Global markets experienced a massive jolt earlier today, as the US stock market cap shed $1 trillion, while crypto markets erased $120 billion. A mix of macroeconomic and industry-specific factors likely played a role in today’s market bloodbath.

Why is Bitcoin falling?

At press time, Bitcoin is trading marginally above $86,000, tumbling 7.3% over the last 24 hours, whereas Ethereum trades just above $2,800, down 7.4%.

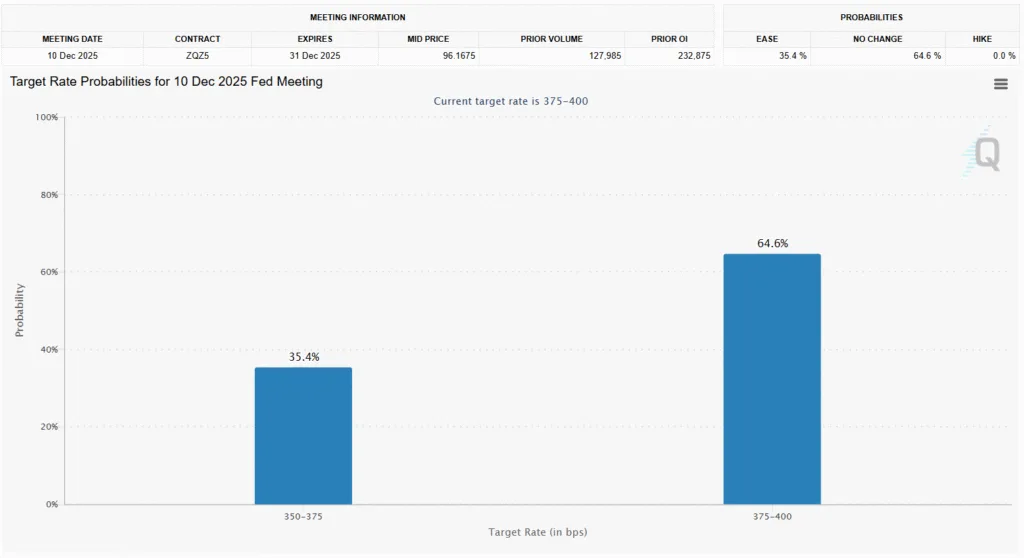

Economists are now giving a 64.6% chance to the US Federal Reserve keeping the interest rates unchanged at its December 10 meeting. This is a sharp change in odds, as on October 20, the FedWatch CME Tool was giving a 98.8% chance of the Fed slashing interest rates by another 25 basis points (bps).

The Fed keeping the interest rates at its current level, between 3.75% to 4%, is likely to weigh on risk-on assets like stocks and cryptocurrencies as raising debt will remain more expensive than in a low-interest-rate environment.

Meanwhile, fears over the tech bubble bursting and artificial intelligence (AI) spending going down are further exacerbating the market drawdown. Recently, Google CEO Sundar Pichai warned that no company, including Google, would come out unscathed if the AI bubble bursts.

Another symptom of the exhaustion of the AI narrative can be seen in the form of Nvidia stock’s recent performance. The stock has declined slightly over the past month, starting to show signs of having run out of steam. However, it’s still up 30.6% on a year-to-date basis.

Crypto liquidations inching toward $1 billion

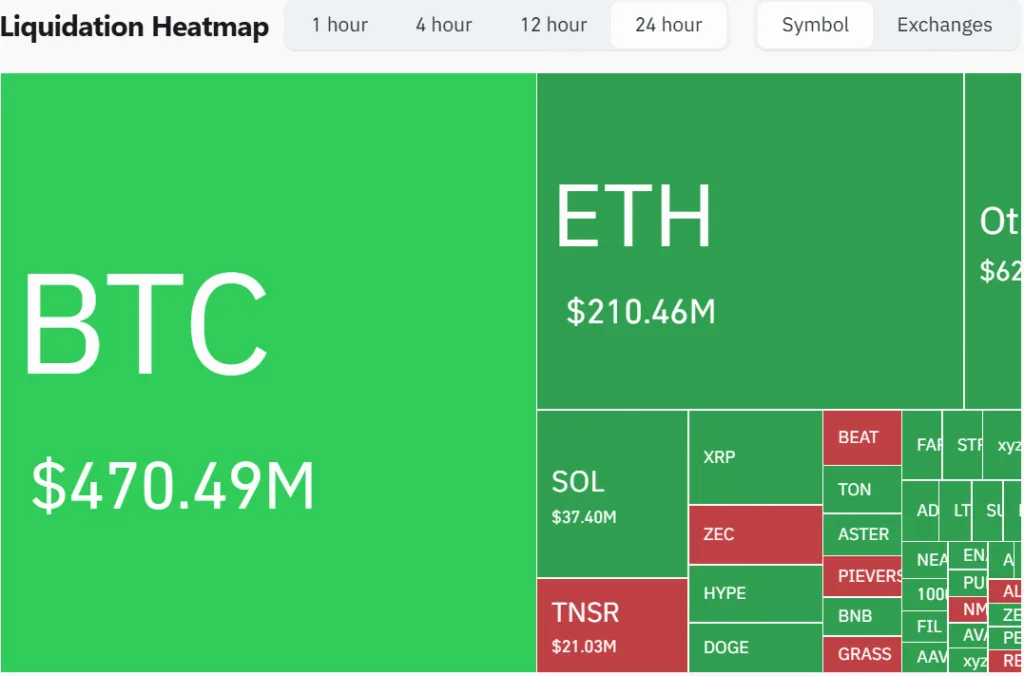

As is characteristic of every major crypto market crash, 24-hour liquidations are reaching the $1 billion mark, currently hovering at $954 million. According to the latest data from Coinglass, BTC liquidations hit $470.35 million, while ETH liquidations reached as high as $210 million.

In the past 24 hours, a total of 253,085 traders got liquidated, with the single largest liquidation happening on HTX exchange, where a BTC whale got liquidated to the tune of $30.91 million.