Latest data from crypto trading platforms shows that the Bitcoin (BTC) supply tumbled below 2.5 million earlier this week, the lowest level in seven years. Notably, more than 100,000 BTC were withdrawn from major exchanges, including Binance and Coinbase.

Crypto ETF inflows spike as exchange supply dwindles

Bitcoin supply on major cryptocurrency exchanges, such as Binance and Coinbase, is witnessing a sharp pullback. Fresh trends suggest that investors are moving their BTC to spot exchange-traded funds (ETFs) and self-custody options such as cold wallets. These on-chain movements have vastly increased the likelihood of a Bitcoin supply shortage.

It’s the first time since 2018 that BTC supply on crypto exchanges has fallen below 2.5 million. The following chart shows how BTC reserves across all exchanges have fallen from 3.03 million as of November 2024, to 2.3 million as of today, confirming a decline of approximately 24.1% within a year.

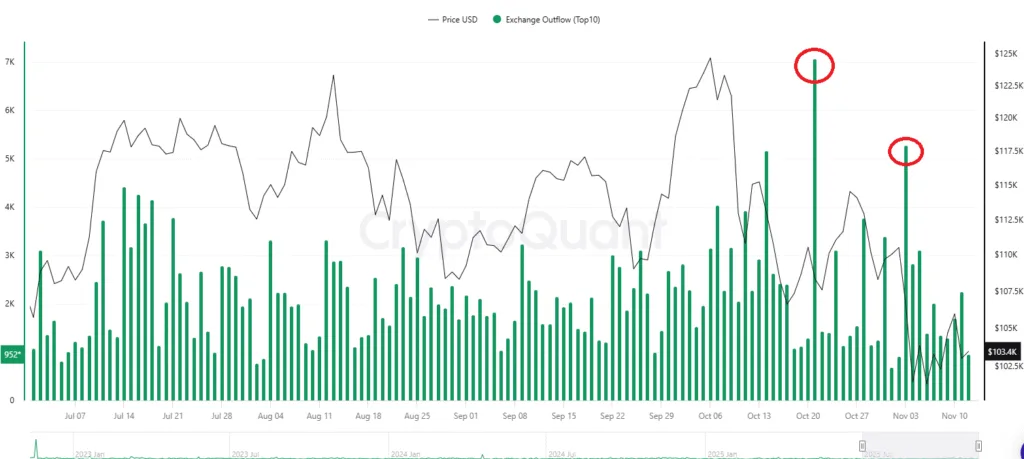

The chart below shows that BTC outflows from Binance have shown multiple spikes over the past month. For instance, on October 21, 7,068 BTC were withdrawn from Binance, while another spike on November 3, saw 5,068 BTC pulled from the top exchange.

Past data suggests that an increase in large-scale Bitcoin withdrawals from crypto exchanges is typically indicative of long-term accumulation. As an increasing number of BTC investors move their crypto holdings to cold wallets, it signals confidence in holding rather than trading.

The timing of such withdrawals is also interesting, as it follows a period of price consolidation for BTC around $103,000. This suggests that long-term holders and whales are preparing for the next move by the leading cryptocurrency, possibly a Bitcoin supply crunch that could lead to extraordinary price appreciation in the short-term.

Bitcoin ETFs are picking up momentum

Meanwhile, the latest data from SoSoValue shows that while November has seen net outflows worth more than $694 million from US-based spot Bitcoin ETFs, the investment products are starting to buck the trend as they recorded net inflows on November 10 ($1.15 million) and November 11 ($523.98 million).

For comparison, the total inflows to US-based spot ETFs in September stood at $3.53 billion, while in October, they hovered around $3.42 billion. The steady change in trend over the past two days is an early indication of institutional BTC holders expecting another leg up for the premier digital asset.