New York crypto miners came under the pump after State senators introduced a tax bill targeting miners who consume a massive amount of electricity. However, miners using renewable energy and below 2 million kWh per year will be exempted.

On Wednesday, New York State Senator Liz Krueger introduced a tax bill targeting crypto miners. The senator introduced the tiered bill that taxes crypto miners based on the amount of energy consumed. According to the proposal, mining firms using less than 2.25 million kWh per year and miners using renewable energy will be exempted from tax. Miners consuming between 2.26 and 5 million kWh would pay 2 cents per kWh.

Moreover, crypto miners using up to 10 million kWh will be charged 3 cents per kWh, while 4 cents will be charged up to 20 million kWh. Those exceeding the 20 million threshold will pay 5 per kWh. This bill highlights New York’s ongoing scrutiny of crypto mining’s environmental footprint and its approach of economic incentives against sustainability goals.

As shown above, mining machine manufacturing companies have been working on their research and development, releasing better mining machines. The above charts show how the energy consumed to generate a trillion hashes has reduced over time.

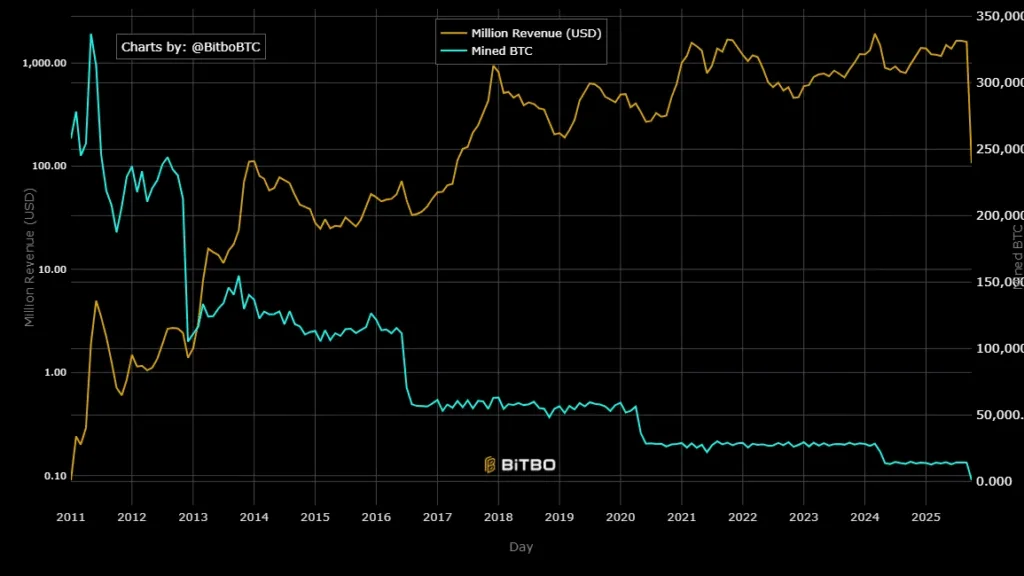

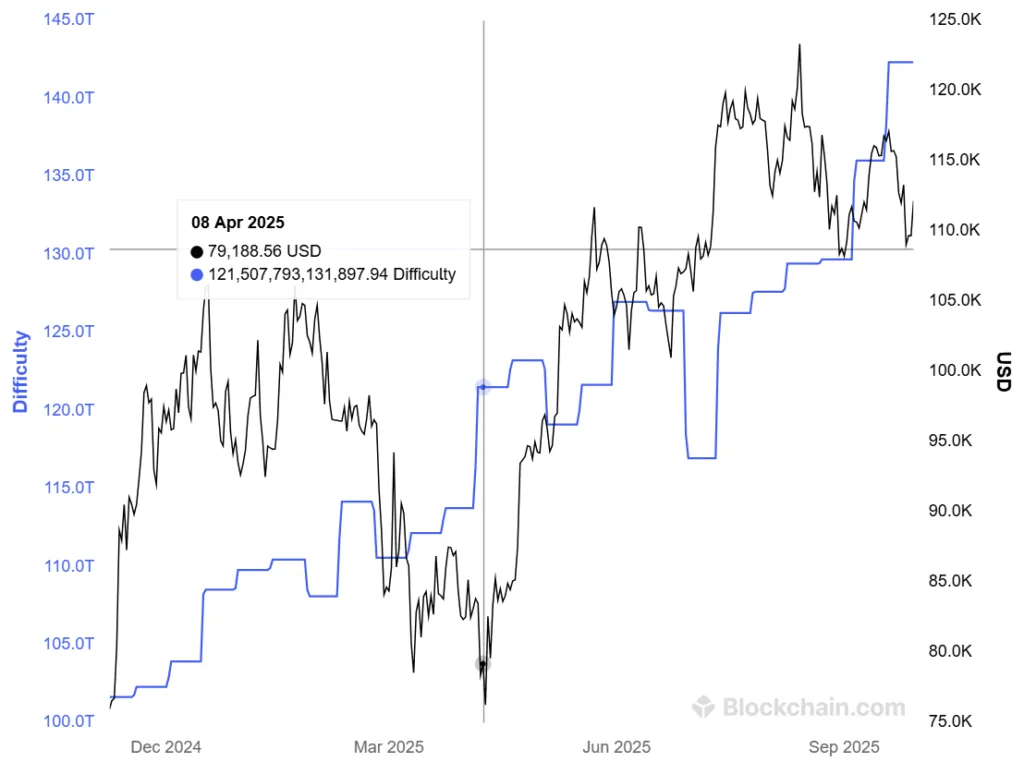

However, despite producing better miners, the Bitcoin hash difficulty has been rising while the mining rewards have been shrinking. With all these factors constraining miner profits, there has been a mass exodus of miners.