The gloomy clouds that overshadowed the crypto market in September have cleared; it’s bright and shiny Uptober now. It’s time to make hay when there is shine.

As stated in the previous market wrap, it was, after all, False Evidence Appearing Real (FEAR) on the charts. Bitcoin is back on track, trading around $ 122,000, while Ethereum has crossed $ 4,500 and BNB has hit a new all-time high of four digits, as the market sentiment as a whole has shifted. From the total crypto market cap crossing above $4 trillion to Bitcoin and Ethereum supply drying out on exchanges, the market is set for a massive price explosion.

October has historically been a very positive month—many call it Uptober! And 2025 seems to be following the same trend.

— Alphractal (@Alphractal) October 3, 2025

🔗https://t.co/MgcOqabEWz pic.twitter.com/WhIOuMr1Ec

Market cap crosses significant level

The crypto market cap once again crossed above the $4 trillion level. During the beginning of the week, the market cap was at $3.78 trillion, but as the week progressed, the market kept rising, making higher lows, and at the time of writing, it is $4.13 trillion. An increasing market cap signals the investors’ strong confidence and the demand for cryptocurrency.

Fear and Greed Index shifts

The Fear and Greed Index indicator, which gives an overall view of the sentiment of the investors, has moved away from the fear zone. Reading a value of 59, the indicator is on the verge of entering the greed zone, where the traders go into a buying frenzy, expecting the prices to rise higher.

Bitcoin supply shrinks on exchanges

Smart money has already started to flow into the market, drying out the Bitcoin and Ethereum supplies on exchanges. With the supply shrinking, BTC finally broke above the $120K resistance level after two months. The supply shrinkage happened since traders usually move their crypto holdings from exchange wallets to cold wallets when they expect the prices to appreciate. In other words, it’s called long-term accumulation.

🚨🚨🚨🚨🚨 FIVE-YEAR RECORD LOW

— Bitcoin Exchange Balance (@btconexchanges) October 3, 2025

Almost 170,000 Bitcoins removed from exchanges in the last 30 days. pic.twitter.com/nID3wluPwo

According to analyst PelinayPA, “The less supply held on exchanges, the lower the immediate selling pressure. This creates strong upward potential when new demand enters. Since 2020, coins have consistently moved off exchanges, tightening liquidity. Each demand wave now has a magnified impact on price, pointing to a structural supply shock.

Technically, this environment supports the possibility of Bitcoin reaching $150,000 in the next major cycle.”

For the price to reach $160K by early 2026, the market needs to confidently break through and hold $128K (Base) on weekly closes.

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 3, 2025

Trend Invalidation: $102K a breakdown below this level will create a quick scenario reset. pic.twitter.com/bwueMLQh5e

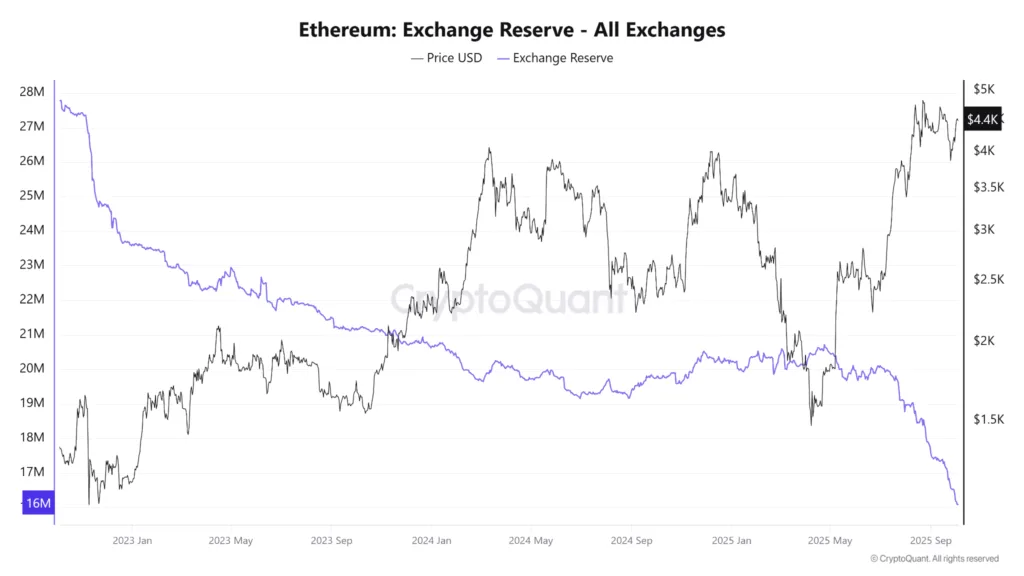

Ethereum demand, the missing piece

It’s not just the Bitcoin supply, but the Ethereum supply on exchanges has also shrunk drastically. Ethereum reached a 9-year low of 14.8 million ETH, according to Glassnode. However, unlike Bitcoin, ETH does not emit any excitement. The ETH price stays flat despite the big drop in supply on exchanges. So it means that although there is buying, there is also selling that neutralizes the effect. So it’s the lack of demand that has ETH prices consolidating.

But the bright side of the story is that the falling reserves mean the ground is fertile and ready for the rally to start, but demand needs to show up.

Altcoin season index hardly moves

The Altcoin Season Index (ASI), which oscillates between the Bitcoin and Altcoin seasons, has not moved much. It shows a value of 67 below the 75 threshold of the altcoins season. This means it is neither an Altcoin season nor a Bitcoin season. So the market is quite neutral.

So let’s put it altogether, the Bitcoin supply on the exchange has shrunk, and the price has appreciated. ETH supply on exchanges drops, but the price stays flat. So there must be something going on behind the scenes for Bitcoin to appreciate and Ethereum not to gain value in a market where buyers are greedy.

Crypto enthusiast Michael van de Poppe stated that Ethereum will continue to move within a tight range for a few weeks before the trend reverses. With Ethereum finding its footing, the altcoins will also start to gain value.

There is 1-2 weeks more for $ETH of consolidation before it turns around.

— Michaël van de Poppe (@CryptoMichNL) October 4, 2025

This turn-around is the signal for #Altcoins to continue outperforming. pic.twitter.com/PY7JZcCOKV

What to expect?

Comparing Bitcoin with Gold, Head of asset research firm, VanECK, Matthew Sigel stated that the Bitcoin to Gold volatility has hit 1.85, meaning you have to apportion 1.85 times the capital needed for Gold to maintain the same level of risk, “then mechanically the market cap of bitcoin at $2.3tr currently would have to rise by close to 42% (implying a theoretical bitcoin price of $165k), to match on a vol-adjusted basis the around $6tr of total private sector investment in gold via ETFs or bars and coins.”

🚨JPM Says Bitcoin Undervalued vs. Gold, Highlights "Significant Upside" to $165k.

— matthew sigel, recovering CFA (@matthew_sigel) October 2, 2025

"The steep rise in the gold price over the past month has made bitcoin more attractive to investors relative to gold, especially as the bitcoin to gold volatility ratio keeps drifting lower to… pic.twitter.com/7YuIaP2Kzi

BTC is a stone’s throw from its all-time high and the key on-chain metrics are all neutral.

— Frank (@FrankAFetter) October 3, 2025

MVRV-Z: Neutral

STH-SOPR: Neutral

STH-MVRV: Neutral

Futures Funding Rates: Neutral

Higher. pic.twitter.com/m1j3de7gNQ

What to do?

The volatility in the current market is quite low, as the premium in contracts (especially in options and other derivatives), the price paid to acquire the right or protection the contract offers, is low. The premium in the contract goes up when either the buyers are sellers are lopsided in the market.

To put it into context, an umbrella selling for $10 during normal days could sell for $50 during rainy days. So if you happen to have no umbrella on a rainy day and go to pick one up, you might end up paying $40 extra. Now the market is shining, it’s your time to go get your umbrella for a steal.