The United Arab Emirates has completed its first government financial transaction using the Digital Dirham, in collaboration with the Central Bank of the UAE (CBUAE). The announcement was made jointly by the Ministry of Finance (MoF) and Dubai Finance (DOF), highlighting strong coordination between federal and local financial authorities.

The payment happened between the Ministry of Finance and the Dubai Finance Department. It went through mBridge, a system built for government payments with central bank digital currencies (CBDCs). Officials said the entire process took less than two minutes, showing how much quicker and safer government payments could be.

Leadership highlights strategic importance

Sheikh Mansour bin Zayed Al Nahyan, Vice President and Chairman of the Central Bank, called the Digital Dirham key for the UAE to build a digital economy. He said this first payment proves they have the tech and how well their financial systems work together.

Sheikh Maktoum bin Mohammed bin Rashid Al Maktoum, First Deputy Ruler of Dubai and Minister of Finance, said using the Digital Dirham for government services shows the Ministry is serious about going digital. This is to make clearer and better systems in order to help the national and local systems work better together.

How the Digital Dirham started

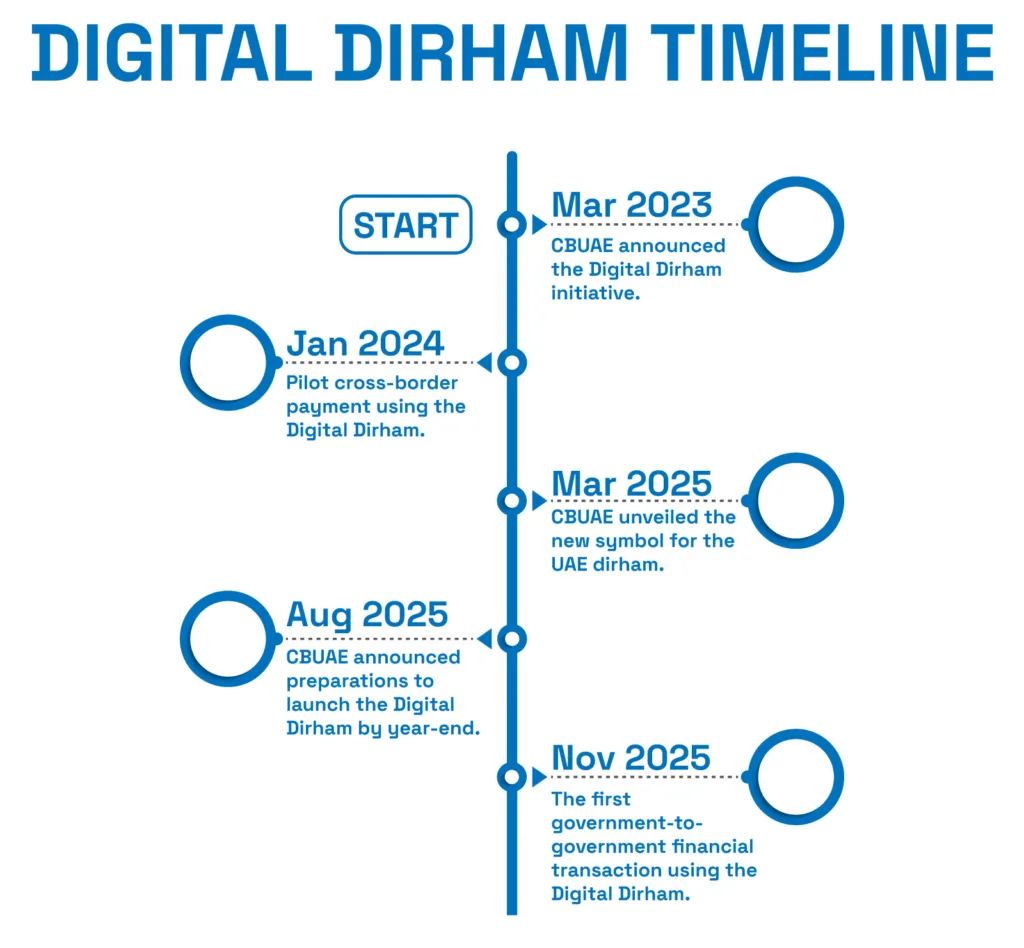

The Digital Dirham project was announced in March 2023 as part of the Central Bank’s Financial Infrastructure Transformation (FIT) Program, meant to get the UAE to use less cash. Later that year, they started testing it out with international central banks through the mBridge platform.

In 2024, they tested it in real situations in government and finance. By 2025, they had everything working together, ready for the UAE’s first government-to-government payment. This demonstrates the country’s big ambition to be advanced in digital finance.

Part of a broader transformation

As part of the Central Bank’s FIT Program, the Digital Dirham project wants to update the UAE’s financial system and get more people to use digital payments. Central Bank Governor Khaled Mohamed Balama said the program cuts costs, makes processes more stable, and makes the UAE a center for financial innovation.

DOF Director General Abdulrahman Saleh Al Saleh said the test payment checked if they were ready and if everything worked with the Central Bank. He noted how important these tests are to make sure the coin goes smoothly when it becomes publicly available.

A step toward a digital future

With this first Digital Dirham payment, the UAE is among the first to use a digital currency for government payments. Officials believe this will not only speed up and secure government payments but also pave the way for wider use in the private sector, strengthening the UAE’s position in digital finance.