The crypto market is showing signs of recovering after suffering for more than two weeks at a stretch. It all started last week when U.S. President Donald Trump announced 100% tariffs on China. Not long after this announcement, about $19 billion was liquidated. After taking such a hard hit, investors started to panic-sell, and ‘Uptober’ turned out to be ‘Downtober’.

Fear grips market

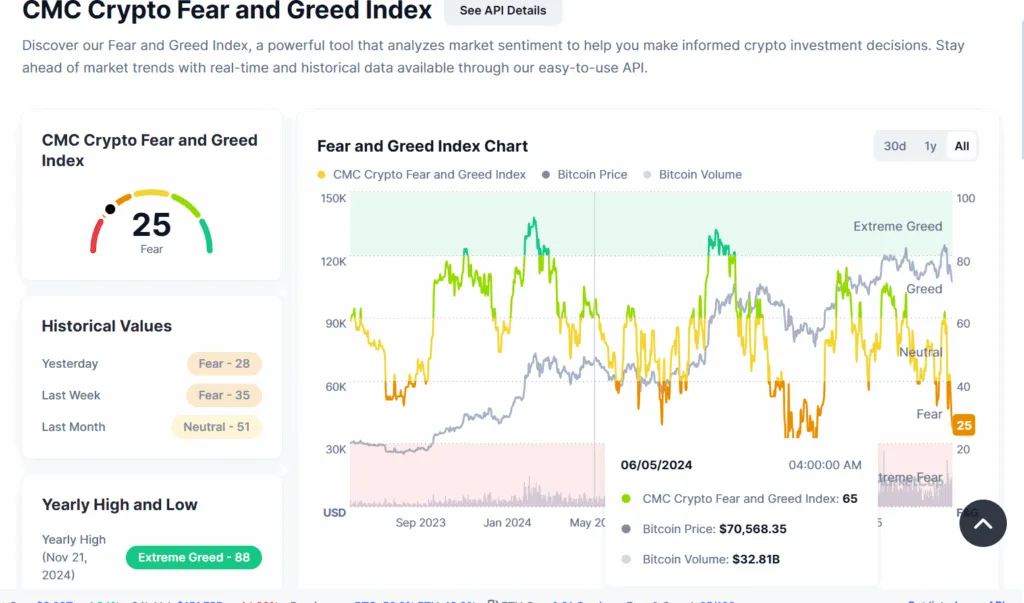

CoinMarketCap’s Fear and Greed Index, which gives an overall mood of the market, crashed deeper into the fear zone. Last week it was at 35, and today it is at 25– on the verge of falling into the extreme fear zone. The last time the market was in extreme fear was nine months ago, when Bitcoin was trading at $80K.

However, Bitcoin is currently trading at $107K after the recent market crash. The top crypto tried to penetrate the resistance level at $123K a couple of times but was unsuccessful in doing so. But the season has changed for the flagship cryptocurrency, as there is a little green candlestick sprouting from the $107K resistance level after a series of red candlesticks took BTC deep into bear territory.

In addition, the Bitcoin liquidity index, which has been down since July, is rising for the first time, signalling that capital is flowing into it. Based on historical data, re-entering capitalization precedes a breakout or altseason.

Major shift in market sentiment

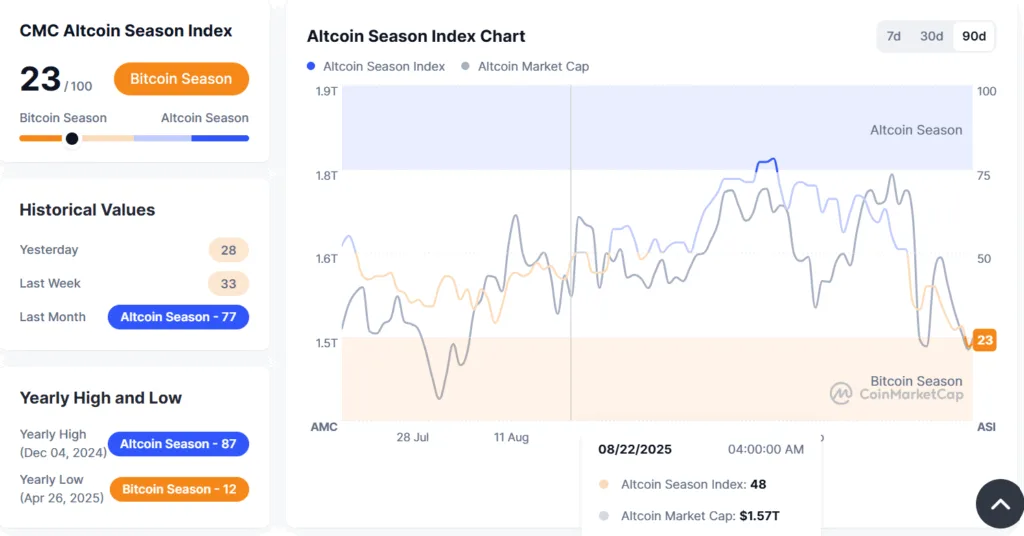

CoinMarketCap’s Altcoin Season Index (ASI) has changed its direction. The ASI tool goes above 75 when more than 75% of the top 50 cryptocurrencies are outperforming Bitcoin. During this month, the ASI dropped from 55, which is neutral zone on its scale, to 22, which is Bitcoin season. This does not by any means say it’s Bitcoin season, but it’s just that ripple effect of a market crash that resonates into altcoins. However, after dipping into the Bitcoin, the ASI has changed its direction of motion and is starting to head in the right direction (upwards).

Ethereum shows a glimpse of a rally

Ethereum was rebounding inside a bull flag, making lower highs and lower lows. Right now, ETH has produced a green candlestick even before it made a lower low. This is a very early symptom that the bulls are taking over the market. Given that ETH breaks out conventionally from the bull flag, the token could reach as high as $6K.

Gold has no further upside

In the past days, investors transferred their funds into metals like Gold and Silver. With a mass migration, Gold hit a new all-time high of about $4K. However, according to a crypto netizen who goes by the Skydolic stated that there was no upside remaining for Gold. “GOLD is overdue a cool off. Alts are overdue a pump.”

Rate cut–the icing on the cake

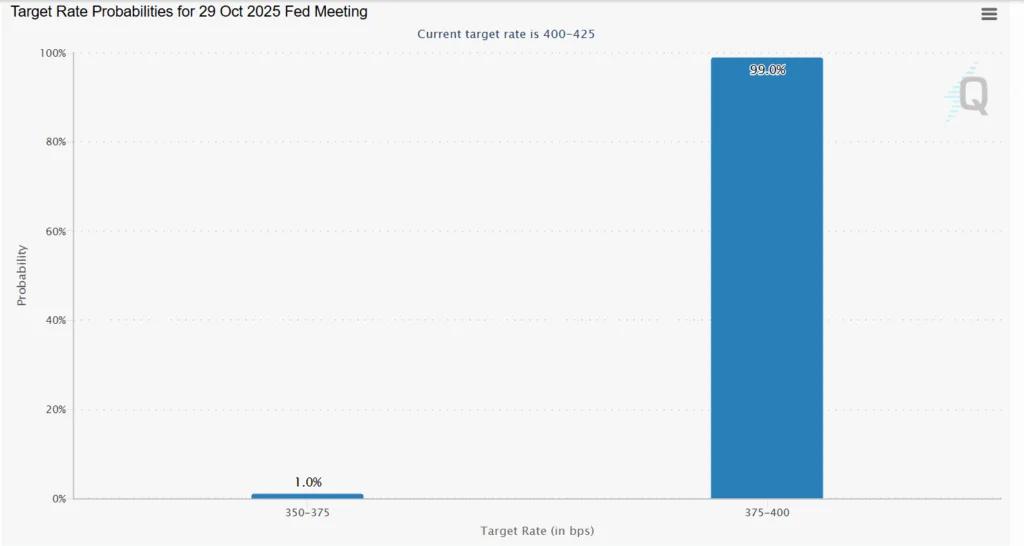

Meanwhile, the Federal Open Market Committee (FOMC) will gather on October 29 to decide on the interest rate cut. According to CME Group markets data, there is a 99% chance of a rate cut. With the rate cut, the interest rate will fall between 3.75% and 4.00%.

When the interest rates are low, the money supply in the market will increase, and investors will be interested in putting their money into profitable securities with a higher risk appetite. As Gold has already reached its all-time high and has no upside left, investors might be looking at cryptocurrencies, which are almost at their local floor level. With symptoms of the market recovering, the prices of the cryptocurrencies will keep appreciating.