From traders’ sentiment fluctuating between greed and neutral, to the crypto ETFs seeing more than $500 million netflows, much happened today.

UK lifts ETP ban after seeing progress

The United Kingdom lifted its ban on Exchange Traded Notes (ETN), which it imposed at the beginning of this year. The UK removed the ban after seeing the market evolve and products becoming more understandable.

The Financial Conduct Authority press release stated, “Since we restricted retail access to crypto ETNs, the market has evolved, and products have become more mainstream and better understood. In light of this, we’re providing consumers with more choice while ensuring there are protections in place.”

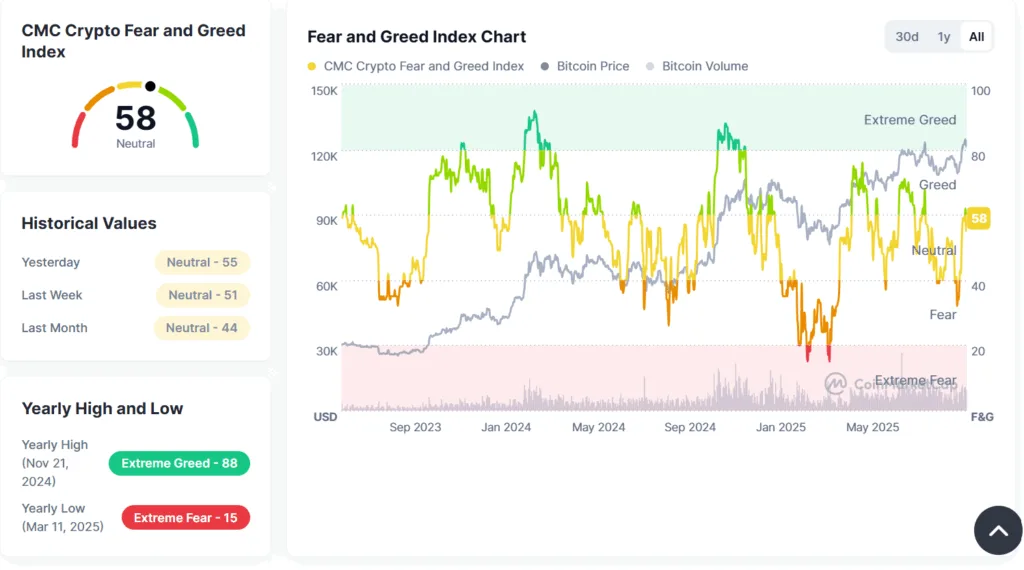

Crypto traders are neutral

The Fear and Greed index, which gauges the sentiment of the traders, is heading towards the greed zone, once again. This indicator has been oscillating to and fro, swinging from greed to neutral and back. Now the indicator shows 58 on its scale. This action shows the indecisiveness of the traders in the market.

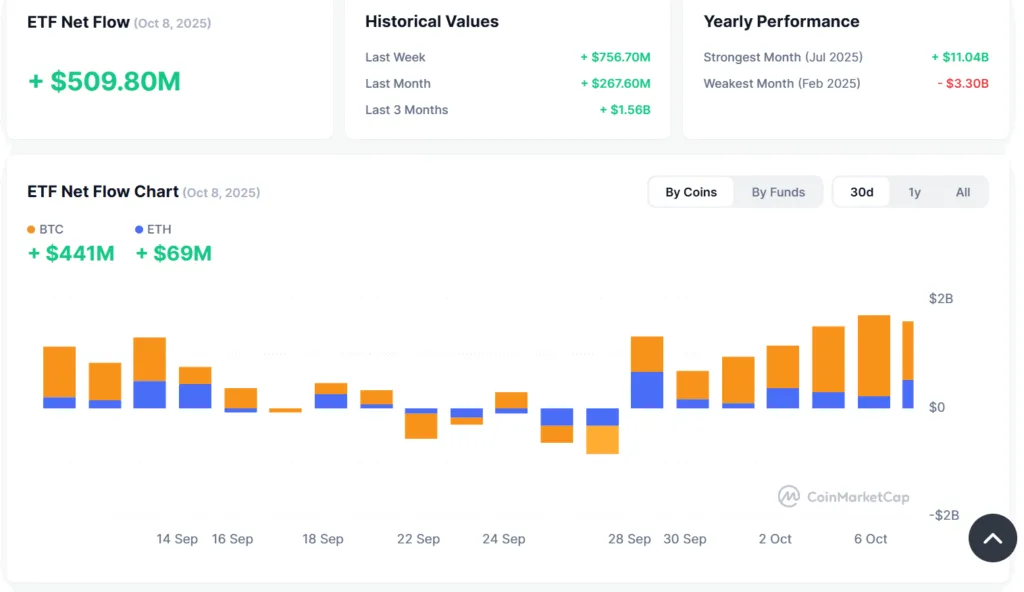

Crypto ETFs secure more than $500 million

The crypto derivatives market saw a net flow of more than $500 million yesterday. Bitcoin ETFs saw an inflow of $441 million, while ETH ETFs attracted about $70 million. Since the last few days of September, the crypto ETF inflows have been on the rise, showing investor confidence and a growing market.

Altcoin Season Index uptrend nullified

The Altcoin Season Index keeps falling deep into the neutral zone. From around 69, the ASI has fallen to 51. More importantly, the ASI uptrend of making higher lows seems to have been dismantled. The ASI scale runs from 0-100, with values above 75 showing altcoin season, while values below 25 signalling Bitcoin season.

Ripple moves to the Kingdom of Bahrain

Ripple, the company behind XRP and the infrastructure provider for institutions, is expanding its reach to Bahrain. In a partnership with a Bahrain fintech, Bay, Ripple will enhance the digital asset ecosystem.

As per the agreement, the duo will see “development of proofs-of-concept and pilot projects relevant to Bahrain’s fintech ecosystem; showcasing solutions across areas such as blockchain technology, cross-border payments, digital assets, stablecoins, and tokenization; leading knowledge initiatives through educational collaborations and accelerator programs; and participating in dedicated local ecosystem events to foster new industry partnerships and drive innovation.”

Bank of France urges the EU

The Bank of France urged the EU that its regulator should be given the mandate to oversee major crypto firms, as fragmented authority could threaten the final sovereignty of the bloc.

Bank of France Governor François Villeroy de Galhau said that the European Securities and Markets Authority (ESMA) should be given the authority to oversee crypto-asset issuers under the EU’s Markets in Crypto-Assets (MiCA) framework. “I also advocate, along with the president of the AMF, for European supervision of crypto-asset issuers, carried out by ESMA,” he said.

Altcoin market cap finds a new uptrend

In the backdrop of the ASI indicator falling into the neutral zone, a crypto investor spotted a positive technical signal. The investor Michael van de Poppe mentioned that the altcoin market cap had started a new uptrend when compared to the BTC market cap.

The #Altcoin market capitalization valued against $BTC is simply starting to have a strong uptrend. pic.twitter.com/JXlEPDViOm

— Michaël van de Poppe (@CryptoMichNL) October 9, 2025

Uganda launches RWA pilot

The Global Settlement Network, a Blockchain financial infrastructure company, partnered with Ugandan developer Diacente Group in an attempt to tokenize $5.5 billion of real-world assets. This pilot project comes in the wake of its African counterpart, Kenya, passing the virtual asset service providers (VASP) bill in parliament.

Metals soar while BTC is undervalued

As the dollar continues to fall in value, metals like Gold and Silver have been on the rise. Gold reached $4,000 per ounce while Silver hit $50 per ounce. With these commodities reaching their threshold and the market exhausting, investors could be on the lookout for alternatives to invest in. As Bitcoin is undervalued compared to Gold, analysts expect Q4 of 2025 to be bullish.