On Wednesday, the Federal Reserve announced another 25-basis-point rate cut, following its previous rate cut on September 17. Unlike Trump’s tariffs, which caught the cryptocurrency markets off guard, liquidating nearly $20 billion, the Fed rate cut did not have a significant impact on the market.

According to analysts, the market was numb to the interest rate cuts as it anticipated this coming and absorbed it even before the rate cut was officially announced.

Speaking to a prominent crypto media, Matt Mena, a market analyst at investment company 21Shares stated, “November has historically been one of Bitcoin’s best-performing months, with positive returns in 8 of the past 12 years, averaging 46.02% returns. Overall, we remain moderately risk-on and see a credible path for Bitcoin to break its all-time high before year-end.”

BTC crashes to $108K but smart money saves

As the interest rate cut was telegraphed, traders started to sell Bitcoin, seeing that there was no exciting factor remaining to push the price higher. With no hopes of their profit margin expanding, the market started to sell, and Bitcoin crashed from $115K on October 28 to $108K. However, with BTC below the $110K, some smart money investors moved into the market and helped Bitcoin once again recover above $110K level. This further neutralized the impact of the interest rate cut.

During 2021, when the quantitative tightening ended (QT) and the quantitative easing began (QE) with the rate cuts, Bitcoin prices rose exponentially; however, this is not the case now.

Fear and Greed Index shows no change

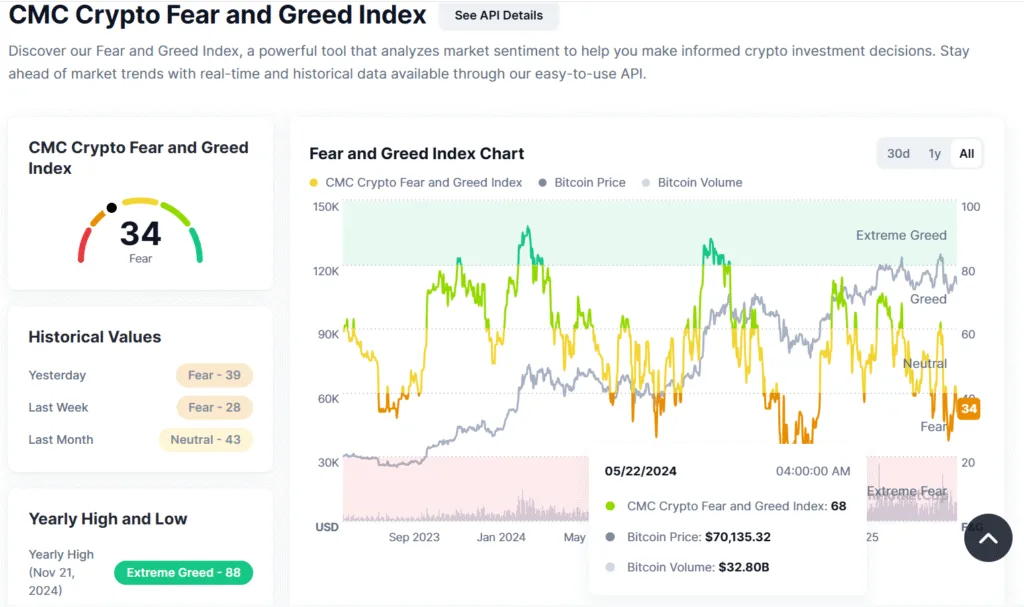

Even the Fear and Greed index, which gauges the mood of the traders, did not show a significant deflection. It dropped deep into the fear to 34 from a shallow end of 38, which was much closer to neutral. Given the Fed rate cut, which is revered as a major event, this small deflection on the indicator is negligible.

Market cap recovers

Even the crypto market cap did not show a significant move despite recovering from $3.69 trillion to $3.76 trillion. Why? If you consider the chart below, this spike or recovery is just another spike that would happen on any random day. Events like Fed rate cuts bring about trend-changing effects. However, the crypto market cap is still on a downtrend.

With the 25 basis points cut, the borrowing rate has now fallen between 3.75%-4.00%. The CMEGroup prediction tool now shows that there is a 70% chance of a rate cut for December.

However, a deputy chief US economist at Oxford Economics, Michael Pearce, speaking to a new outlet, stated, “Future moves are becoming more contentious. We expect the Fed to slow the pace of cuts from here.” Although Mena expects Bitcoin to hit a new all high, let’s not forget the trade war between China and the U.S. If the U.S. imposes more taxes, the whole market dynamics could change altogether. For now, the market is calm, but it’s not for long.