Among the top stories for today, Paxos made a huge mistake of minting $300 trillion stablecoins and then immediately burned it. The U.S. government is among the largest Bitcoin holders.

Paxos makes big blunder

Paxos, the issuer behind the PayPal-branded PYUSD stablecoin made a huge blunder by minting $300 trillion which is about 2.5 times of the entire world’s GDP. However, just about 20 minutes after they recognized the error, the minted token were burned. According to sources, the stablecoin issuer made two transactions of $300 million prior to the mistakenly minting these stablecoins. They claimed that the glitch added a few extra zeroes.

The U.S. government is the largest BTC holder

The U.S. government is one of the largest Bitcoin holders as it has 316,760 $BTC which approximately worth about $35.9B. Many other countries including the Americans are worried what the country might do with that massive amount of Bitcoin.

Bank of England to lift restrictions on stablecoins

The Bank of England announced its plan to lift proposed restrictions on stablecoins once the digital assets does not appear as a threat to the economy. Deputy Governor Sarah Breeden stated that the rapid adoption of stablecoins could leak bank deposits and thereby constrict the flow of funds into businesses and households. As such the BOE is set to put limits on the overal transaction volume and holdings.

Altcoin season pushed back

The Altcoin Season Index which oscillates between the Bitcoin and altcoin season is very close to the Bitcoin season during a crucial time when the market is anticipating an altcoins season. From yesterdays value of 30 on its scale, the ASI has crashed to 29.

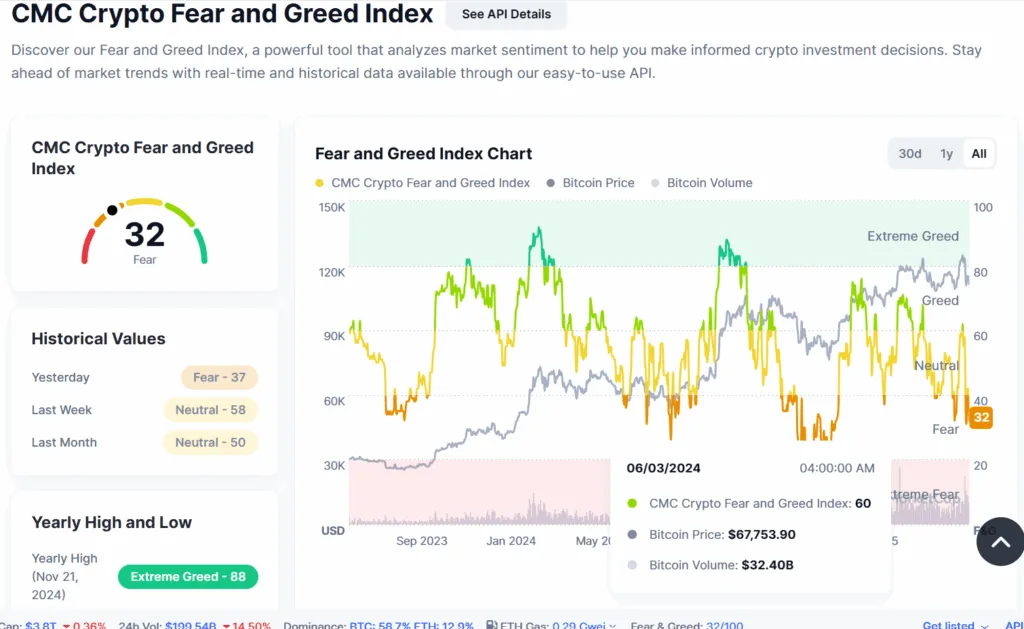

Traders still fear to enter market

CoinMarketCap’s Fear and Greed index has crashed back into the fear zone. This tool which gauges the emotions of the market, basically says that the traders are now not in a position to take any new positions. This could have been because of the recent turbulence in the prices after Donald Trump’s tariffs announcement on China.

Kraken acquires Small Exchange

Crypto currency exchange Kraken recently acquired Small Exchange, which is a CFTC-approved Designated Contract Market (DCM), from IG Group. The exchange bought Small Exchange for $100 million

“Kraken’s acquisition of a CFTC regulated Designated Contract Market creates the foundation for a new generation of United States derivatives markets. It is designed for scale, transparency, and efficiency.” said, CEO of Kraken.

EthZilla price crashes after reverse stock split

EthZilla stock prices crashed with the announcement of a 1-for-10 reverse stock split. Treasury firm ETHZilla shares crashed on Wednesday following an announcement about a 1-for-10 reverse stock split. In a reverse stock split of 1:10, the company reduces the number of shares while maintaining the investment. In this case 10 shares will be clubbed into one and will be priced at 10 times its value.

Follow AltcoinDesk for more!