The supply of Bitcoin held by long-term holders has drastically reduced over a couple of months. The Fear and Greed Index has been wildly fluctuating between neutral and the fear zone. The crypto market is confused, and the amount of liquidation is rising. From strong hand selling BTC to traders betting wrong, here’s what happened today.

FalconX acquires 21shares

In an attempt to bolster exchange-traded products (ETP), the Digital asset brokerage, FalconX, announced its plan to acquire 21shares, a crypto ETP provider. The acquisition will integrate 21shares’ asset management product development and distribution expertise with FalconX’s digital asset infrastructure and risk management platform, which will help in delivering tailored investment products for both institutional and retail investors.

Raghu Yarlagadda, chief executive of FalconX, said: “We’re witnessing a powerful convergence between digital assets and traditional financial markets, as crypto ETPs open new channels for investor participation through regulated, familiar structures.

Tether reaches major milestone

Stablecoin Tether achieved a major milestone with the number of Tether users crossing 500 million worldwide. The rise in the number of users not only makes Tether the top stablecoin in the crypto market, but it also shows that digital assets play a vital role in today’s crypto economy.

U.S. Fed Reserve considers payment account

The U.S. Federal Reserve is considering a new payment account that would ease long-standing access that small tech companies face when it comes to connecting with payment infrastructure. The Fed Governor Christopher J. Waller put forward this idea during the Payments Innovation Conference on Tuesday.

Waller stated, “I believe we can and should do more to support those actively transforming the payment system,” Waller said. “To that end, I have asked Federal Reserve staff to explore the idea of what I am calling a ‘payment account.’”

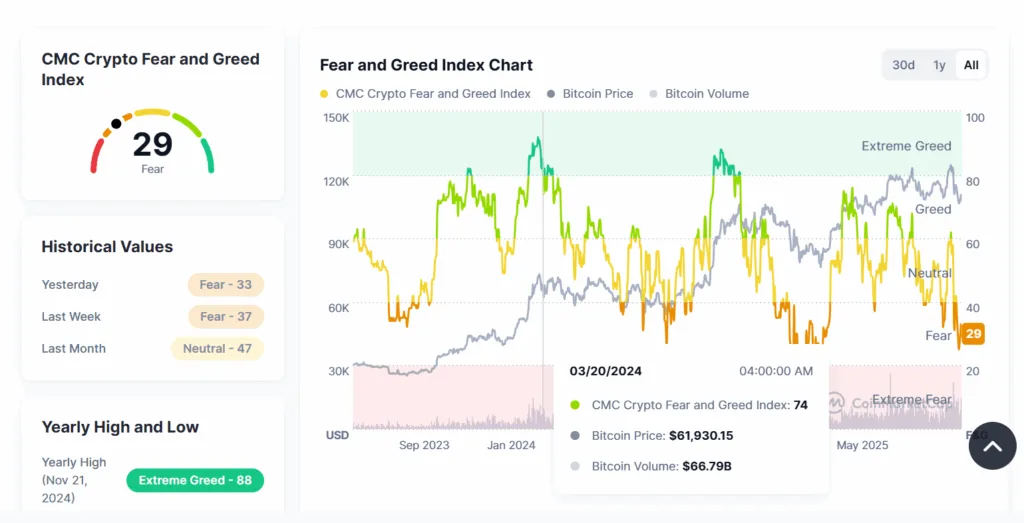

Traders are still in fear

The crypto traders are still in fear mode, as the Fear and Greed index shows 29 on its scale. Yesterday, the indicator hit a value of 33, while today, it moved more towards the extreme fear zone.

Ex-employee sentenced to 3 years’ probation

The U.S. Department of Justice ordered 3 years’ probation for an ex-employee who used former employer’s cloud server to mine cryptocurrencies. 45-year-old Joshua Paul Armbrust was convicted of a felony count of computer fraud after he used his former employer, e-commerce company Digital River’s Amazon Web Services account remotely. This unauthorized access to the server cost the company about $45,000.

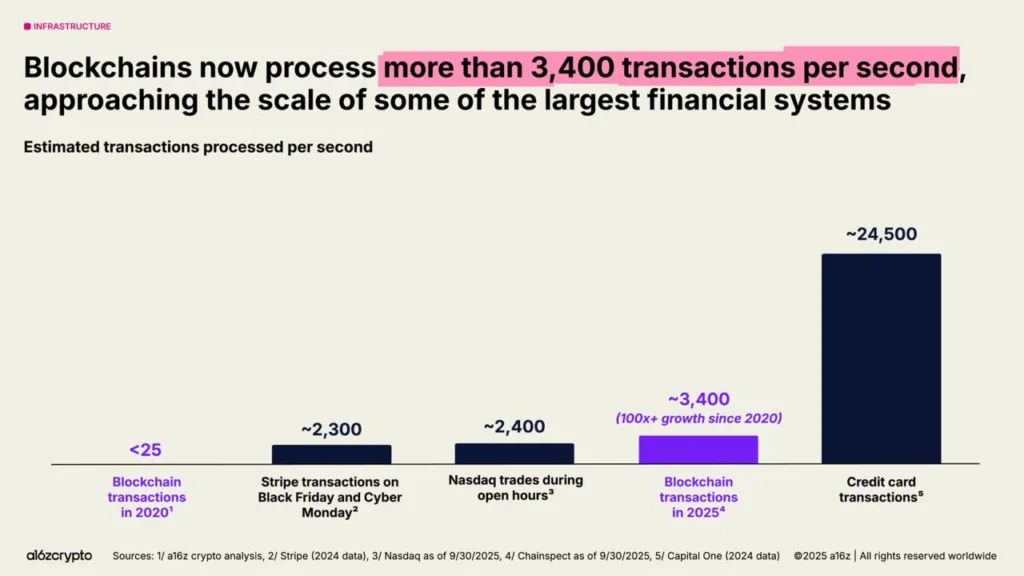

Blockchain tps surpass Nasdaq

Blockchain networks are competing with some of the largest financial systems in transactions per second (tps). From processing transactions just above 25 tps in 2020 to processing 3,400 tps, blockchains have evolved beyond some of the largest financial systems like Stripe and Nasdaq. However, when compared to credit card transactions, blockchain is far below.

$750 million worth of positions liquidated

During the past 24 hours, around $740 million worth of leveraged positions were liquidated from the crypto market. Nearly $305 million short positions were liquidated, while the long position liquidations, a little higher than the shorts were recorded at $435 million. During the past 3-4 days, the liquidated amount has been rising ever so slightly, showing that the market volatility is on the rise.

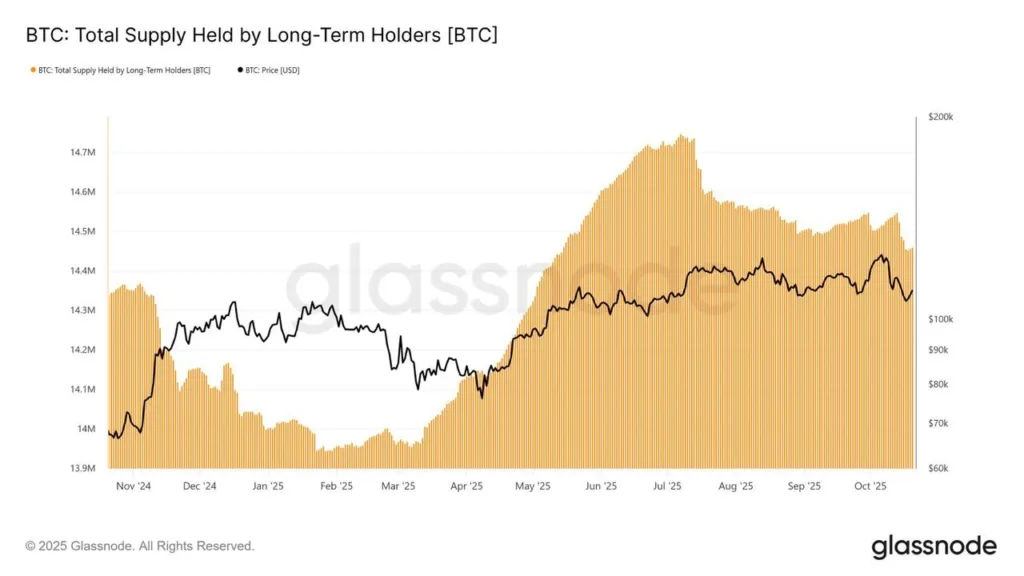

BTC slips out of strong hands

The total supply held by long-term holders of Bitcoin has been gradually reducing. From 14.7 million BTC in July 2025, the crypto held by long-term holders has reduced to below 14.5 million. With such a reduction, the question of whether Bitcoin has yet more upside. It is fair to have this argument, as long-term holders may start realizing profits once the rally takes over. This often happens near market tops or during periods of strong price strength. It indicates that confidence in short-term upside may be weakening.