent and immutable. Blockchain transactions are cheaper compared to WIRE transfers and traditional SWIFT transfers due to the lack of intermediaries.

Decentralization: Users want more control over their funds and transparency with their transactions, so banks are opting for blockchain in the hopes of tapping into the decentralized nature of blockchain.

Shawn Young, Chief Analyst of MEXC Research, stated that banks no longer view blockchain as an enemy but as the next layer of financial infrastructure. So, as banks reassess their role as intermediaries, the only way to stay relevant would be with collaboration, stated Young.