U.S. President Donald Trump imposed tariffs on China, and the crypto markets crashed. Fear took hold of the crypto market to such an extent that even hackers started selling their stolen funds, while incurring a loss. This is just one example of what happened. Read further, more interesting things happened today.

G7 countries issue stablecoin

A group of leading international banks is issuing a stablecoin to test whether a nationwide offering could bring the benefits of a digital asset. Banco Santander, Bank of America, Barclays, BNP Paribas, Citi, Deutsche Bank, Goldman Sachs, MUFG Bank Ltd, TD Bank Group, and UBS, in a press release, mentioned that the stablecoin would be pegged to G7 currencies.

According to the press release, “The objective of the initiative is to explore whether a new industry-wide offering could bring the benefits of digital assets and enhance competition across the market, while ensuring full compliance with regulatory requirements and best practice risk management. ”

Fear takes over the market

The Fear and Greed Index, which was fluctuating between the neutral and greed zone, has retraced and fallen back to the fear zone. From yesterday’s value of 54 (neutral zone), the indicator dropped to 35 all of a sudden. The markets went into a state of fear with Donald Trump announcing tariffs on China. The US president imposed a 100% tariff on the already existing 30% tariff on China. These tariffs are to take effect from November 1.

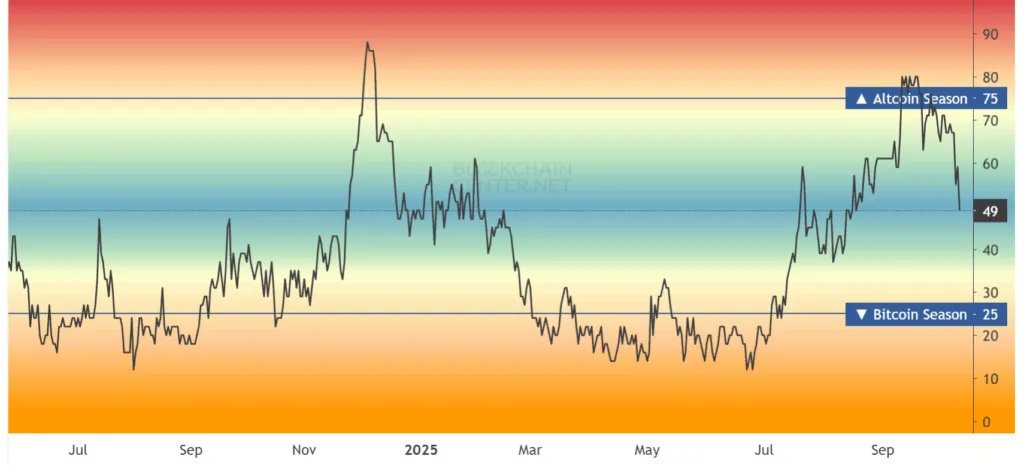

Altcoin Season Index crashes

Not only did Trump’s tariffs alter the market’s mood, but they also delayed the altcoin season. The Altcoin Season Index (ASI) fell from yesterday’s 59, and it is currently showing 49 on its scale. The ASI is an indicator that oscillates between the Bitcoin and Altcoin Season. When the ASI reaches values above 75, it is Altcoin Season, while values below 25 signal Bitcoin Season.

$16 billion in long positions were wiped out

The markets plummeted with the announcement of tariffs. With the crypto market crashing, more than $16 billion in long positions were liquidated, while only about $2.5 billion was liquidated. The stark difference between the liquidated amount points out that traders were heavily biased toward upside expectations that failed to materialize under pressure.

Europe feels threatened by U.S. stablecoins

Europe mentioned that the only way to combat the U.S. Stablecoin is to issue a Euro-pegged stablecoin, after it felt threatened by the U.S stablecoin. Senior European Union official, Pierre Gramegna, the managing director of the European Stability Mechanism (ESM), stated, “Europe should not be dependent on U.S. dollar-denominated stablecoins, which are currently dominating markets.”

Uptober marred by tariffs

The crypto markets crashed after the US president announced tariffs. Bitcoin took a massive hit, crashing from $122K and landed on $102K. Ethereum (ETH) also crashed from $4.4K to $3.8K while Solana crashed from around $225 to $174.

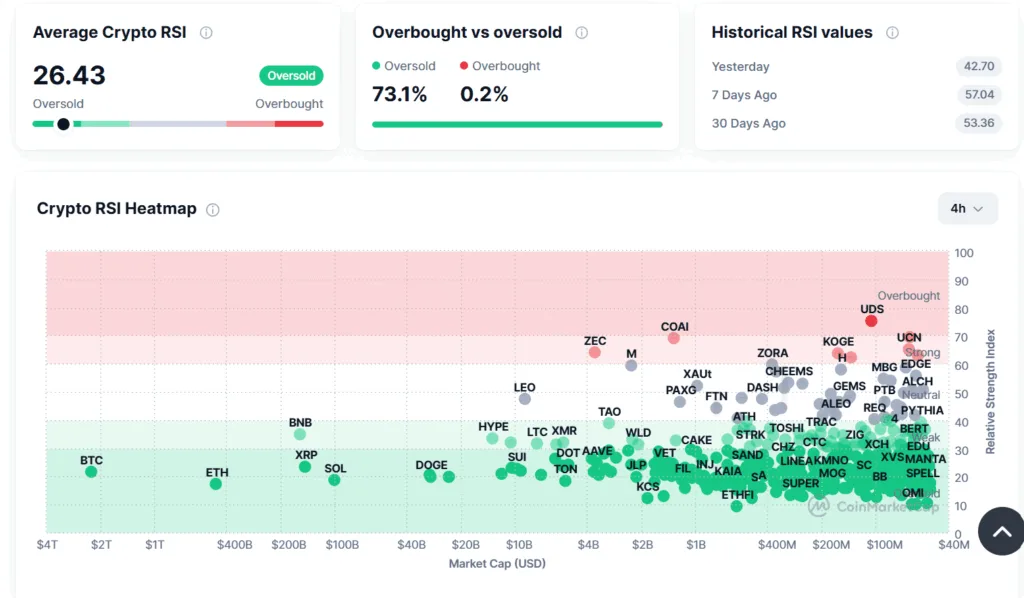

70% of cryptocurrencies are oversold

The average Relative Strength Index (RSI) shows that the overall market is oversold, as it shows 26 on its scale. The RSI is an indicator that measures the gains against the losses in the market. Overall, more than 70% of the cryptocurrencies in the market are oversold, while nearly 30% remain in the neutral zone, and a minute 0.2% is in the overbought region.

Hackers panic sell

The market crash made even hackers panic-sell their cryptocurrency. According to Lookonchain, two wallets which is likely to be linked to hackers dumped nearly 5,500 ETH, making a loss of $3.7 million.

Hacker steals 21 million

A crypto user lost about $21 million on the Hyperliquid exchange as his private key was exposed. The victim lost his holdings after his private key, an alphanumeric figure used to access the funds in the wallet, was leaked.

As the markets are gripped with fear, some of the traders are seeing this as an opportunity to enter the market. Sometimes success is all about taking risks.