US-based blockchain technology firm BitMine Immersion Technologies Inc. (BMNR), continues to bolster its ETH reserves, having recently increased its total ETH holdings by 110,288. The firm’s latest ETH acquisition has further extended its lead as the largest corporate holder of the digital asset.

BitMine buys the Ethereum dip

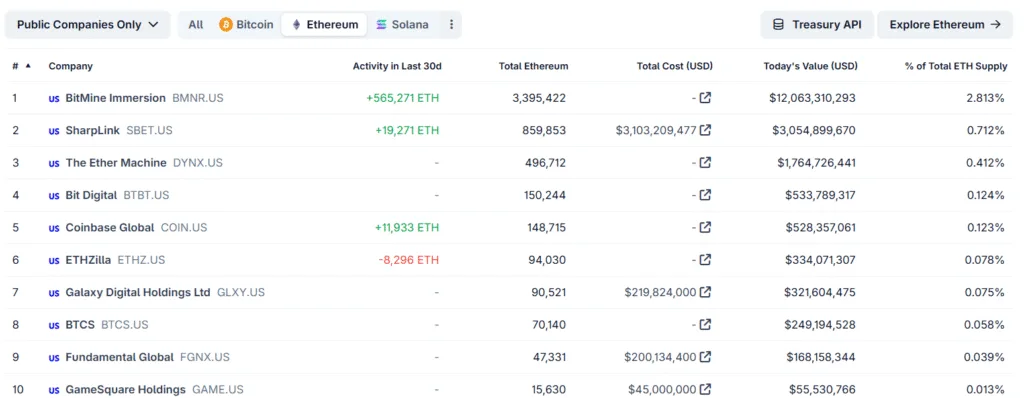

According to an official announcement yesterday, BitMine has added another 110,288 ETH to its Ethereum holdings, effectively controlling 2.9% of the cryptocurrency’s total supply. The firm aims to eventually accumulate 5% of Ethereum’s total supply.

To recall, the Thomas Lee-led firm began buying ETH in late June 2025, accumulating more than three million ETH in less than six months. BitMine’s pace of ETH accumulation has stood out in the industry, as an increasing number of firms introduce crypto treasury strategies.

Lee commented on BitMine’s latest ETH purchase, saying that the firm purchased “34% more ETH than last week.” The firm’s latest ETH purchase comes at a time when the wider crypto market is witnessing a brief pullback amid a rise in global macroeconomic uncertainty.

It is worth highlighting that BitMine also reported an increase in its unencumbered cash, currently standing at $398 million, an increase of $9 million from the previous week. With surging cash reserves, expect the firm to continue accumulating ETH in the coming months.

BitMine’s shares reported a modest surge today, trading at $41.15 at the time of writing. However, the stock is up an impressive 467% on a year-to-date basis, outperforming ETH, which is up 6.3% in the same period.

Companies warming up to altcoin treasury strategies

Although it was Strategy – formerly known as MicroStrategy – that spearheaded the crypto treasury trend by adding Bitcoin (BTC) to its balance sheet, an increasing number of firms are now warming up to the idea of adding exposure to altcoins such as ETH, Solana (SOL), and others.

For instance, Nasdaq-listed firm SharpLink Gaming currently ranks second among the companies with ETH treasury holdings. According to data from Coingecko, the company currently holds 859,853 ETH.

In the same vein, Forward Treasuries – a firm known for providing medical and consumer electronics – has emerged as the top company with a Solana-focused corporate treasury strategy.