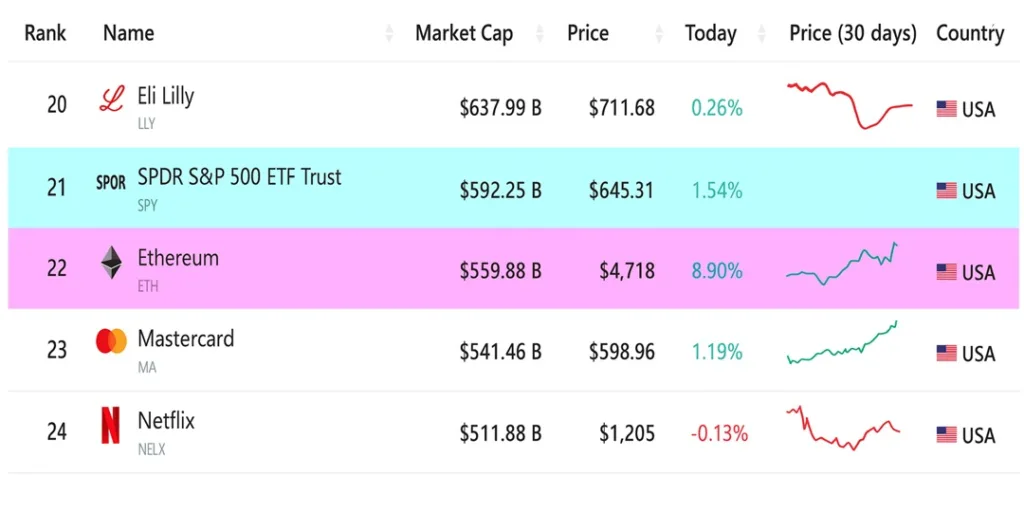

Ethereum (ETH), the second-largest crypto by market cap, has surpassed payment giant Mastercard, reaching 22nd position among global assets.

Mastercard got blockchained out of the top spot.

(Source: Companies Market Cap)

Earlier this month, the programmable blockchain surpassed Mastercard, gaining the same position it now holds. The current market cap of ETH is $569.88 billion, whereas Mastercard’s is $541.46 billion.

Meanwhile, Bitcoin (BTC) is just below Amazon, with a soaring market cap of $2.301 trillion, among the largest assets by market cap. Earlier, the master coin hit the 5th position, surpassing Amazon and Alphabet.

Market price hike and liquidation

High activities on any blockchain network can lead to increased liquidations, which may drive up the market cap, combined with an increasing price. In contrast to Friday’s low price, Bitcoin and other altcoins, including Ethereum, experienced a price surge in the wake of an anticipated interest rate cut in September. Federal Reserve Chair Jerome Powell mentioned the interest cut in a speech at the Jackson Hole symposium, to which the crypto market responded strongly.

Ethereum surged by 9.46% in the past 24 hours, and it currently trades at $4,735 at press time. Bitcoin also jumped from its previous $112,000 low to $115,000.

ETH reserve holds 4.1 million ETH

Moreover, a recent report revealed that the aggregate Ethereum treasury holding now has 4.1 million ETH, valued at nearly $17 billion. Institutional adoption of ETH, legitimacy, and long-term confidence have reportedly gained positive momentum for the coin. Worth noting, BlackRock, Fidelity, and other ETFs have recently accumulated $337.7 million worth of Ethereum.