Crypto is electric right now: ETH supply on exchanges has plunged to multi-year lows, Circle’s controversial move to reverse transactions has stirred fresh debate, and a string of other shocks keeps traders on edge. The Fear & Greed index sits at 41 — teetering on the cusp of the fear zone — meaning market sentiment is cooling and volatility could spike.

Ethereum supply on exchange hits unprecedented levels

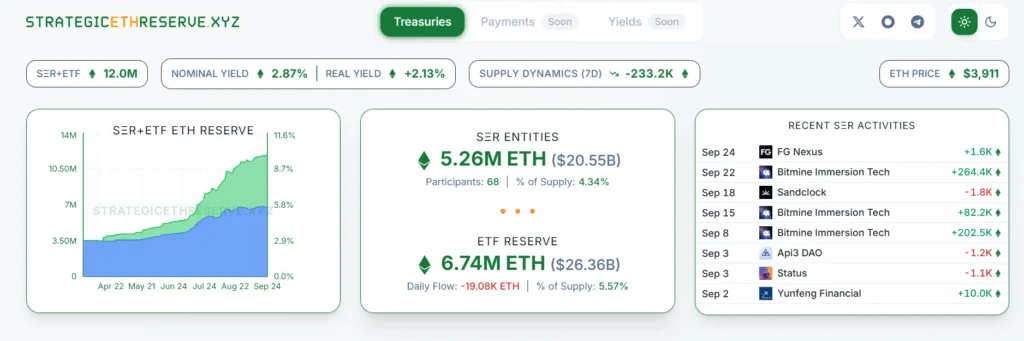

Ethereum supply on exchanges shrank to a 9-year low with aggressive buying from institutions. The Ethereum supply on exchanges dropped to 14.8 million ETH, with digital asset treasury firms and exchange-traded funds going into a buying frenzy. According to the Strategic ETH Reserve, 68 institutions bought 5.26 million ETH worth about $21 billion.

Circle is on the hunt to reverse transactions

In a move that infringes on blockchain’s core principle, stablecoin issuer Circle is exploring how it could reverse a transaction. Circle took this out of the ordinary approach of reversing transactions in an attempt to recover funds from fraud and hacks. Making a statement on Financial Times, Circle president Heath Tarbert said, “We are thinking through [. . .] whether or not there’s the possibility of reversibility of transactions, right, but at the same time, we want settlement finality,”

Bitcoin ETF inflows hit $240 million

On September 24, the total Bitcoin spot ETF recorded $241 million in inflows while the total net assets hit $150 billion. ETH spot ETFs recorded an outflow of 19K ETH, a decrease from the day before yesterday’s 33K ETH.

24-hour liquidation hit $1 billion

The liquidations on long positions have subsided largely after hitting record levels on September 22. The total long liquidations hit $170 million today after drastically dropping from $1.65 billion, the highest recorded long wipeouts, on September 22. The total liquidations, short and long, during the past 24 hours amounted to $1 billion.

Total crypto market crashes

The total crypto market capitalization fell below the psychological $4 trillion mark and reached $3.8 trillion. The market cap crashed below $4 trillion on September 21 and thereafter consolidated before falling again.

Australia passed law to regulate digital assets

In an attempt to beef up consumer protection, Australia released a draft legislation that would bring digital-asset platforms under financial-services law. Assistant Treasurer Daniel Mulino announced this on Wednesday at the Digital Economy Council of Australia’s Global Digital Asset Regulatory Summit. “This is about legitimizing the good actors and shutting out the bad,” Mulino said.

Fear and Greed Index falls

A reading of 41 shows sentiment has cooled from neutral and is teetering on the edge of fear — market confidence is fading. That proximity to fear usually brings higher volatility and thinner order books, increasing the chance of sharp downside swings.

European banks plan to launch stablecoin

Nine European banks — including UniCredit, Banca Sella, DekaBank, and ING — plan to launch a MiCA-compliant, euro-backed stablecoin in 2026.

This move underlines a broader push from traditional banks to build regulated digital cash and deepen euro liquidity within crypto markets.

Gate exchange launches new layer

Gate officially launched Gate Layer on Sept. 25, a high-performance Layer-2 designed to scale blockchain transactions, and unveiled a revamped tokenomics model for its native GateToken — moves that signal the exchange’s push to evolve into a broader web3 ecosystem.

Gate says its Layer can handle >5,700 TPS with ~1s block times, far outpacing most Layer-1s. Cost is a focus too: Gate estimates 1 million transfers would cost under $30, versus roughly $700 on Base and $1,000+ on Solana.

The market is fragile. ETH’s retreat from exchange custody and growing controversy around Circle have cooled sentiment and raised the odds of sharp moves. That doesn’t guarantee a crash, but it does mean thinner liquidity and bigger price swings — so tighten stops, reduce leverage, and watch on-chain indicators (exchange balances, inflows/outflows) alongside the Fear & Greed index for confirmation before adding size.