The crypto market is slowly recovering after being hit hard by tariffs. Bitcoin is up by 4% during the week as it hits $115K while Ethereum is up by 3% as it reads $4,170. As the whole market is improving, it’s time for us to take a look at three tokens: Zcash, TON, and TRX.

Zcash is overbought, and a correction is due

Zcash is a project that focuses on privacy and anonymity, and reveals data only when that option is enabled. Unlike Bitcoin and other tokens, which are pseudonymous and not anonymous, Zcash is different.

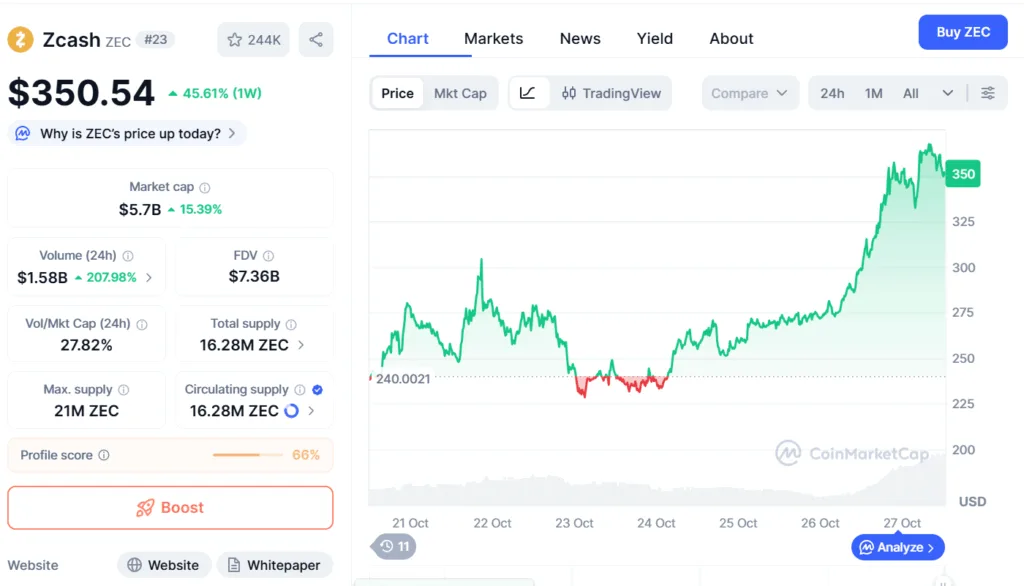

On the weekly chart, Zcash is trading at $350 after gaining more than 45% during the past week. The token rose exponentially from below $250 just two days ago.

As shown in the chart below, Zcash (ZEC), which ranks 23rd on the biggest crypto by market cap, is now trading inside a rising wedge. Since this is the beginning of the formation of the rising wedge, we need to establish that it is a rising wedge.

In a rising wedge, the prices hit the upper and lower trendlines of the pattern, making higher lows and higher highs, as the range of motion narrows. Now that ZEC has hit the upper trendline, it is due for a rebound, and the prices could fall. According to the Relative Strength Index (RSI), the ZEC prices are overbought; hence, the market will correct the prices, and ZEC will fall to $283.

Toncoin’s volume creeps up 90%

Capturing the 24th place on CoinMarketCap’s largest crypto, Toncoin (TON) is trading at $2.24. TON is the native cryptocurrency of the decentralized layer-1 blockchain — The Open Network (TON). The 24-hour trading volume is up by nearly 90% to $153 million, while its price has lost nearly 1% during the week.

TON is currently trading inside a symmetrical triangle, which will eventually break out towards higher price levels. Since the pattern is not complete, the breakout will be delayed. However, once the range of motion narrows and the pattern is complete, TON could reach as high as $2.87.

Tron (TRX) has a major obstacle to cross

TRON network’s native token, TRX, was once an ERC-20 token on the Ethereum network. However, a year after launching on the Ethereum blockchain, they moved the TRX tokens to their own chain.

On the daily chart, TRX is trading inside a bullish falling wedge. The token keeps making lower highs and lower lows, and the range of fluctuation keeps getting narrower. When the price action narrows down, the buying pressure will start to build, and then TRX will break out.

But before TRX completes the pattern, there is one mandatory requirement, it needs to fulfill. TRX has crashed below the 200-day Moving Average, which will be a hard-to-break-through resistance level at $0.30. Once TRX breaks above this resistance level, it will be back on course inside the falling wedge. After completing the wedge, the token will appreciate and hit $0.38.