As the entire crypto market bides its time with bated breath, anticipating the return of the altcoin season, the Altcoin season index has fallen, deferring all hopes. Imagine the skies turn grey, thunder and lightning take over, and you are 101% sure it’s going to rain, but in the end, you see the silver lining on the cloud as the sun shines through it. That’s exactly what’s happening in the crypto market.

Altcoin season index falls back to 41

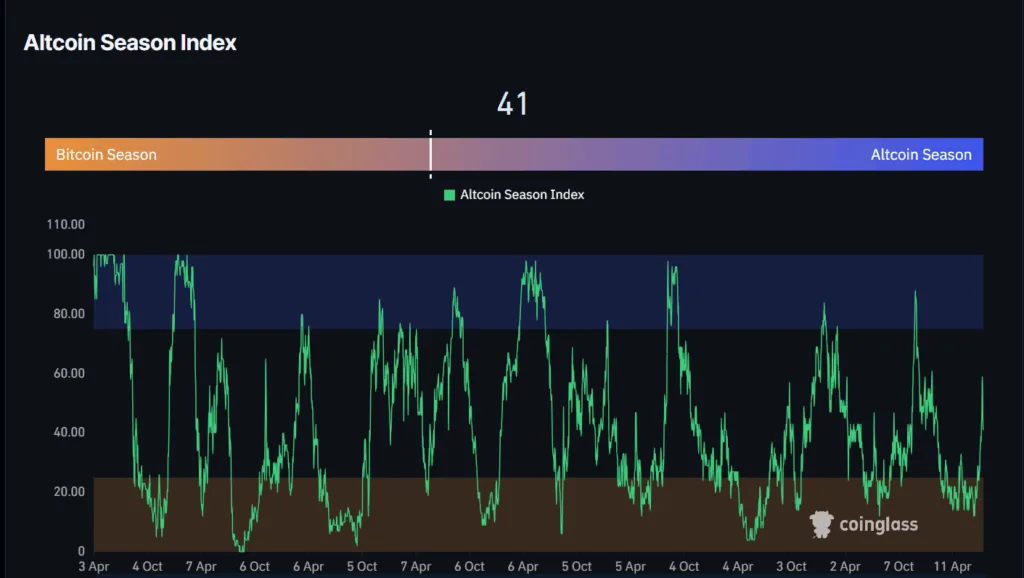

According to Coinglass, the altcoin season index reached 59 on July 21st; however, today the indicator stands at 41, signaling a slight move towards the Bitcoin season. The market usually considers any value below 50 as Bitcoin season, and values above 50 are considered to be an altcoin season.

When it is Bitcoin season, traders favor BTC over altcoins, and money flows into BTC, leading to higher Bitcoin dominance. On the 24-hour chart, the Bitcoin dominance has increased from 60.5% to 62.33%, showing that investors are more confident in Bitcoin than the altcoins.

Bitcoin still dominates the market

When taking a look back at where the Bitcoin dominance stood when the altcoin season in 2020-2021 started, the BTC dominance was below 40%. The dominance level crashed from 73% to below 40% before the altcoin season took over.

However, this was not a methodical decline, but a free fall from as high. As such, an increase in Bitcoin dominance can not negate that the altcoin season has been postponed. This is because if it follows its historic behavior, the BTC dominance could fall in no time below 40% and the altcoin season could take over the market before we all know.

The Altcoin season ain’t far off

Although the Bitcoin dominance has increased, the BTC ETF netflow has dropped into the negative zone, marking $-83 million in the past 24 hours. This means that the outflows are greater than the inflows for Bitcoin ETF, and investors are redeeming (selling) more ETF shares than new ones being bought. This usually happens when traders are profit-taking after a rally. The total assets under management (AUM) have been hovering around $152 billion.

Ethereum ETFs have recorded a 30-day net inflow of $300 million, pushing total assets under management above $17 billion. The positive net flow indicates stronger buying demand for ETF shares, prompting providers to purchase additional ETH in the spot market to back these inflows.

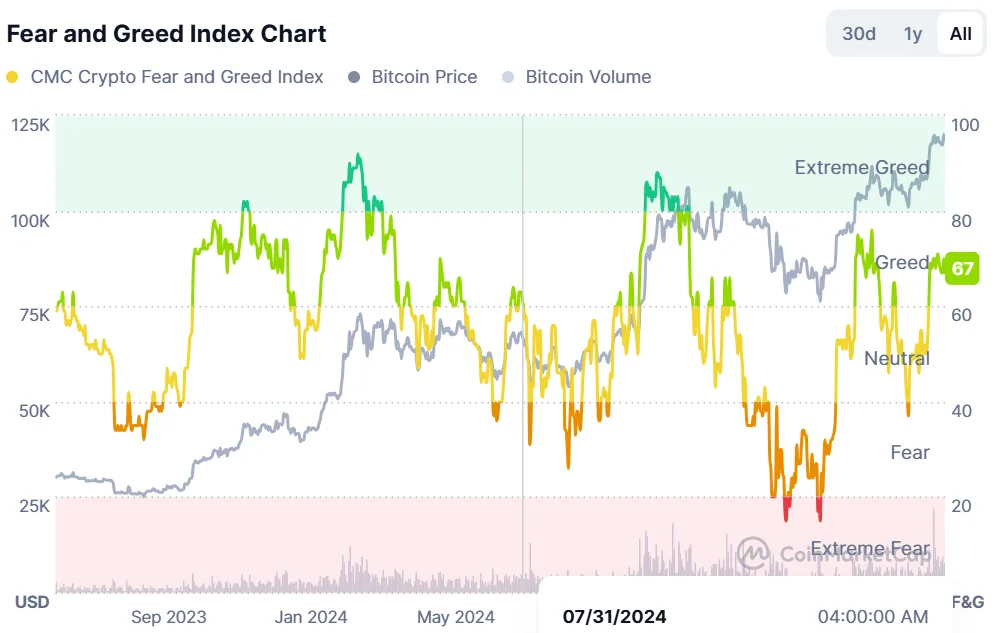

The market has entered a phase where the traders are making decisions based on their emotions, and FOMO (fear of missing out ) has kicked in. The Fear and Greed Index chart shows that the market has entered the greed phase, where the traders are aggressively buying cryptocurrencies. It could be that this abrupt rush of blood in traders caused Bitcoin’s dominance or market cap rise.

What to do during dodgy situations like these?

During times like these, where the outcome is unpredictable, traders may want to take precautions, make adjustments to their portfolio so that they are in a better position to take the loss on trades or orders they have placed. In fact, the best practice in chaotic times would be to keep away, or if you are a risk-taker, you might want to weigh out the risk and keep it to a minimum. Maybe if you want to try out Bitcoin in an altcoin season, you could use the Dollar Cost Averaging (DCA) method to mitigate the risk and spread it across.

Although the moment looks gloomy for altcoin season it is never out of hand. As such you might want to selective projects with strong fundamentals, active development, and sufficient liquidity. Or you may also consider Staking or yield farming with high-quality altcoins which can generate passive income during Bitcoin’s dominance phase. Analysts state not to do trade reacting to market movements and news instead advocate patience and work to the set strategy.