The crypto market has been dull in terms of price action; however, there have been a lot of things happening beyond just price movement. FTX unfreezes $500 million for its creditors while BTC mirrors Nasdaq’s 100 futures, and much more happened. Keep reading to understand what happened today.

FTX exchange unfreezes $500 million

The FTX Recovery Trust unfroze about $500 million for claims after two years. Initially defunct exchange was of the notion that it would not distribute the lost funds to FTX creditors belonging ot restricted regions like China, Russia, and Iran. However, as the exchange changed, the notion creditor who lives in this region may be compensated. On Nov. 3, the FTX Recovery Trust filed to withdraw its “Restricted Jurisdiction Procedures” motion after growing resistance from creditors and scrutiny from the U.S.

More than $1 billion liquidated during the past 24 hours

$1.33 billion was liquidated during the last 24 hours, with long positions amounting to 1.17 billion, while short liquidations aggregated to just $160 million. When considering the liquidation by coins, more than $400 million was liquidated from Bitcoin long positions, while $325 million was liquidated from Ethereum.

Bitcoin mirrors Nasdaq 100 futures

Bitcoin crashed to $100.8K mirroring the Nasdaq 100 futures’ 1.67% price drop. The correlation between Bitcoin and Nasdaq 100 futures is such that there is a 75% chance of Bitcoin posting a negative return when Nasdaq 100 futures fall by more than 1.5% per day. According to analysts, Bitcoin’s weakness in prices cannot be attributed to fundamentals only, but it is the overall financial condition that is very loose.

Sam Bankman-Fried’s lawyer speaks up

Six years into serving his 25-year sentence, Sam Bankman-Fried’s team appealed on his behalf. Lawyers representing SBF presented reasons as to why the court should consider his sentence once again. Although the details were not clear, the lawyers argued along the lines that SBF was “never presumed innocent,”.

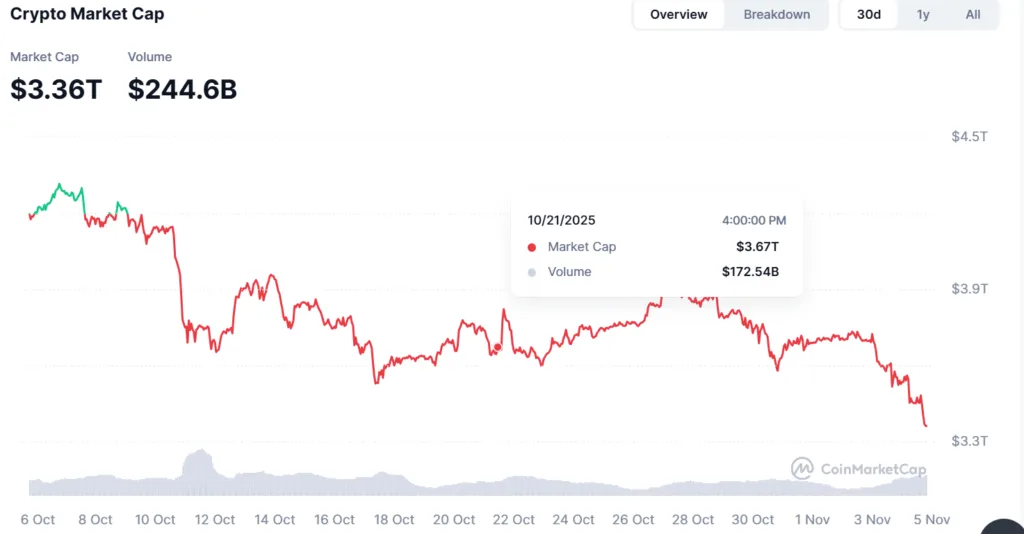

Market cap falls to 30-day low

The crypto market cap fell to a 30-day low of $3.36 trillion while its volume was seen at $244 billion. The crypto market cap saw a drastic fall fall on after Trump announced tariffs. Since this announcement, the market cap has never been able to get back up above the $4 trillion level.

Ripple USD hits $1 billion market cap

Ripple’s stablecoin, Ripple USD, reached $1 billion even before completing one year of being launched. The stablecoins showed immense growth, achieving a remarkable 1,278% year-to-date growth in market capitalization. Meanwhile, Ripple’s XRP token is currently capturing the fourth place as the largest token by market capitalization.