From the crypto market breaking the September curse after rising above $4 trillion, and the RWA making a new all-time high, to the Fear and Greed Index hitting 50 —neutral zone, the crypto market is active. The market is slowing but surely moving towards the Altcoins Season Index of 75 as it hits 65.

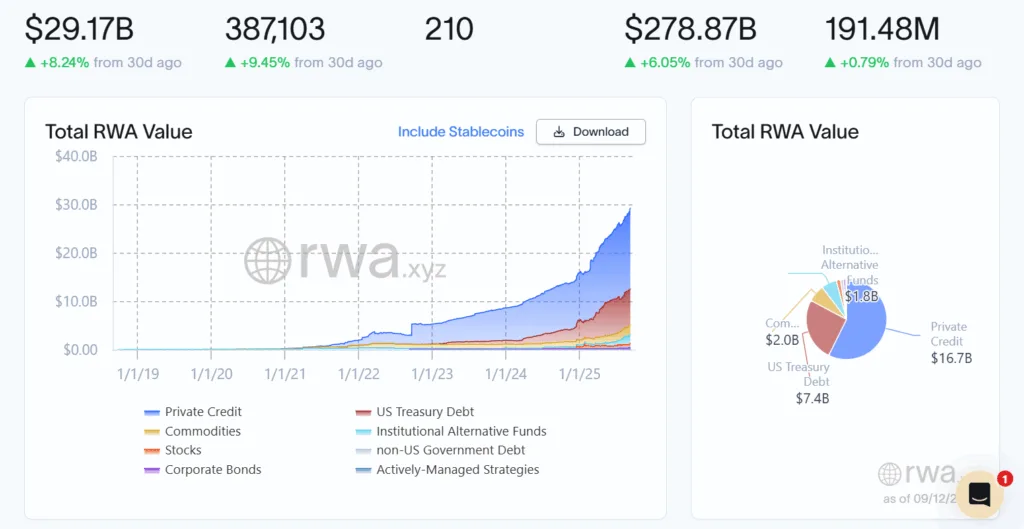

RWA on-chain reaches a new all-time-high

Real World Asset (RWA) on chain reached a new all-time high of $29.17 billion, and it is up more than 8% since the last 30 days. In addition to this, the total asset holders count also spiked up by almost 10% hitting just above 387K. Segregated into sectors, the RWA in private credit has the biggest share of $16.7 billion, more than half of the total value of RWS on chain, while the US Treasury’s debt has $7.4 billion.

Crypto markets flourish, erasing September curse

In the backdrop of the September curse, where the crypto market struggles to get going, the total crypto market cap just crossed above the $4 trillion mark. This happens in the backdrop when the Fear and Greed Index, which gauges the market sentiment, hits 50– neutral, while the altcoin season index inches further towards the altseason, where the altcoins perform better than Bitcoin.

FTX CEO’s case called back

FTX CEO Sam Bankman-Fried’s case will be called on November 4 for a hearing, after he was imprisoned for 25 years for seven felony charges. This hearing comes as a result of SBF’s lawyers filing a notice of appeal in April 2024.

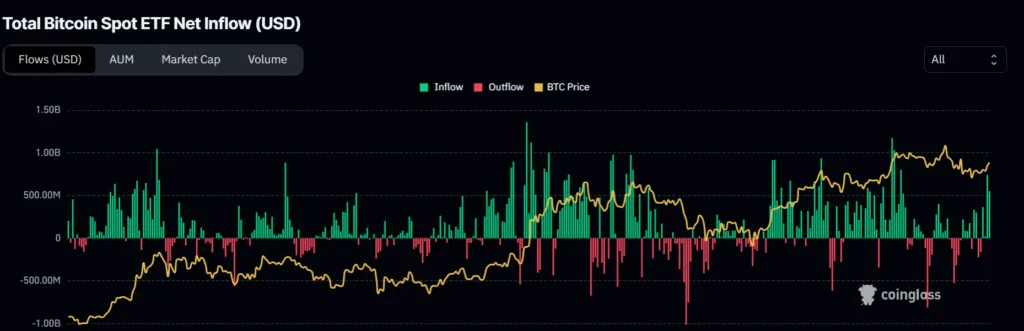

Bitcoin and Ethereum ETF inflows drop

The total Bitcoin spot ETF net flow for September 11 crossed above $550 million and hit $552.7 million. Compared to the inflows the day before, this is a massive drop from $751 million. Meanwhile, spot Ethereum ETF netflow also came out lower than the netflow the day before.

The netflow for yesterday dropped from September 10’s net inflow of $171 million to $113 million. Compared to the Bitcoin drop, Ethereum’s drop is quite insignificant.

Bitcoin options could push prices to $120K.

Bitcoin options are derivatives that give traders the right (but not obligation) to buy or sell Bitcoin at a set price (the strike price) before expiry. When the expiry date comes near, the traders who sold the call option must hedge by buying BTC as the expiry date approaches, which eventually pushes the price higher. With $4.3 billion expiring contracts, the Bitcoin price might rally to $120K.

Solana’s market cap hits new all-time high

Solana’s market cap hit a new all-time high of over $126 billion with increased institutional and treasury purchases, upcoming ETFs, and network upgrades. All the factors in unison helped it surpass BNB and capture the 5th spot as the largest cryptocurrency by market cap.

Coinbase accuses the SEC

Coinbase exchanges blame the US Securities and Exchange Commission for deleting former Chairman Gary Gensler’s text message. Industry observers called it a “credibility crisis”.

“The Gensler SEC destroyed documents they were required to preserve and produce,” Coinbase Chief Legal Officer Paul Grewal tweeted Thursday, alongside a link to the court filing. According to a report last week by the SEC’s Office of the Inspector General, it was found that text messages of over 1 year (October 2022 and September 2023) belonging to the then-Chairman, Gary Gensler, were permanently deleted.

Total liquidations drop from day before

On September 11, more than $86 million in short positions were liquidated while only $82 million in longs were liquidated. Compared to the $105 million short liquidations of September 10, yesterday’s shorts were much less. In terms of coins, many positions of Ethereum were liquidated, $30 million in longs and $62 million in shorts.

Tether injects liquidity

With the Federal Open Market Committee’s interest rate cuts around the corner, Tether has minted 1,000,000,000 $USDT on Ethereum. Fresh liquidity has been injected, and the traders are waiting for the markets to move.