Does it make you wonder how one person’s decision could tumble the whole crypto market, which is supposed to be decentralized? Well, it’s debatable. Think about it. The technology is decentralized, but is the overall market decentralized? Not really.

U.S. President Donald Trump imposed 100% tariffs on China, in addition to the already existing 30%. With the announcement of the tariffs, the crypto markets and stocks started to bleed. In an instant, all the crypto charts turned red. The market entered a state of confusion, and investors are not taking any risks.

Bitcoin hit hard with tariffs

It was just a few days ago that Bitcoin made a new all-time high, and the market was gaining momentum. However, before that momentum could break into a full-blown rally, Donald Trump’s announcement crashed the prices. The tariffs not only weakened the trade relationship between China and the U.S. but also liquidated $19 billion, the largest Bitcoin liquidation.

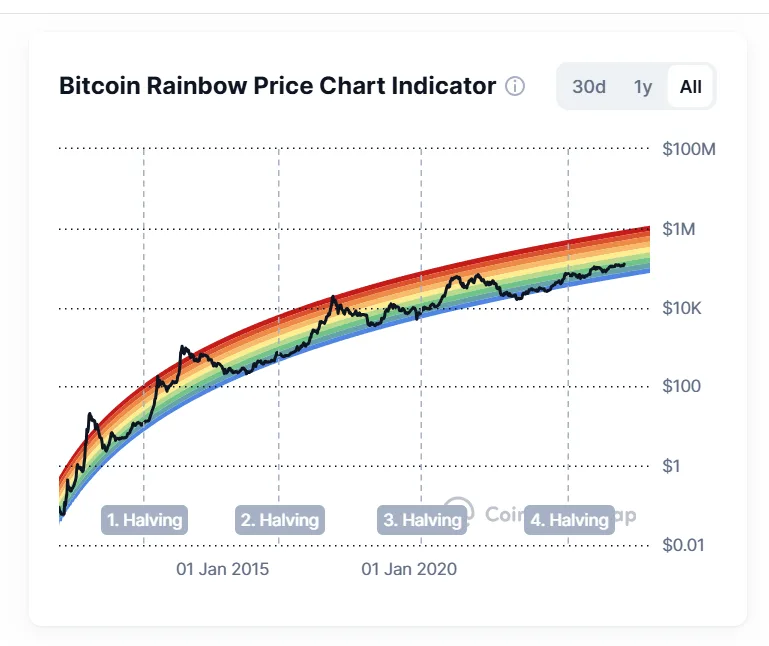

Bitcoin indeed crashed, and the biggest liquidation happened; however, if you look at the chart, the flagship crypto is still on course. Despite the crash, the token was able to hold its pattern of making higher lows. In addition, the BTC market still holds $2.3 trillion.

A crypto netizen stated that this resilience further solidifies the idea behind one BTC reaching $1 million.

In fact, BTC is still within the limits of the rainbow, as shown above. This means that BTC is still on course towards hitting $1 million.

ETH forms bull flag

Ethereum is no different from Bitcoin. ETH crashed from $4.4K to $3.8K; it crashed, but it did not fall. ETH is currently supported at $3.8K level, and it has every chance of once again bouncing back. On the technical front, the crash that happened formed a bullish flag, and once ETH has completed the flag, it will break out further to the upside, reaching 7K or higher.

Atlcoins Season Index falls

The Altcoins Season Index (ASI) further fell from 55 deep into the neutral zone and is now at 47. With the ASI crashing below, the hopes of an altcoin season seem to be diminishing. It is worrying to see the ASI breaking the overall uptrend, as the last hope was for the traders to see it hold its uptrend, whether it fell or rose. However, it was not to be. So will the altcoins season come?

Of course it will. Technical analyst, who goes by the pseudonym, altstreet bet, stated this crash completed the macro abc correction of the alt, which eventually will bring a big wave where the altcoin market cap could reach above $1 trillion.

Fear swaddles investors

The Fear and Greed index, which was fluctuating in the neutral zone and at times reaching the greed zone during the week, has now moved into the fear zone. This shows that the investors are confused and are maintaining a risk-averse approach, as there is uncertainty in the market. Interestingly, the Fear Zone can signal an opportunity for contrarian investors — as Warren Buffett famously said: “Be fearful when others are greedy, and greedy when others are fearful.”

With the announcement of the tariffs, the market sieved out all the weak hands and has reset itself. Interestingly, though, when more than $19 billion was liquidated, many whales who are most often referred to as insiders took profits by shorting their holdings just before the announcement. It’s good to separate the wheat from the tares, but whether the way of doing it is ethical or not is a question. Or, maybe that’s how the harsh world works. What do you think?