In a devastating blow, GMX V1, a decentralized perpetual exchange on Layer 2 blockchain, Arbitrum, incurred nearly $42 million in losses following a suspected hack that exploited its GLP (GMX Liquidity Provider) pool. The hackers reportedly stole a huge amount of funds and transferred them from the GLP pool to an anonymous wallet. To conceal the traces of the exploit, the bad actors bridged the funds from the Arbitrum network to the Ethereum network.

Bridging is a process in crypto where digital assets and data are transferred from one blockchain to another blockchain network in the form of a wrapped token.

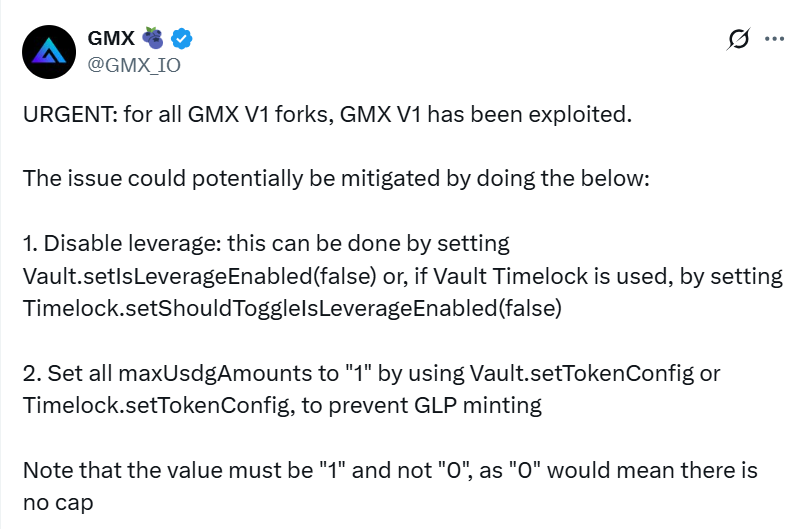

GMX responds to the hack

Following the hack, GMX executives shared their concerns on X. The team is actively looking to tackle the issue and find the root cause of the breach. Security is baked into the very foundation of GMX, and top security experts examine its smart contracts, wrote the company executives.

Currently, hackers have exploited GMX V1 and GLP pool; however, GMX V2, its markets, liquidity pools, and GMX token remain unaffected.

In another post, the team requested that all users follow procedures to mitigate the hacking issue.

Price dips as hackers strike

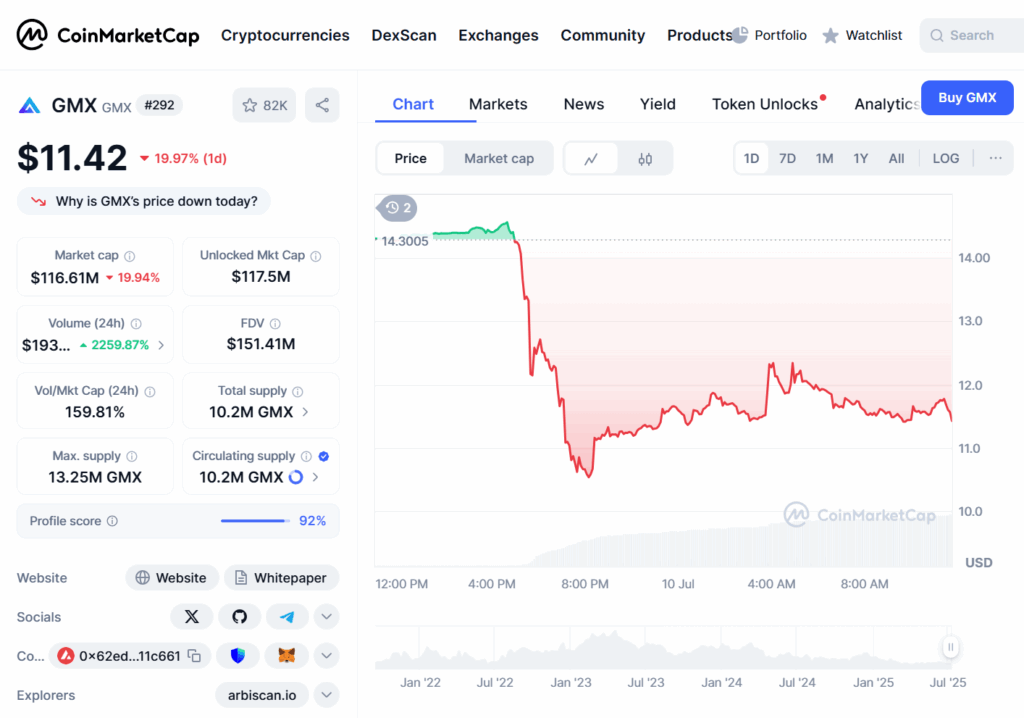

In the wake of the malicious exploit, GMX token (GMX) experienced a price dip of $10.56. At the time of reporting, the coin was trading at $11.66, marking an 18.4% loss over the past 24 hours.

A screenshot of GMX’s price pattern over the past day. Source: CoinMarketCap

Major recent hacks that rocked crypto exchanges

In February 2025, crypto exchange ByBit’s cold wallet was hacked, causing $1.4 billion loss. Phemex also went through a downturn after bad actors breached its hot wallet for $85 million. Around 69,000 accounts from Coinbase were allegedly leaked by customer support agents in May. Iran’s Nobitex exchange also faced exploitation following a $90 million fund loss.