Bitcoin crashed to $98.5K after the U.S. joined its allies, Israel, in hitting Iranian nuclear sites. On Sunday, briefly after the bomb carrier BNorthrop B-2 Spirit bombed 3 major nuclear sites, the crypto markets crashed. However, the tremors of the bombs seemed to have been absorbed well by the traders, as Bitcoin got back up on its feet and is trading at $ 102 K after crashing below the psychological $100K level.

(Source: Tradingview)

On the daily chart, Bitcoin has made a double top pattern—a bearish trend reversal. The double top pattern took shape as Bitcoin tested the $111.6K level once and then the $110.2K resistance but failed to break above, as the bears in the market were too strong. In a conventional breakout, the price falls; however, the situation is quite dodgy, and Bitcoin’s trajectory could take any direction.

Bearish double top pattern may not be validated

According to the double top, unless the pattern has failed, there should technically be a breakdown and the prices might fall towards the support level close to $ 95 K. But, Bitcoin is oversold, hence, there might be a market correction oncoming and the price might appreciate.

However, that’s not it. There was a poll that was carried out by a popular analyst on X, where he asked his followers to guess where Bitcoin would head. 49.8% of voters stated that it could hit $114K, while 50.2% stated it could fall to $ 94 K.

ETH breaks bearish market cap trend

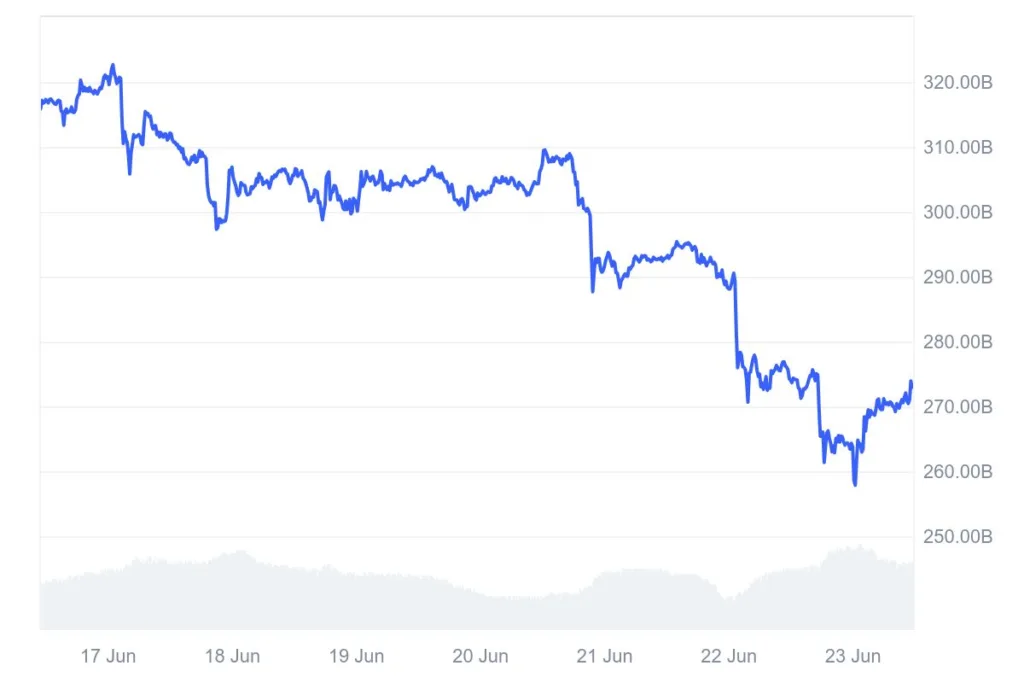

Meanwhile, the Ethereum market cap has been bearish, making lower highs during the past 7 days. It fell from as high as $308 billion to $257 billion in just a few days. However, despite the geopolitical situation in the Middle East, ETH has broken this trend of making lower highs, and it is currently recording a market cap of $272 billion.

Source: CoinMarketCap

After losing value of almost 14% during the last week, ETH is priced at $2,258. The ETH market is very active as its trading volume increased by 19% to $25 billion.

Source: Tradingview

ETH is trying to find a support level on it way down. Although the token tried to recover at the support level close to $2.4K, the bears crashed the prices below this level. However, the emerging green candlestick could be the start of a new beginning for ETH. Primarily, because the ETH market has been oversold, hence, there could be a market correction. This correction might see ETH regain the support level 1.

Adding more weight to the bullish outlook, the 50-day EMA is approaching the 200-day EMA from below. If the 50-day EMA intersects the 200-day EMA, a golden cross could happen and the token might appreciate drastically. As such, when ETH gains the support level 1, it could further move toward $2.8K.

Please note that all price predictions are based on data analysis and are provided for informational purposes only. They do not constitute financial advice. Altcoin Desk is not liable for any financial decisions you make.