As Solana Breakpoint 2025 concluded on December 13, one keynote stood out. Macro investor and the self-proclaimed “hopium dealer” Raoul Pal had the audience intrigued during his address, as he highlighted several charts with macro-economic data to uplift the audience in attendance about the crypto market’s medium-term outlook.

Pal at Solana Breakpoint: Crypto market to peak in 2026

Pal opened his address without mincing words, starting with the statement “diversification is dead.” He referred to the “everything code,” a hypothesis that assumes that only population growth and debt expansion power economic growth.

One of the tenets of Pal’s speech was the declining birthrate in the Western economies. In his address, Pal remarked that falling birth rates and reduced labor participation are shrinking economic growth.

He added that governments across these economies are trying to compensate for reduced labor productivity by unchecked borrowing in the form of money printing. As a result, the interest obligation for major economies, such as the US, is expected to hit “obscene” levels in the future.

Pal noted that the US’s debt-to-GDP ratio will reach a staggering 160% by 2030. He added that the US government is likely to print another $8 trillion to maintain economic stability and avoid the headwinds that a reduced labor force is likely to create.

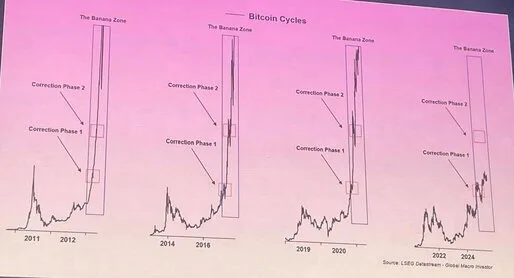

The co-founder and CEO of Real Vision stated that since the 2008 financial crisis, debt interest payments have introduced cyclicality into global markets. He further noted that the standard Bitcoin four-year cycle has now turned into a 5.4 year cycle. As a result, the crypto market will hit its peak in 2026.

Pal’s statement is in stark contrast to that of crypto mogul and former CEO of Binance, Changpeng ‘CZ’ Zhao. Speaking at Bitcoin MENA 2025, CZ said that the Bitcoin four-year cycles are dead.

Pal dubs Bitcoin a macro asset

Moving the conversation toward digital assets, Pal dubbed Bitcoin a macro-asset. He stated that BTC’s performance mirrors that of broader business cycles, such as crude oil, Russell 2000, and industrial metals.

Pal said that leading digital assets such as Bitcoin and Ethereum are significantly influenced by prevailing liquidity conditions. He shared a chart emphasizing a 90% correlation between BTC and fiat liquidity.

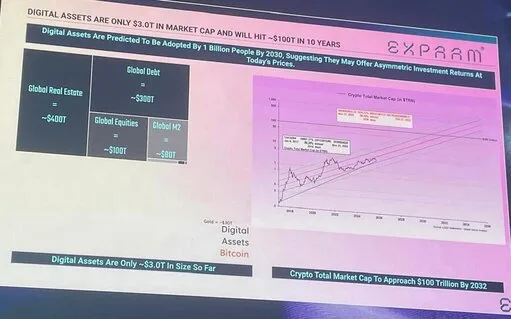

Serving some ‘hopium’ to the audience at Solana Breakpoint, Pal shared the following chart, predicting that the total digital assets market cap will reach a massive $100 trillion in ten years.

The acclaimed macro-economic investor closed his speech with a forecast about when Bitcoin is likely to hit the ‘banana zone.’ He shared the following chart, predicting that the top digital asset will witness parabolic price appreciation in 2026.