In a crypto market filled with fear, it is very seldom that you find tokens that go against the market trend. ASTER is one such token that is not conforming to the bear market, while Solana might join ASTER in the coming days. Unlike these two, which are not going in sync with the market, BNB is on a downtrend.

Binance exchange’s native token, BNB, bled profusely throughout the past 7 days. The coin crashed from almost $1,000 to $930 during the course of these 7days. On the weekly chart, BNB lost more than 6%, while its trading volume, on the other hand, spiked. Currently, the BNB trading volume is at $2.8 billion after trading increased by more than 50%.

As shown in the chart below, BNB has completed the head and shoulders pattern, as it currently rests just above the 200-day moving average at $930. With the mounting bear pressure, the token will keep crashing as the RSI indicator has fallen below the signal line, which means the coin is below par. In this bearish outlook, if BNB bulls don’t defend the support level near the 200-day MA, BNB will crash to $840.

Solana captures 4th place on trending list

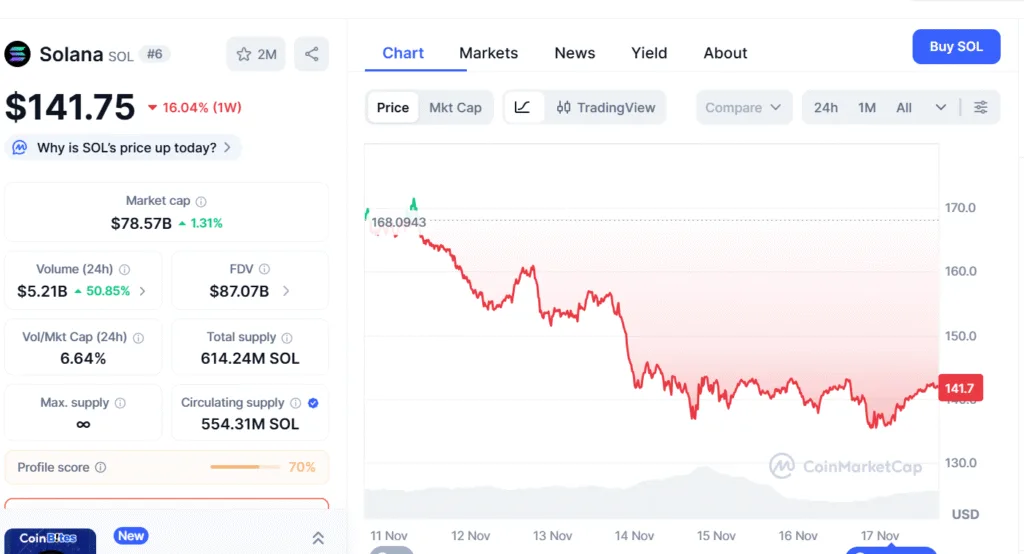

Solana captures the 4th place on CoinMarketCap’s trending list even after losing more than 15% during the past week. Unlike BNB, crash, SOL’s crash was very methodical. It is not actually a crash but more of a descent from $168 to $140 during the course of the past 7 days.

After slipping out of the ascending channel, SOL is currently trading inside a falling wedge, as shown below. Solana lost its way out of the ascending channel after the death cross occurred. Once the death cross occurs (50-day MA intersects the 200-day MA from above), the prices crash. Although the token is out of the macro ascending pattern, however, the token is inside the bullish falling wedge since September. Given that the bullish falling wedge pattern breakout is activated, Solana could go past $200.

ASTER’s next target is $1.5

ASTER has been on a roll since the last few days, making higher highs and higher lows. Although the token appreciated by than just a meagre 10% during the past week, it broke through some strong weekly resistance levels at $1.15 and $1.20. Second only to Bitcoin among the trending cryptocurrencies, ASTER’s 24-hour trading volume increased by 20% to almost $990 million.

Currently, ASTER is testing the 50-day MA at $1.32, and if it maintains its uptrend, it will rise until it hits the resistance level at $1.5, and then the next stop would be close to $2.