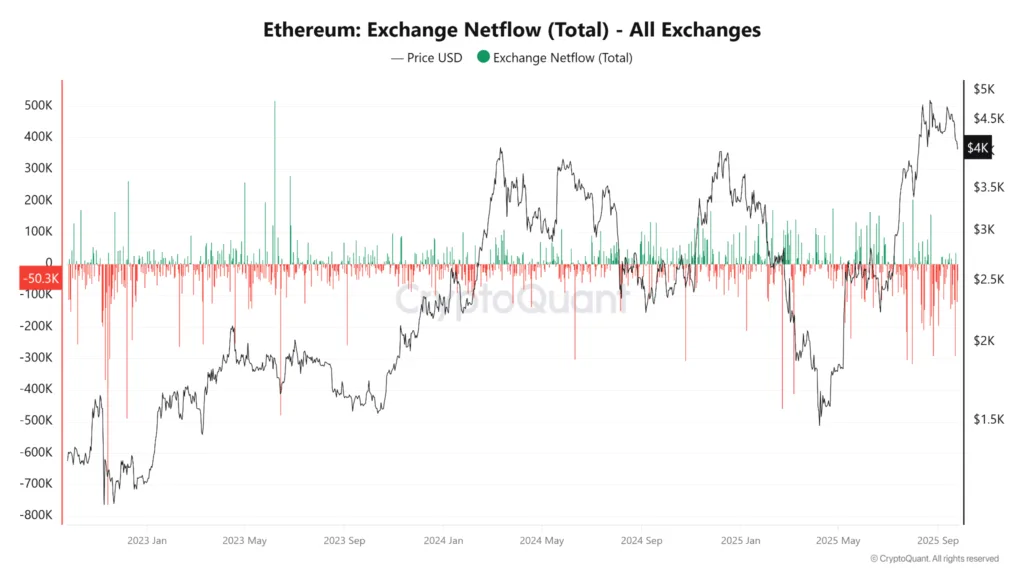

The Ethereum supply level on exchanges reached a 9-year low, with digital asset treasuries and exchange-traded funds going into a buying frenzy. The Ethereum supply tanked to 14.8 million ETH, the lowest point seen since 2016, with growing institutional demand.

The Ethereum supply on exchanges was at its peak in July 2020. However, it started to decline, slowing after reaching this peak level. This steady decline turned into a chaotic fall in January 2023, when the supply crashed from around 30 million to 20 million Ethereum within a few months. Thereafter, there was a period of consolidation where the supply fluctuated between 18 million and 20 million since July 2023, before falling to almost 15 million as of present.

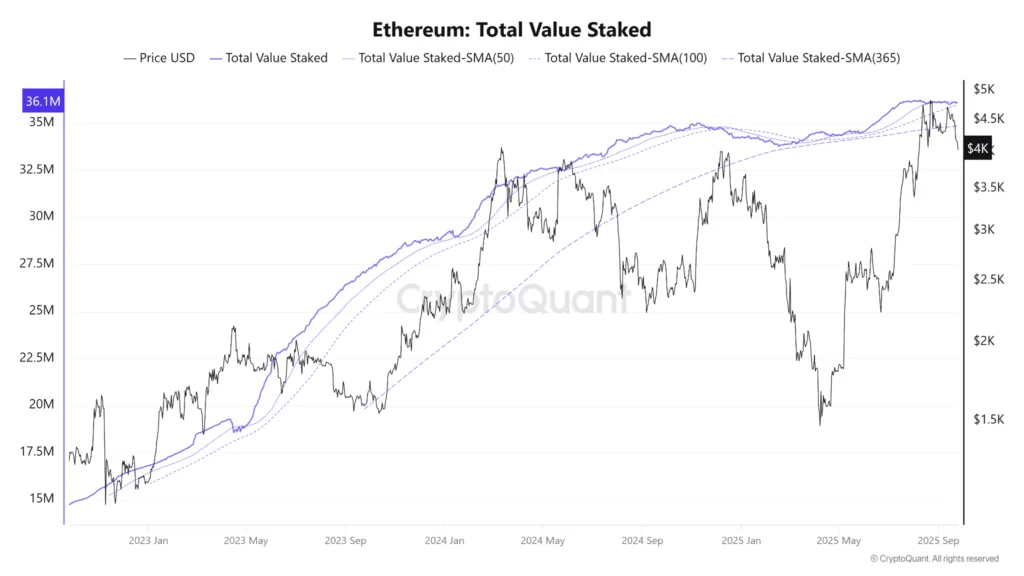

Ethereum’s Total Value Locked (TVL) reached $36 million

When Ethereum is being moved from exchanges, it means that institutions and retail investors are moving the tokens into cold wallets and other activities like staking. The total value of staked Ethereum has reached $36.1 million, rising moderately from around $28 million last year.

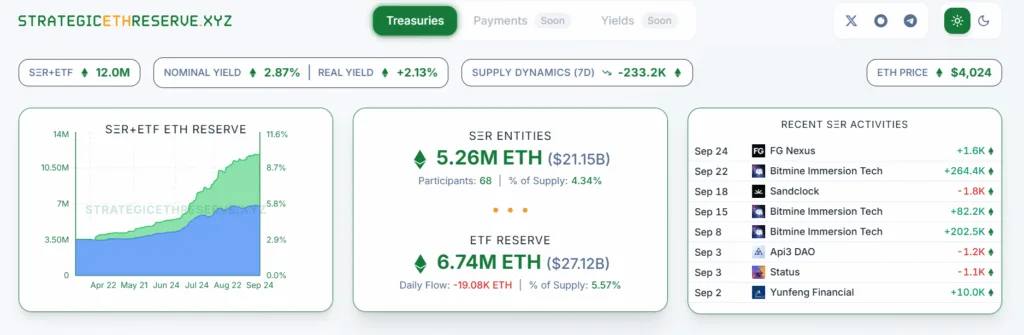

Ethereum reserves hold about 5% ETH of the total supply

According to the Strategic ETH reserve, 68 institutions have gulped up more than $5 million which is worth about $21.15 billion. This represents 4.34% of the total supply. Among the treasuries holding Ethereum, BitMine Immersion Tech ranks first with a holding of 2.42 million ETH worth about $10 billion.

Despite the circulating supply draining, Ethereum’s price is still stagnating. On the daily chart, ETH formed a bullish ascending triangle which eventually breaks out upwards. However, in this case the token crashed below from $4.4K to $4K.