The crypto market looks like it’s dead; however, it’s not the markets that are dead but the prediction markets, which is causing the people to believe that the markets are dead. Behind this bearish scenario, liquidity is being lodged into Neo Finance projects. It is ‘dry powder’ building, says analyst.

Extreme fear haunts market

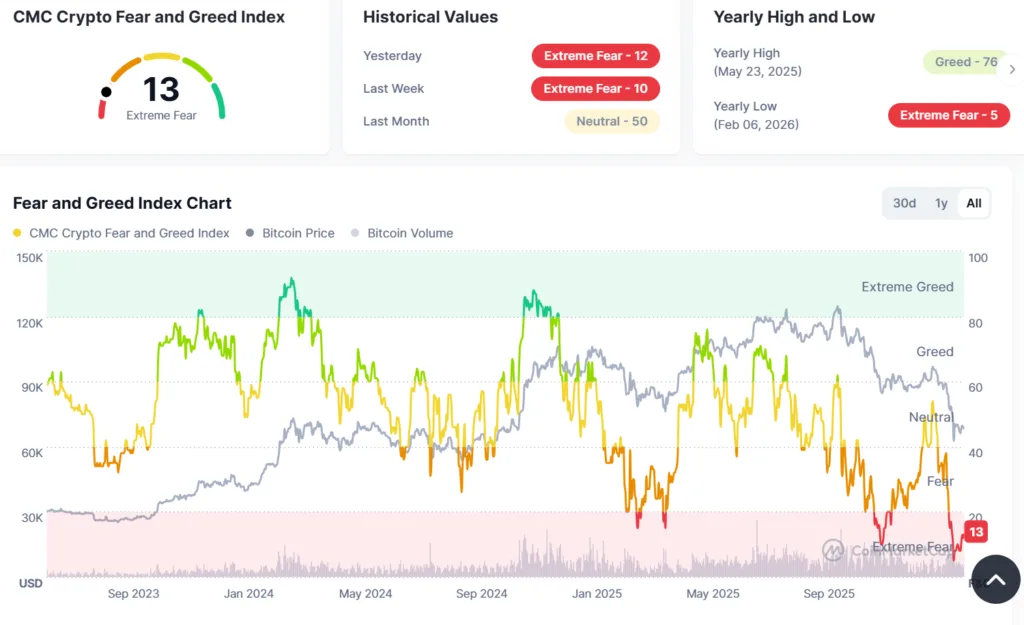

At the outset, the crypto market is bearish. Extreme fear still continues to haunt the crypto market after the Fear and Greed Index fell into the extreme fear zone in late January. From deep fear (5) within the extreme fear zone region on the Fear and Greed Index scale, now the scale has moved to the shallow end.

With the overall market sentiment still in an extreme fear zone, crypto traders are buying into the fact that the market is dead. However, it is just the speculative markets that are making this whole scenario up.

Prediction markets are the main catalyst

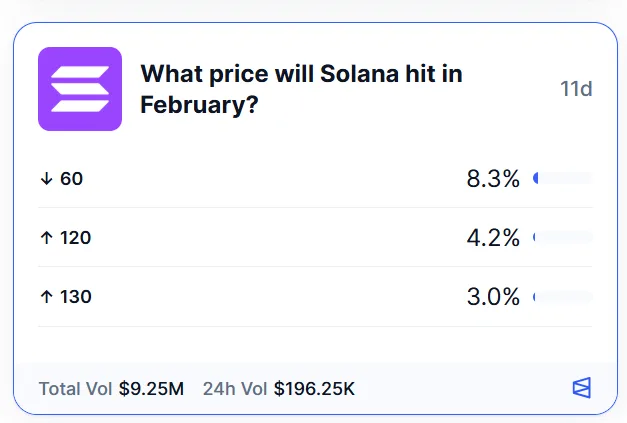

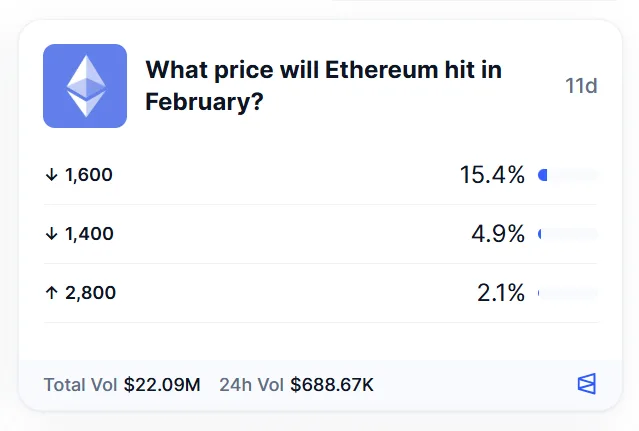

The prediction market Polymarket shows that ETH prices will crash to $1,600 by February. There were about 15% votes, the highest votes for ETH prices crashing to $1,600 by February, while the Solana prices are predicted to hit $60, with approximately 8% of voters expecting this to happen.

However, behind this overall bearish market sentiment, liquidity is being locked into Neo Finance projects. For instance, Maple Finance syrupUSDC hit a new all-time high of over $1.6 billion, while AAVE, with $23b in active loans, has gained around 62% market share, courtesy of becoming the RWA lender. Pendle Finance saw its monthly active users spike by 44% quarter-over-quarter.

Just because the prices are not appreciating and the market sentiment is extreme fear does not mean that the market is dead. Just a couple of weeks back, the weekly stablecoin inflows jumped from about $51B in late December to roughly $102B now, well above the 90-day average of $89B. This shows that money, although not deployed, is waiting on the sidelines.

In analyst Lavneet Bansal’s words, the increase in stablecoin inflow shows that traders are ‘building dry powder,’ waiting for the perfect opportunity to enter the market.