31st of October is the day that is known as Halloween. People believed that on this day, the dead have access to once again roam the earth, breaking the distance between the living and the dead. People dress up for the occasion to meet their loved ones. But have you ever thought, what if that person’s character had changed after death? Let’s say you see the same person, but he/she is not what they used to be. They speak differently, think differently, and you find it hard to have a normal conversation that you used to have with them during the time they lived on earth. How awkward would you feel?

Well, I bet that’s what has happened to the crypto market, this Halloween. The same ‘Uptober’ which used to be a time for crypto prices to skyrocket during the past years, saw the market crash. Not just another crash, but the biggest crash, where around $20 billion was liquidated. Of course, this liquidation came amid a trade war between the U.S. and China.

Fed cut interest rates by 25 basis points

On the 29th of October, the Federal Reserve cut interest rates by 25 basis points, bracketing the borrowing between 3.75% and 4%. Some called this quantitative easing (QE), while others called it repos. During QE, the central bank buys back government bonds and long-term treasury bills, etc, from the banks to increase the supply of money (M2) in the market. The central banks usually do this to stimulate the economy and control inflation.

Whatever they call it, nothing served the purpose. The crypto market, which was recovering from the tariff hit storm, did not see rapid progress.

In fact, traders started to sell Bitcoin as the market had already priced in the rate cut coming. There was no upside for BTC visible, and when your profit margins don’t expand and there’s no sign of it expanding in the future, what do you do? Take home what you got. That’s exactly what they did.

Bitcoin closes in on $110K

Bitcoin crashed from $115K to $108K, after the market started to take profit. But thanks to smart money inflow that helped the top crypto is closing in on the psychological mark of $110K.

As bitcoin is trading inside a falling wedge, it will hit the upper trendline at $110K and then rebound off it and continue rebounding until the wedge is fully formed. Once the wedge is successfully formed, BTC will surge if it is a conventional breakout.

Interest rate cut is no more a thing to fear

A Fed reserve meeting is more of a calendar event that puts fear or relief in the hearts of the traders and investors. The crypto fear and greed index did not show much of a deflection as it usually does. It was not something that could take the people by surprise. Maybe a 50 basis point cut would have shocked the market.

Altcoins Season Index is still neutral

The altcoin season index (ASI) is still at 43 in the neutral zone. The ASI is a tool that gauges where the funds are moving. Values above 75 show its altcoin season, while values below 25 mean its Bitcoin season, or money is flowing into Bitcoin. Values between 25 and 75 are treated as neutral.

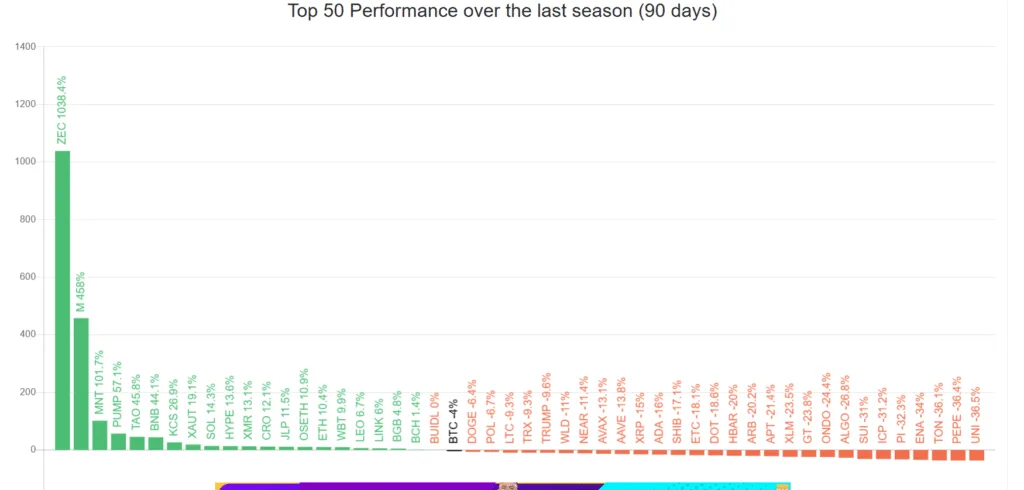

When the altcoin season index goes above 75, it means that more than 75% of the top 50 tokens are outperforming Bitcoin over 90 days.

However, according to the chart above, only 20 tokens have outperformed Bitcoin during the past 90 days, signalling that it isn’t altcoin season yet. The criterion is that at least 37 tokens out of the 50 tokens should outperform Bitcoin straight on for 90 days, but it has not been.

Market acts abnormally

The market is acting weird and very different from what it usually is. Maen Ftouni, CEO of CoinQuant, a company that produces algorithmic trading tools, stated that this time the altcoins would behave differently. Speaking to a top crypto media, Ftouni, stated:

“Not every single coin is going to have massive returns; the liquidity is going to be concentrated into certain places. He stated that the funds would flow into older cryptocurrencies that have their ETF or will have an ETF in the future.

He stated: “Since the flow of funds is coming mostly from traditional finance and ETFs at the moment, those people are probably looking at these major coins, all the coins established that have the potential of getting an ETF, ….”

So what are these tokens that have their own ETFs? Solana, Hedera, Litecoin

Funds move into Solana ETF

Traders started to invest in SOL ETFs, and on Friday $44.48 million flowed in, taking the cumulative inflows to $199.2 million and the total assets to over $500 million. The Bitwise Solana ETF (BSOL) spearheaded this charge, contributing the bulk of new capital with a 4.99% daily gain.

In contrast to SOL, BTC and ETH ETFs, were leaking funds. ETFs saw $191.6 million in daily net outflows on the same day, continuing a week-long trend of profit-taking. $488.43 million flowed out on Thursday and $470.71 million on the previous day.

Solana eyes $200

On the daily chart, Solana is trading inside a bullish falling wedge, where the prices move in a zigzag pattern, hitting the upper and lower trendlines as the wedge narrows. However, with funds flowing into the SOL ETF, the token has not touched the lower trendline to make a lower low. Given that traders keep fuelling the SOL ETF, reaching $200 for Solana would be just a walk in the park.

HBAR and Litcoin ETF to shift market dynamics

Let’s not forget the other tokens whose ETFs could be upcoming in the next few months. Canary’s Litecoin and Hedera (HBAR) ETFs are expected to hit the market along with the anticipated conversion of Grayscale’s Solana Trust into an ETF. This is not just happening in the U.S alone but also in Asia, where Hong Kong approved its first spot Solana ETF last week. So all in all, the market dynamics have changed, and it’s not because of Halloween but because of ETFs, which give the traders the upper hand to be exposed to the token without actually owning it.