Chainlink (LINK) broke above its 7-month resistance level, with a rally that was supported by many contributing factors.

Chainlink (LINK), a blockchain abstraction layer that enables smart contracts to connect universally with external data, soared to new heights unseen in the last seven months. On August 3, the bull rally started when LINK was priced at $15.6. As the month progressed, the bull gained control of the market thanks to some contributing factors like heightened whale accumulation, increased wallet creation, Real World Asset (RWA), and institutional partnerships. With all these factors synchronizing together, the token was able to break above the $26 resistance level, which hindered its upward movements.

LINK whales accumulate 1.1 million LINK

In the past seven days, wallets holding large amounts of LINK—whales—have collectively acquired 1.1 million LINK, valued at roughly $27 million. The top 100 LINK wallets also raised their stakes by over 12%, reflecting strong conviction among institutional and high-net-worth investors.

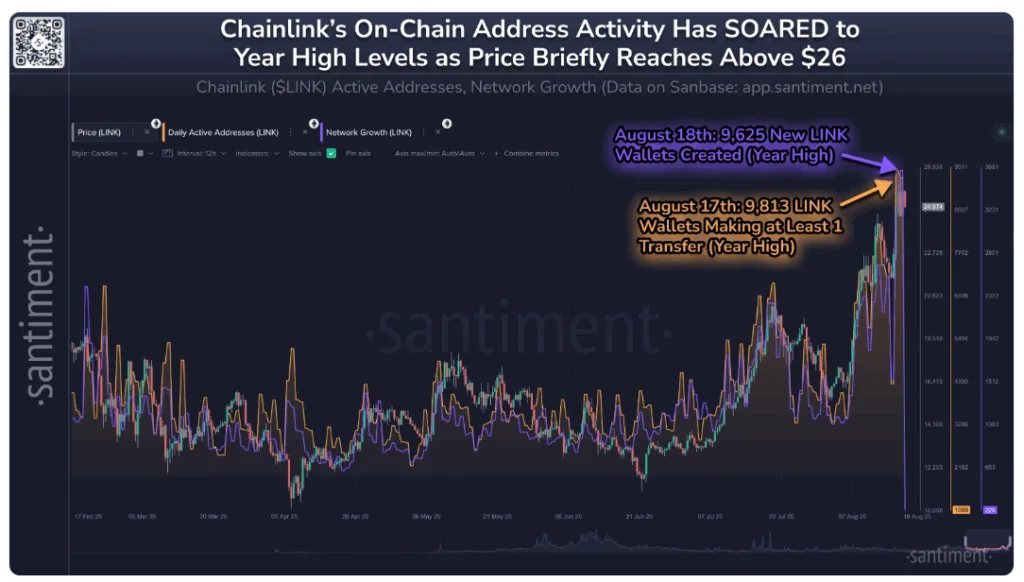

New LINK wallets created surpassed 9500 in August

Santiment data shows that over 9,600 new LINK wallets were created in mid-August, while daily transfers exceeded 9,800 — both reaching 2025 highs. Additionally, the introduction of real-world asset (RWA) data feeds, such as U.S. equities and ETFs, and partnerships with institutions like ICE and SWIFT, underscore Chainlink’s expanding importance as a bridge between traditional finance and blockchain.

What’s Chainlink’s (LINK) price today?

At the time of publication, LINK is trading at $24 after gaining almost 5% during the past week. The 24-hour trading volume has dropped by 24% to $2.2 billion, as the token dipped slightly after reaching its 7-month high of $26.

What will be Chainlink’s (LINK) price in 2025?

According to crypto trader Crypto Feras’s analysis on the daily chart, LINK will have a pullback once it reaches $26, which LINK has already gone through, and thereafter, it will hit $30 in the short term.

On the weekly chart, market signal indicator who goes by the pseudonym, Crypto Traders, stated, “Chainlink is predicted to reach new all-time highs by 2025.” In the thread, Crypto Trader, set $35, $82, and $130 as the targets for LINK to reach in the future.

So, how will LINK reach these levels? As shown in the chart below, LINK is trading inside a broadening wedge. A broadening wedge is a chart pattern that looks like a megaphone, where price swings start small but expand over time, creating higher highs and lower lows. It reflects growing market volatility and uncertainty, with buyers pushing prices up and sellers dragging them down with increasing force.

The price rebounds off of the upper and lower trendline until the pattern is completed and thereafter breaks out. After hitting the lower trendline, LINK is heading towards $40 after breaking the $32 resistance level.