The U.S government reopened after 43 days, and the whole crypto market came crashing down. BTC dropped from around $104K, to $97K, and is currently at $95K. One more fall, and if BTC crashes below $94K, the whole crypto market will enter a bearish cycle.

November 13, 2025, will go down as a historic day in the United States of America, as it ended the longest U.S government shutdown. On Thursday, the standoff between the Republicans and the Democrats came to an end after U.S. President Donald Trump signed the funding bill. However, as the government reopened, the crypto markets came crashing down. Bitcoin crashed from $104K to $97K, in an inclined free fall.

With the fall, BTC exited the bullish falling wedge, which would eventually have led to an upward breakout. Priced at $95K, Bitcoin and the overall crypto market are on the brink of a bear season. Analysts predicted that the prices should hold above the $94K, for the bull market to be still in play.

Crypto market drops below $3.5 trillion

The crypto market cap crashed from $3.5 trillion to $3.25 trillion during this downfall. The total market capitalization was last seen at these levels 4 months ago. With the market crashing hard, fear, uncertainty, and doubt were as large as life.

Extreme fear haunts

On CoinMarketCap’s Fear and Greed Index indicator, the market is on the verge of entering an extreme state of fear. From last week’s 25 level, which is on the shallow end of the fear zone, the market went into deep fear territory as the volatility of the overall market was quite high.

Volatility keeps rising

Since the beginning of November, the Crypto Volatility Index (CVI) has been on the rise. The CVI shows the expected volatility of the prices based on the BTC and ETH option market, whether traders are buying insurance (puts) or betting on big moves (calls).

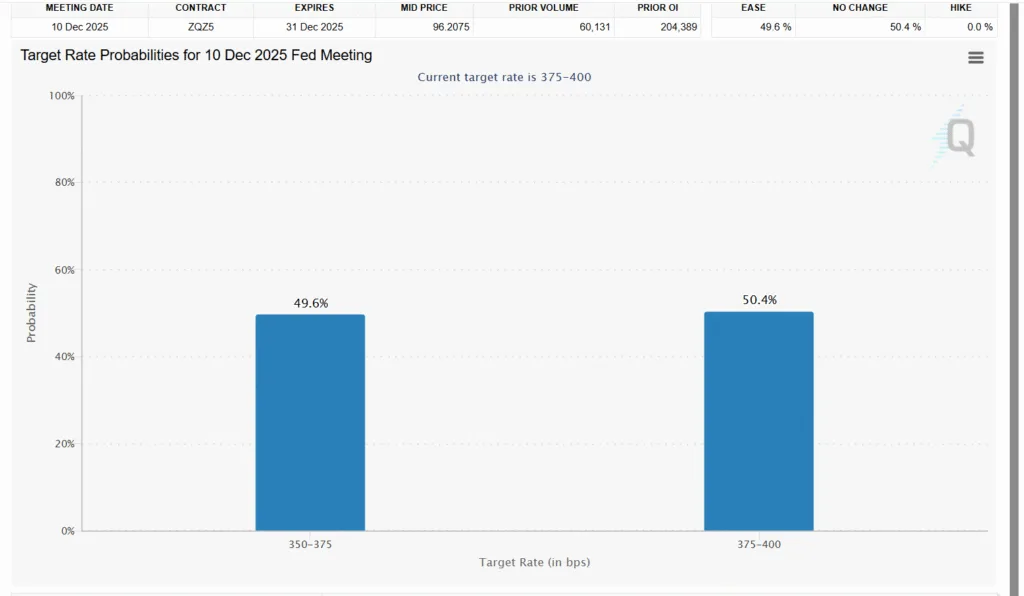

As there is more uncertainty lying on the horizon, there is a high chance the CVI will only further increase. So what are the uncertainties that are to happen in the foreseeable future? The next Federal Open Market Committee meeting, scheduled for December 10, will decide on another interest rate.

No CPI, no rate cut

However, with no Consumer Price Index data for October, the Fed Chair Jerome Powell might not go for a cut. With the inflation level just above 3% and no CPI data, the chances for the next interest rate cut have drastically dropped.

With no interest rate cut, the expected bull run and the altcoin season are questionable. However, if Bitcoin holds above $94K, there will be a rotation of funds into the altcoins, and the altcoins will start to bloom once again.

Altseason depends on BTC $94K support

According to the Altcoin Season Index, which gauges the performance of altcoins against BTC, the current market is neutral. It means it is neither Bitcoin nor altcoins season. This is mainly because traders are shunning away from the market, as there is so much uncertainty.

The ETH/BTC pair chart is a classic example of a saturated market, where there is very limited movement. If you look closely, ETH is now resting on the 200-day Moving average after crashing hard. The very small fluctuations show that no one is committing to any risky move.

So the bottom line is that the market is at an important stage, approaching an important event, the FOMC, with fear. Whether the FOMC cuts rates or not, BTC has to hold above the $94K level, if the bull cycle is to be activated.